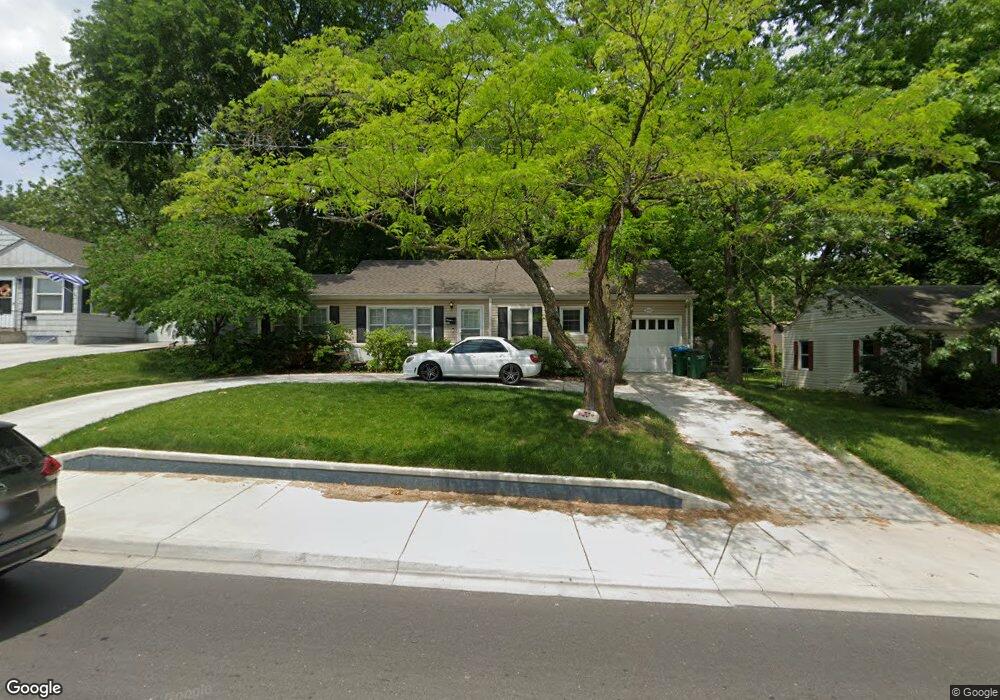

5430 Roe Blvd Roeland Park, KS 66205

Estimated Value: $259,000 - $298,000

2

Beds

1

Bath

968

Sq Ft

$283/Sq Ft

Est. Value

About This Home

This home is located at 5430 Roe Blvd, Roeland Park, KS 66205 and is currently estimated at $274,322, approximately $283 per square foot. 5430 Roe Blvd is a home located in Johnson County with nearby schools including Roesland Elementary School, Hocker Grove Middle School, and Shawnee Mission North High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 22, 2008

Sold by

Wells Fargo Bank N A

Bought by

Payne Roger

Current Estimated Value

Purchase Details

Closed on

Oct 11, 2006

Sold by

Kospelich Ralph

Bought by

Wells Fargo Bank Na

Purchase Details

Closed on

Apr 26, 2004

Sold by

Federal Home Loan Mortgage Corporation

Bought by

Kospelich Ralph J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$105,450

Interest Rate

5.5%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Sep 18, 2003

Sold by

Messplay Beth E and Mortgage Electronic Registrati

Bought by

Federal Home Loan Mortgage Corporation

Purchase Details

Closed on

Nov 23, 2002

Sold by

Messplay David Clyde

Bought by

Messplay Beth Elaine

Purchase Details

Closed on

Feb 27, 2002

Sold by

Alexander Christopher L and Alexander Melinda S

Bought by

Messplay Beth Elaine and Messplay Beth E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$93,000

Interest Rate

6.81%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Payne Roger | -- | Mokan Title Services Inc | |

| Wells Fargo Bank Na | $108,852 | None Available | |

| Kospelich Ralph J | -- | Guarantee Title | |

| Federal Home Loan Mortgage Corporation | $101,537 | -- | |

| Messplay Beth Elaine | -- | -- | |

| Messplay Beth Elaine | -- | Shawnee Land Title & Escrow |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Kospelich Ralph J | $105,450 | |

| Previous Owner | Messplay Beth Elaine | $93,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,258 | $24,944 | $8,025 | $16,919 |

| 2023 | $3,201 | $23,897 | $7,301 | $16,596 |

| 2022 | $2,990 | $21,976 | $6,632 | $15,344 |

| 2021 | $2,593 | $17,745 | $5,519 | $12,226 |

| 2020 | $2,531 | $17,113 | $4,796 | $12,317 |

| 2019 | $2,382 | $15,790 | $3,071 | $12,719 |

| 2018 | $2,408 | $15,951 | $3,071 | $12,880 |

| 2017 | $2,130 | $13,341 | $3,071 | $10,270 |

| 2016 | $2,052 | $12,547 | $3,071 | $9,476 |

| 2015 | $1,908 | $11,604 | $3,071 | $8,533 |

| 2013 | -- | $11,110 | $3,071 | $8,039 |

Source: Public Records

Map

Nearby Homes

- 5600 Roe Blvd

- 4415 W 52nd Terrace

- 5343 Rosewood St

- 5239 Catalina St

- 4304 Brookridge Dr

- 5429 Maple St

- 5024 Fontana St

- 5335 Maple St

- 5057 Buena Vista St

- 5332 Neosho Ln

- 5817 Fontana Dr

- 5434 Maple St

- 5312 W 58th St

- 3812 W 52nd Place

- 5211 W 50th Terrace

- 5004 Juniper Dr

- 5400 W 58th St

- 4976 W 60th Terrace

- 5307 W 50th Terrace

- 5914 Granada St

- 5434 Roe Blvd

- 5426 Roe Blvd

- 5440 Roe Blvd

- 5431 Linden St

- 5427 Linden St

- 5435 Linden St

- 5420 Roe Blvd

- 5421 Linden St

- 4615 W 54th Terrace

- 5439 Linden St

- 5444 Roe Blvd

- 5417 Linden St

- 5419 Roe Blvd

- 5443 Linden St

- 5441 Roe Blvd

- 5432 Granada Ln

- 5446 Roe Blvd

- 4612 W 54th Terrace

- 5411 Linden St

- 4720 W 55th St