5421 Brewer Ln Inver Grove Heights, MN 55076

Estimated Value: $263,000 - $273,000

2

Beds

2

Baths

1,492

Sq Ft

$180/Sq Ft

Est. Value

About This Home

This home is located at 5421 Brewer Ln, Inver Grove Heights, MN 55076 and is currently estimated at $267,877, approximately $179 per square foot. 5421 Brewer Ln is a home located in Dakota County with nearby schools including Hilltop Elementary School, Inver Grove Heights Middle School, and Simley Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 6, 2021

Sold by

Walter Julie

Bought by

Wojnar Colleen Terese

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$230,156

Outstanding Balance

$209,283

Interest Rate

2.9%

Mortgage Type

New Conventional

Estimated Equity

$58,594

Purchase Details

Closed on

Jul 6, 2016

Sold by

Forman Paul M and Forman Heidi M

Bought by

Walter Julie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$157,003

Interest Rate

3.25%

Mortgage Type

FHA

Purchase Details

Closed on

Jul 14, 2004

Sold by

Bruggeman Homes Inc

Bought by

Withrow Carl F

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wojnar Colleen Terese | $252,000 | Results Title | |

| Walter Julie | $159,900 | Edina Realty Title Inc | |

| Withrow Carl F | $180,860 | -- | |

| Wojnar Colleen Colleen | $252,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Wojnar Colleen Terese | $230,156 | |

| Previous Owner | Walter Julie | $157,003 | |

| Closed | Wojnar Colleen Colleen | $212,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,676 | $234,900 | $46,900 | $188,000 |

| 2023 | $2,676 | $235,500 | $47,200 | $188,300 |

| 2022 | $2,044 | $229,200 | $47,100 | $182,100 |

| 2021 | $1,928 | $200,400 | $41,000 | $159,400 |

| 2020 | $1,814 | $187,700 | $39,000 | $148,700 |

| 2019 | $1,747 | $178,000 | $37,200 | $140,800 |

| 2018 | $1,683 | $162,700 | $34,400 | $128,300 |

| 2017 | $1,641 | $156,300 | $31,900 | $124,400 |

| 2016 | $1,873 | $150,400 | $30,300 | $120,100 |

| 2015 | $1,727 | $147,900 | $28,900 | $119,000 |

| 2014 | -- | $129,500 | $26,600 | $102,900 |

| 2013 | -- | $115,500 | $24,500 | $91,000 |

Source: Public Records

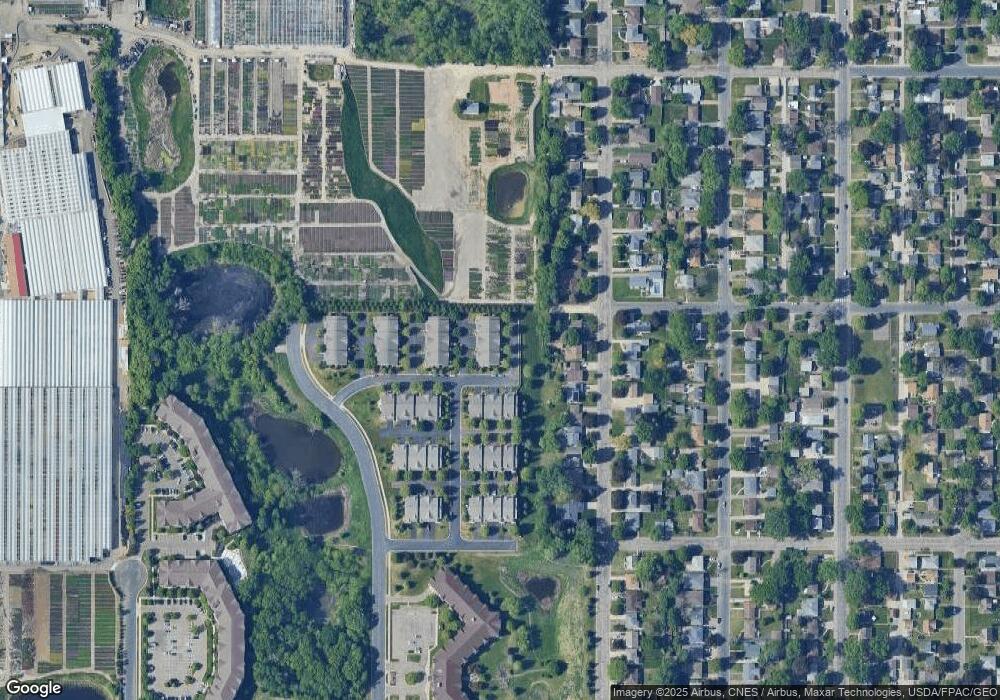

Map

Nearby Homes

- 5472 Bryce Ave

- 1205 8th Ave S

- 1253 7th Ave S

- 1333 6th Ave S

- 1456 6th Ave S

- 1436 5th Ave S

- 5903 Bryant Ln

- 209 Macarthur St W

- 5938 Burke Trail

- 233 Richmond St W

- 5887 Blackberry Bridge Path

- 6050 Cahill Ave

- 101 Frost St W

- 235 9th St S

- 851 5th Ave S

- 804 8th Ave S

- 159 Richmond St E

- 6280 Carleda Way

- 227 Dale St E

- 4852 Bisset Ln Unit 9504