5423 54th Way Unit 28B West Palm Beach, FL 33409

Palm Beach Lakes NeighborhoodEstimated Value: $291,782

2

Beds

3

Baths

1,285

Sq Ft

$227/Sq Ft

Est. Value

About This Home

This home is located at 5423 54th Way Unit 28B, West Palm Beach, FL 33409 and is currently priced at $291,782, approximately $227 per square foot. 5423 54th Way Unit 28B is a home located in Palm Beach County with nearby schools including Seminole Trails Elementary School, Bear Lakes Middle School, and Palm Beach Lakes High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 14, 2012

Sold by

Bartl Gerald and Bartl Sandra

Bought by

5423 Llc

Current Estimated Value

Purchase Details

Closed on

Sep 11, 2000

Sold by

Barry Gregory and Barry Kristin

Bought by

Barti Gerald and Barti Sandra

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$62,000

Interest Rate

8.11%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 23, 1996

Sold by

Oberhauser Norma

Bought by

Barry Gregory and Kiesel Kristin

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$54,800

Interest Rate

7.65%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| 5423 Llc | -- | Attorney | |

| Barti Gerald | $77,500 | -- | |

| Barry Gregory | $68,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Barry Gregory | $62,000 | |

| Previous Owner | Barry Gregory | $54,800 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,653 | $198,996 | -- | -- |

| 2024 | $4,653 | $180,905 | -- | -- |

| 2023 | $4,314 | $164,459 | $0 | $0 |

| 2022 | $3,789 | $149,508 | $0 | $0 |

| 2021 | $3,412 | $147,493 | $0 | $147,493 |

| 2020 | $3,153 | $135,493 | $0 | $135,493 |

| 2019 | $2,988 | $131,493 | $0 | $131,493 |

| 2018 | $2,655 | $127,405 | $0 | $127,405 |

| 2017 | $2,408 | $112,405 | $0 | $0 |

| 2016 | $2,244 | $84,393 | $0 | $0 |

| 2015 | $2,089 | $76,721 | $0 | $0 |

| 2014 | $1,931 | $69,746 | $0 | $0 |

Source: Public Records

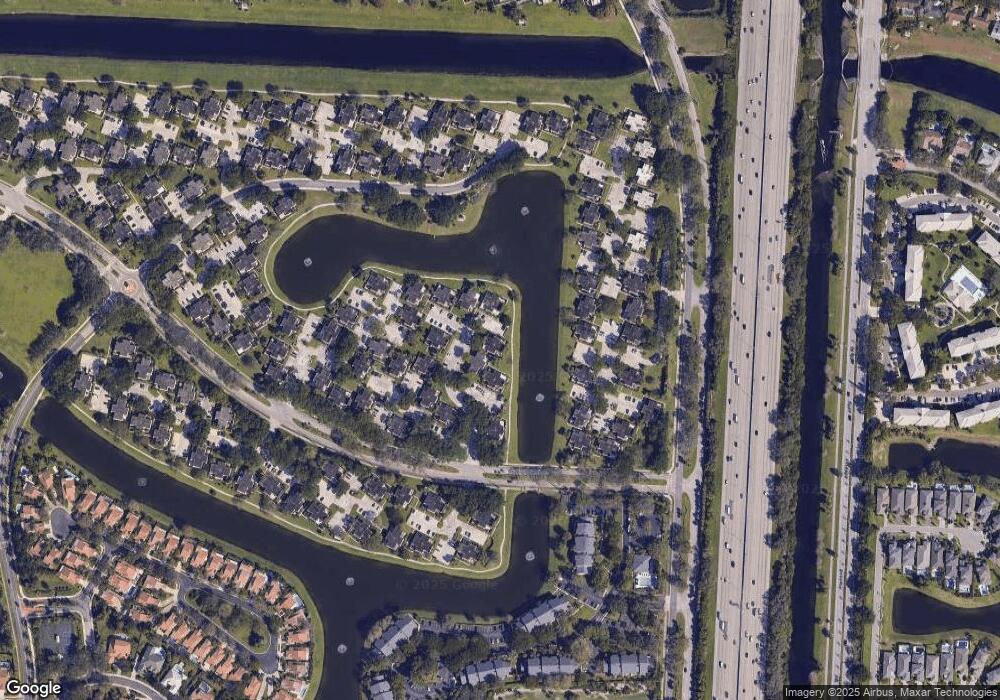

Map

Nearby Homes

- 5428 54th Way

- 5321 53rd Way

- 5110 51st Way

- 5209 52nd Way

- 5609 56th Way

- 6001 60th Way

- 5616 56th Way

- 3635 Whitehall Dr Unit 4010

- 5905 59th Way

- 3826 Whitehall Dr Unit 3050

- 3826 Whitehall Dr Unit 2050

- 620 6th Way

- 3716 Whitehall Dr Unit 1030

- 325 3rd Way

- 2760 Tecumseh Dr

- 3650 Whitehall Dr Unit 2020

- 3049 Safflower Cir

- 505 5th Way

- 3516 Whitehall Dr Unit 101

- 302 3rd Way