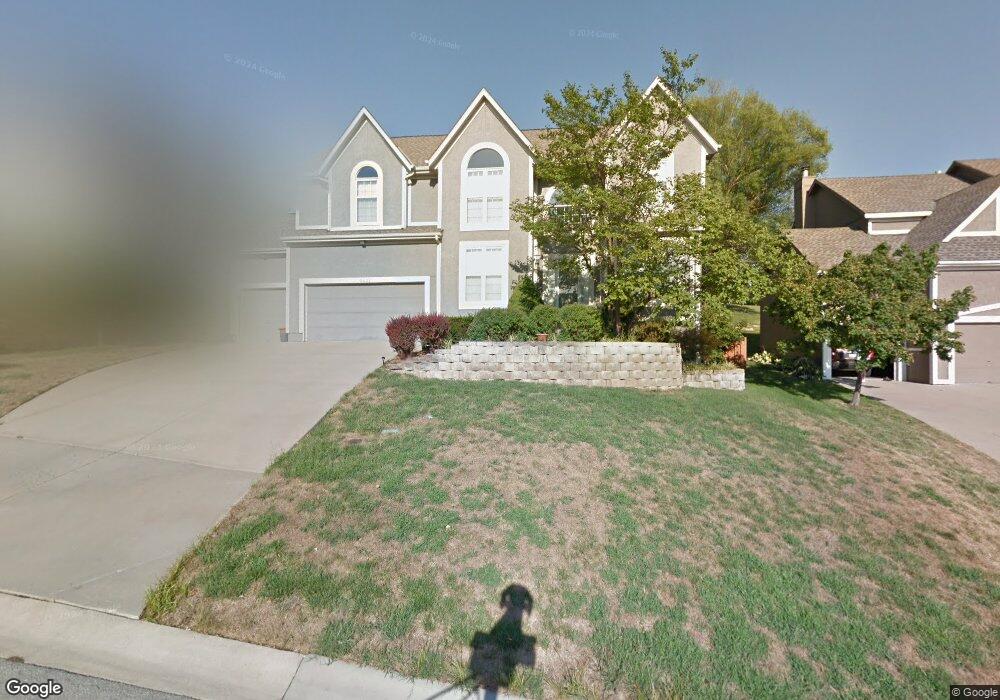

5437 Oakview St Shawnee, KS 66216

Estimated Value: $532,058 - $564,000

5

Beds

5

Baths

2,898

Sq Ft

$190/Sq Ft

Est. Value

About This Home

This home is located at 5437 Oakview St, Shawnee, KS 66216 and is currently estimated at $550,765, approximately $190 per square foot. 5437 Oakview St is a home located in Johnson County with nearby schools including Ray Marsh Elementary School, Trailridge Middle School, and Shawnee Mission Northwest High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 28, 2017

Sold by

Hendershot Todd and Hendershot Angela

Bought by

Hendershot Todd R and Todd R Hendershot Revocable Tr

Current Estimated Value

Purchase Details

Closed on

Oct 29, 2011

Sold by

Makkyla James

Bought by

Makkyla Angela

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$245,000

Interest Rate

4.13%

Mortgage Type

New Conventional

Purchase Details

Closed on

Apr 28, 2008

Sold by

Bowker Jeffery J and Bowker Margaret G

Bought by

Makkyla James L and Makkyla Angela

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$250,400

Interest Rate

5.84%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hendershot Todd R | -- | None Available | |

| Hendershot Angela M | -- | None Available | |

| Makkyla Angela | -- | Platinum Title Llc | |

| Makkyla James L | -- | Platinum Title Llc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Makkyla Angela | $245,000 | |

| Previous Owner | Makkyla James L | $250,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,990 | $56,224 | $12,005 | $44,219 |

| 2023 | $5,732 | $53,372 | $10,002 | $43,370 |

| 2022 | $5,302 | $49,209 | $10,002 | $39,207 |

| 2021 | $5,211 | $45,540 | $8,699 | $36,841 |

| 2020 | $4,987 | $43,010 | $8,699 | $34,311 |

| 2019 | $4,757 | $40,998 | $7,940 | $33,058 |

| 2018 | $4,456 | $40,250 | $7,940 | $32,310 |

| 2017 | $4,559 | $38,536 | $6,887 | $31,649 |

| 2016 | $4,536 | $37,858 | $6,601 | $31,257 |

| 2015 | $4,225 | $36,455 | $6,601 | $29,854 |

| 2013 | -- | $34,684 | $6,601 | $28,083 |

Source: Public Records

Map

Nearby Homes

- 5502 Mullen Rd

- 5633 Oakview St

- 5713 Widmer Rd

- 5530 Rene St

- 13810 W 53rd St

- 5703 Cottonwood St

- 5826 Oakview St

- 5300 Summit Ct

- 4940 Alden St

- 14210 W 50th St

- 5507 Noland Rd

- 14105 W 48th Terrace

- 180 Terrace Trail S

- 5919 Pflumm Rd

- 6143 Park St

- 6145 Park St

- 5807 Noland Rd

- 14214 W 63rd St

- 14204 W 63rd St

- 5021 Bradshaw St

- 5433 Oakview St

- 5441 Oakview St

- 5429 Oakview St

- 5432 Oakview St

- 5440 Oakview St

- 5425 Oakview St

- 5428 Oakview St

- 14300 W 55th St

- 5501 Oakview St

- 5424 Oakview St

- 14310 W 55th St

- 5421 Oakview St

- 5433 Alden St

- 5502 Oakview St

- 5437 Alden St

- 5429 Alden St

- 5420 Oakview St

- 5416 Oakview St

- 5505 Oakview St

- 5506 Oakview St