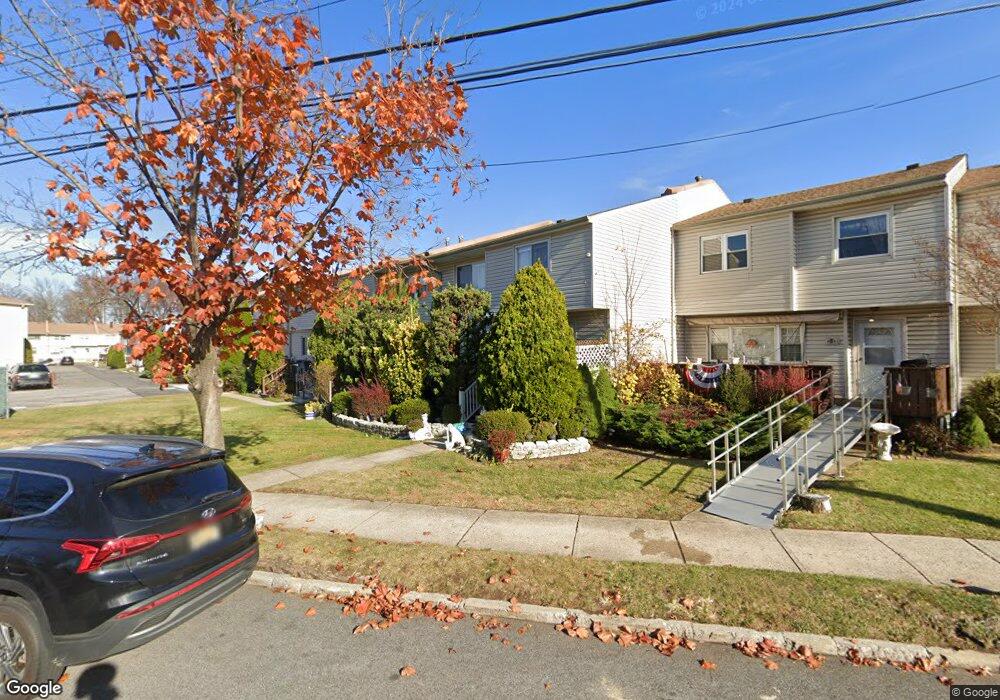

543 Willow Rd E Unit 1 Staten Island, NY 10314

Westerleigh NeighborhoodEstimated Value: $486,342 - $518,000

2

Beds

2

Baths

1,300

Sq Ft

$384/Sq Ft

Est. Value

About This Home

This home is located at 543 Willow Rd E Unit 1, Staten Island, NY 10314 and is currently estimated at $499,836, approximately $384 per square foot. 543 Willow Rd E Unit 1 is a home located in Richmond County with nearby schools including P.S. 30 Westerleigh, I.S. 51 Edwin Markham, and Port Richmond High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 27, 2006

Sold by

Isaza Luz and Ceballos Gloria E

Bought by

Ceballos Gloria E and Reyes Julio

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$260,000

Outstanding Balance

$157,867

Interest Rate

6.5%

Mortgage Type

New Conventional

Estimated Equity

$341,969

Purchase Details

Closed on

Oct 23, 2006

Sold by

Isaza Luz and Ceballos Gloria E

Bought by

Ceballos Gloria E

Purchase Details

Closed on

Oct 31, 2005

Sold by

Segreti Gregg and Segreti Erika

Bought by

Isaza Luz and Ceballos Gloria E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$232,000

Interest Rate

6.06%

Mortgage Type

New Conventional

Purchase Details

Closed on

Oct 25, 2004

Sold by

Segreti Gregg

Bought by

Segreti Gregg and Segreti Erika

Purchase Details

Closed on

Mar 3, 2000

Sold by

Schuchman Leon and Schuchman Bella

Bought by

Segreti Gregg

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$97,600

Interest Rate

8.23%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ceballos Gloria E | -- | Commonwealth Land Title Insu | |

| Ceballos Gloria E | -- | None Available | |

| Isaza Luz | $291,500 | Fidelity Natl Title Ins Co | |

| Segreti Gregg | -- | Stewart Title Insurance Co | |

| Segreti Gregg | $122,000 | Fidelity National Title Ins |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ceballos Gloria E | $260,000 | |

| Closed | Isaza Luz | $232,000 | |

| Previous Owner | Segreti Gregg | $97,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,453 | $32,994 | $903 | $32,091 |

| 2024 | $3,465 | $26,967 | $1,097 | $25,870 |

| 2023 | $3,278 | $17,542 | $1,111 | $16,431 |

| 2022 | $3,017 | $22,367 | $1,591 | $20,776 |

| 2021 | $2,983 | $20,236 | $1,591 | $18,645 |

| 2020 | $3,009 | $20,767 | $1,591 | $19,176 |

| 2019 | $2,948 | $19,408 | $1,591 | $17,817 |

| 2018 | $2,682 | $14,618 | $1,234 | $13,384 |

| 2017 | $2,512 | $13,791 | $1,263 | $12,528 |

| 2016 | $2,291 | $13,011 | $1,246 | $11,765 |

| 2015 | $2,173 | $13,011 | $1,307 | $11,704 |

| 2014 | $2,173 | $12,912 | $1,211 | $11,701 |

Source: Public Records

Map

Nearby Homes

- 251 Cambridge Ave

- 469 Willow Rd E Unit 1

- 423 Willow Rd E

- 443 Willow Rd E Unit 1

- 443 Willow Rd E

- 360 Caswell Ave

- 182 Woodbine Ave

- 22 Francine Ln

- 493 Willowbrook Rd

- 777-805 Willowbrook Rd

- 132 Parkview Loop Unit 85

- 522 Stewart Ave

- 37 Dreyer Ave Unit A

- 124 Woodbine Ave

- 410 Hawthorne Ave Unit 51

- 320 Bryson Ave

- 2441 Victory Blvd

- 255 Caswell Ave

- 2439 Victory Blvd

- 13 Hawthorne Ave

- 543 Willow Rd E Unit 2

- 541 Willow Rd E Unit 2

- 541 Willow Rd E Unit 1

- 539-1 Willow Rd E

- 545 Willow Rd E Unit 2

- 545 Willow Rd E Unit 1

- 539 Willow Rd E Unit 2

- 537 Willow Rd E Unit 2

- 537 Willow Rd E Unit 1

- 539 Willow Rd E Unit 1

- 537 Willow Rd E

- 537-1 Willow Rd E

- 242 Cambridge Ave

- 535 Willow Rd E Unit 2

- 533 Willow Rd E Unit 2

- 533 Willow Rd E Unit 1

- 535 Willow Rd E Unit 1

- 533 Willow Rd E

- 535 Willow Rd E

- 246 Cambridge Ave