5451 Ruby Fork Dr Columbus Grove, OH 45830

Tuttle West NeighborhoodEstimated Value: $360,000 - $378,000

3

Beds

3

Baths

1,400

Sq Ft

$261/Sq Ft

Est. Value

About This Home

This home is located at 5451 Ruby Fork Dr, Columbus Grove, OH 45830 and is currently estimated at $365,721, approximately $261 per square foot. 5451 Ruby Fork Dr is a home with nearby schools including Gables Elementary School, Ridgeview Middle School, and Centennial High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 30, 2021

Sold by

Olympus Borrower Llc

Bought by

Olympus Borrower 1 Llc

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$467,170,000

Interest Rate

3.56%

Mortgage Type

Credit Line Revolving

Purchase Details

Closed on

Jun 10, 2021

Sold by

Frankevic Cereso Larry S

Bought by

Olympus Borrower Llc

Purchase Details

Closed on

Jan 3, 2017

Sold by

Frankevic Larry S

Bought by

Frankevic John E

Purchase Details

Closed on

Jun 15, 2016

Sold by

Pulte Homes Of Ohio Llc

Bought by

Cereso Larry S Frankevic

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$142,597

Interest Rate

3.61%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Olympus Borrower 1 Llc | -- | Servicelink | |

| Olympus Borrower Llc | $280,000 | None Available | |

| Frankevic John E | -- | None Available | |

| Cereso Larry S Frankevic | $182,200 | Pulte Title Box |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Olympus Borrower 1 Llc | $467,170,000 | |

| Previous Owner | Cereso Larry S Frankevic | $142,597 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,619 | $100,800 | $29,400 | $71,400 |

| 2023 | $4,884 | $100,800 | $29,400 | $71,400 |

| 2022 | $4,609 | $80,650 | $19,710 | $60,940 |

| 2021 | $4,513 | $80,650 | $19,710 | $60,940 |

| 2020 | $4,454 | $80,650 | $19,710 | $60,940 |

| 2019 | $4,171 | $64,510 | $15,750 | $48,760 |

| 2018 | $4,166 | $64,510 | $15,750 | $48,760 |

| 2017 | $2,575 | $64,510 | $15,750 | $48,760 |

| 2016 | $980 | $10,570 | $10,570 | $0 |

| 2015 | -- | $0 | $0 | $0 |

Source: Public Records

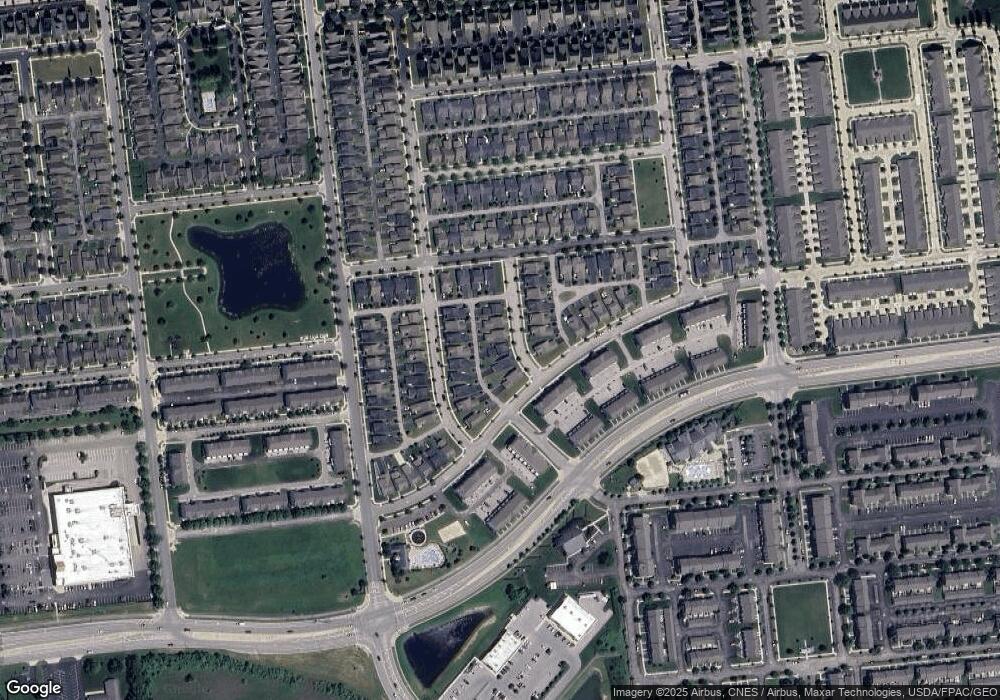

Map

Nearby Homes

- 5749 Passage Creek Dr

- 5726 Hayden Run Blvd

- 5786 Marble Creek St

- 5566 Spring River Ave

- 5526 Tygart Valley Dr

- 5930 Winberry Creek Dr Unit 1107

- 5580 Lime Creek Dr Unit 38

- 5424 Holly River Ave

- 5650 Wexler Rd

- 5640 Lantos Rd

- 6001 Canyon Creek Dr Unit 303

- 0 Hayden Run Rd Unit Tract 7

- 0 Hayden Run Rd Unit Lot 5 224032104

- 5597 Crystal Falls St

- 5631 Middle Falls St Unit 39

- 5605 Chippewa Falls St Unit 60

- 5570 Middle Falls St Unit 52

- 5341 Mystic Falls Dr Unit 58

- 5553 Middle Falls St Unit 30

- 5162 Hayden Woods Ln Unit 22

- 5451 Ruby Fork Dr

- 5457 Ruby Fork Dr

- 5445 Ruby Fork Dr

- 5463 Ruby Fork Dr

- 5439 Ruby Fork Dr

- 5448 Goose Falls Dr

- 5454 Goose Falls Dr

- 5436 Goose Falls Dr

- 5469 Ruby Fork Dr

- 5460 Goose Falls Dr

- 5462 Ruby Fork Dr

- 5430 Goose Falls Dr

- 5456 Ruby Fork Dr

- 5450 Ruby Fork Dr

- 5466 Goose Falls Dr

- 5424 Goose Falls Dr

- 5468 Ruby Fork Dr

- 5418 Goose Falls Dr

- 5817 Trail Creek Dr

- 5817 Trail Creek Dr