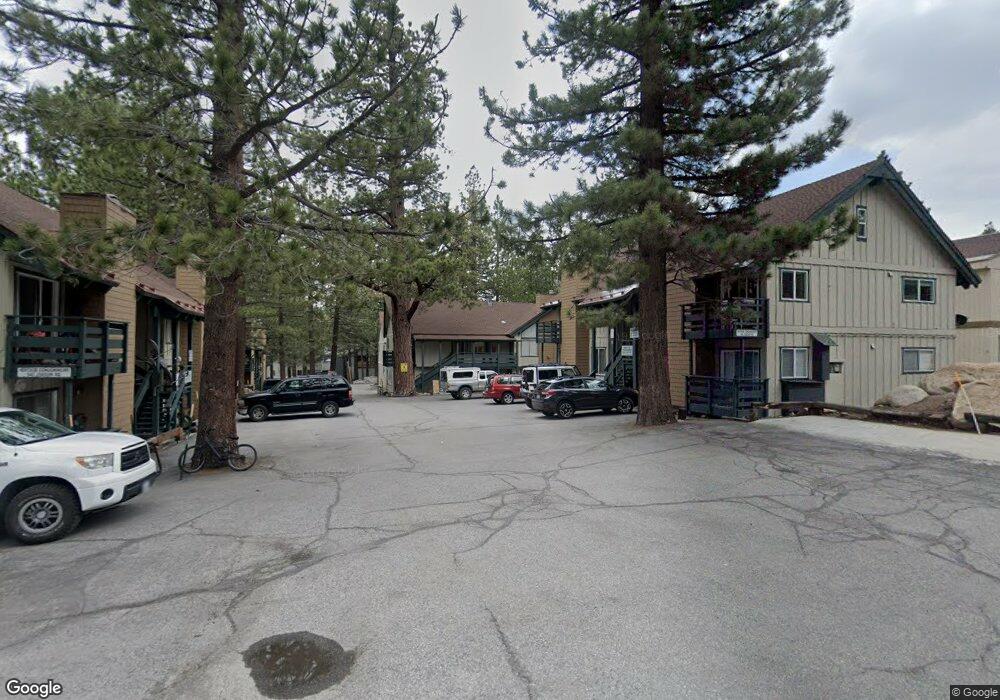

543 Joaquin Rd Unit 101 Mammoth Lakes, CA 93546

Estimated Value: $516,000 - $614,000

2

Beds

2

Baths

831

Sq Ft

$661/Sq Ft

Est. Value

About This Home

This home is located at 543 Joaquin Rd Unit 101, Mammoth Lakes, CA 93546 and is currently estimated at $549,170, approximately $660 per square foot. 543 Joaquin Rd Unit 101 is a home located in Mono County with nearby schools including Mammoth Elementary School, Mammoth Middle School, and Mammoth High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 23, 2019

Sold by

Chen Oscar

Bought by

Yang Qianyun

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$204,750

Outstanding Balance

$178,902

Interest Rate

4%

Mortgage Type

New Conventional

Estimated Equity

$370,268

Purchase Details

Closed on

Apr 18, 2019

Sold by

Malec Jason Robert and Smith Douglas A

Bought by

Yang Qianyun

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$204,750

Outstanding Balance

$178,902

Interest Rate

4%

Mortgage Type

New Conventional

Estimated Equity

$370,268

Purchase Details

Closed on

Nov 24, 2015

Sold by

Eggers Robert S and Eggers Vicki E

Bought by

Malec Jason Robert and Smith Douglas A

Purchase Details

Closed on

Jun 4, 2006

Sold by

Arreola Robert A and Arreola Anne E

Bought by

Eggers Robert S and Eggers Vicki E

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Yang Qianyun | -- | Inyo-Mono Title | |

| Yang Qianyun | $315,000 | Inyo-Mono Title | |

| Malec Jason Robert | $160,000 | Inyo Mono Title Company | |

| Eggers Robert S | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Yang Qianyun | $204,750 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,924 | $344,493 | $68,897 | $275,596 |

| 2023 | $3,924 | $337,740 | $67,547 | $270,193 |

| 2022 | $3,878 | $331,119 | $66,223 | $264,896 |

| 2021 | $3,771 | $324,627 | $64,925 | $259,702 |

| 2020 | $3,743 | $321,300 | $64,260 | $257,040 |

| 2019 | $1,976 | $166,394 | $33,278 | $133,116 |

| 2018 | $2,031 | $166,463 | $33,292 | $133,171 |

| 2017 | $1,881 | $163,200 | $32,640 | $130,560 |

| 2016 | $1,851 | $160,000 | $32,000 | $128,000 |

| 2015 | $1,758 | $150,000 | $30,000 | $120,000 |

| 2014 | $1,764 | $150,000 | $30,000 | $120,000 |

Source: Public Records

Map

Nearby Homes

- 526 Lupin St Unit 205

- 463 Mono St Unit 4

- 541 Mono St Unit 4

- 2252 Meridian Blvd Unit 13

- 2252 Meridian Blvd Unit 39

- 19 Evening Star Dr Unit 2

- 1 Evening Star Dr

- 2289 Sierra Nevada Rd Unit F3

- 2289 Sierra Nevada Rd Unit F-15

- 2289 Sierra Nevada Rd Unit F11

- 2004 Sierra Star Parkway #18 Unit Solstice 18

- 78 Ridge Way Unit 52

- 67 Obsidian Place Unit 27

- 2113 Meridian Blvd Unit 185

- 30 Sunshine Unit Snowcreek I 30

- 105 Sanctuary Unit 105

- 286 Old Mammoth Rd Unit 80

- 3251 Chateau Rd Unit 12

- 3251 Chateau Rd Unit 38

- 1295 W Bear Lake Dr Unit 22

- 543 Joaquin Rd

- 543 Joaquin Rd Unit 202

- 543 Joaquin Rd Unit 104

- 543 Joaquin Rd Unit Heritage 102

- 543 Joaquin Rd Unit 203

- 543 Joaquin Rd Unit Heritage 204

- 543 Joaquin Rd Unit Heritage 201

- 543 Joaquin Road #1 (Door #101) Unit 1

- 543 Joaquin Road Unit 1 (Door #101) Unit 101

- 543 Joaquin Rd Unit B-104

- 543 Joaquin Rd

- 543 Joaquin #102 Rd Unit 102

- 531 Joaquin Rd Unit 9

- 531 Joaquin Rd Unit Sierra Valley Sites

- 531 Joaquin Rd

- 2534 Meridian Blvd

- 526 Lupin St Unit 105

- 526 Lupin St Unit 207

- 526 Lupin St Unit Heritage 208

- 2610 Meridian Blvd Unit 2:01