543 Ravenna Way Hayward, CA 94545

Mount Eden NeighborhoodEstimated Value: $819,000 - $924,000

3

Beds

3

Baths

1,349

Sq Ft

$643/Sq Ft

Est. Value

About This Home

This home is located at 543 Ravenna Way, Hayward, CA 94545 and is currently estimated at $867,572, approximately $643 per square foot. 543 Ravenna Way is a home located in Alameda County with nearby schools including Eden Gardens Elementary School, Anthony W. Ochoa Middle School, and Mt. Eden High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 7, 2016

Sold by

Casanas Jan P and Casanas Ailen A

Bought by

Christiansen Family Living Trust and Trust One

Current Estimated Value

Purchase Details

Closed on

Jan 22, 2015

Sold by

Casanas Jan Paolo R and Casanas Ailen A

Bought by

Casanas Jan Paolo R and Casanas Ailen A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$328,000

Interest Rate

3.75%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 27, 2013

Sold by

Andrada Nelia and Andrada Bonifacio

Bought by

Casanas Jan P and Casanas Ailen A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$283,000

Interest Rate

4.17%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jun 3, 2009

Sold by

Mt Eden Partners Llc

Bought by

Andrada Nelia and Andrada Bonifacio

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$295,200

Interest Rate

4.76%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Christiansen Family Living Trust | $561,000 | North American Title Co Inc | |

| Casanas Jan Paolo R | -- | Orange Coast Title | |

| Casanas Jan P | $360,000 | Old Republic Title Company | |

| Andrada Nelia | $328,000 | First American Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Casanas Jan Paolo R | $328,000 | |

| Previous Owner | Casanas Jan P | $283,000 | |

| Previous Owner | Andrada Nelia | $295,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,082 | $664,094 | $201,240 | $462,854 |

| 2024 | $8,082 | $651,073 | $197,295 | $453,778 |

| 2023 | $7,962 | $638,310 | $193,427 | $444,883 |

| 2022 | $7,807 | $625,795 | $189,635 | $436,160 |

| 2021 | $7,744 | $613,526 | $185,917 | $427,609 |

| 2020 | $7,658 | $607,237 | $184,011 | $423,226 |

| 2019 | $7,721 | $595,333 | $180,404 | $414,929 |

| 2018 | $7,242 | $583,664 | $176,868 | $406,796 |

| 2017 | $7,074 | $572,220 | $173,400 | $398,820 |

| 2016 | $4,283 | $356,794 | $106,603 | $250,191 |

| 2015 | $4,197 | $351,438 | $105,003 | $246,435 |

| 2014 | $3,989 | $344,557 | $102,947 | $241,610 |

Source: Public Records

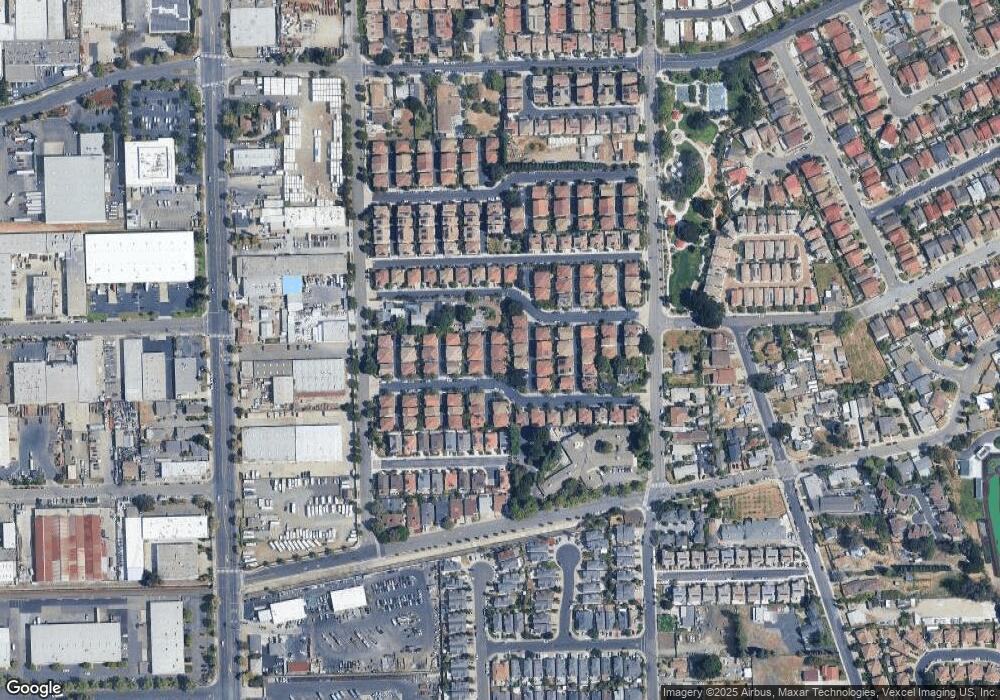

Map

Nearby Homes

- 307 Toscana Way

- 124 Montevina Way

- 1512 Hayden St

- 1508 Hayden St

- 1513 Sylvia St

- 1291 Xavier Ave

- 1200 W Winton Ave Unit 145

- 1200 W Winton Ave Unit 119

- 1200 W Winton Ave

- 1200 W Winton Ave Unit 203

- 1150 W Winton Ave Unit 541

- 25322 Ironwood Ct

- 27276 Cosmo Ct

- 966 Cottonwood Ave

- 828 Bluefield Ln

- 25163 Copa Del Oro Dr Unit 202

- 26147 Stryker St

- 26142 Gettysburg Ave

- 794 Resota St

- 1280 Stanhope Ln Unit 343

- 547 Ravenna Way

- 539 Ravenna Way

- 531 Ravenna Way

- 553 Ravenna Way

- 551 Ravenna Way

- 533 Ravenna Way

- 557 Ravenna Way

- 529 Ravenna Way

- 535 Ravenna Way

- 549 Ravenna Way

- 358 Toscana Way

- 563 Ravenna Way

- 346 Toscana Way

- 344 Toscana Way

- 561 Ravenna Way

- 348 Toscana Way

- 567 Ravenna Way

- 352 Toscana Way

- 559 Ravenna Way

- 354 Toscana Way