54709 Inverness Way Unit A461 La Quinta, CA 92253

PGA West NeighborhoodEstimated Value: $635,000 - $900,000

2

Beds

3

Baths

1,918

Sq Ft

$378/Sq Ft

Est. Value

About This Home

This home is located at 54709 Inverness Way Unit A461, La Quinta, CA 92253 and is currently estimated at $725,694, approximately $378 per square foot. 54709 Inverness Way Unit A461 is a home located in Riverside County with nearby schools including Westside Elementary School, Cahuilla Desert Academy Junior High, and Coachella Valley High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 28, 2001

Sold by

Sander Anne Q and Mancour David A

Bought by

Fieldhouse Wilson S and Fieldhouse Leslie Kim

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$187,000

Interest Rate

7.13%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Apr 14, 2000

Sold by

Sander Anne Q

Bought by

Sander Anne Q and Mancour David A

Purchase Details

Closed on

Jan 31, 2000

Sold by

Gmelich John T

Bought by

Sander Anne Q

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$200,000

Interest Rate

7.87%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Fieldhouse Wilson S | $272,500 | Orange Coast Title | |

| Sander Anne Q | -- | -- | |

| Sander Anne Q | $250,000 | Orange Coast Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Fieldhouse Wilson S | $187,000 | |

| Previous Owner | Sander Anne Q | $200,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,733 | $402,539 | $103,395 | $299,144 |

| 2023 | $5,733 | $386,910 | $99,381 | $287,529 |

| 2022 | $5,471 | $379,325 | $97,433 | $281,892 |

| 2021 | $5,347 | $371,888 | $95,523 | $276,365 |

| 2020 | $5,289 | $368,076 | $94,544 | $273,532 |

| 2019 | $5,197 | $360,860 | $92,691 | $268,169 |

| 2018 | $5,091 | $353,785 | $90,875 | $262,910 |

| 2017 | $5,110 | $346,849 | $89,094 | $257,755 |

| 2016 | $4,933 | $340,049 | $87,348 | $252,701 |

| 2015 | $4,755 | $334,943 | $86,037 | $248,906 |

| 2014 | $4,734 | $328,383 | $84,352 | $244,031 |

Source: Public Records

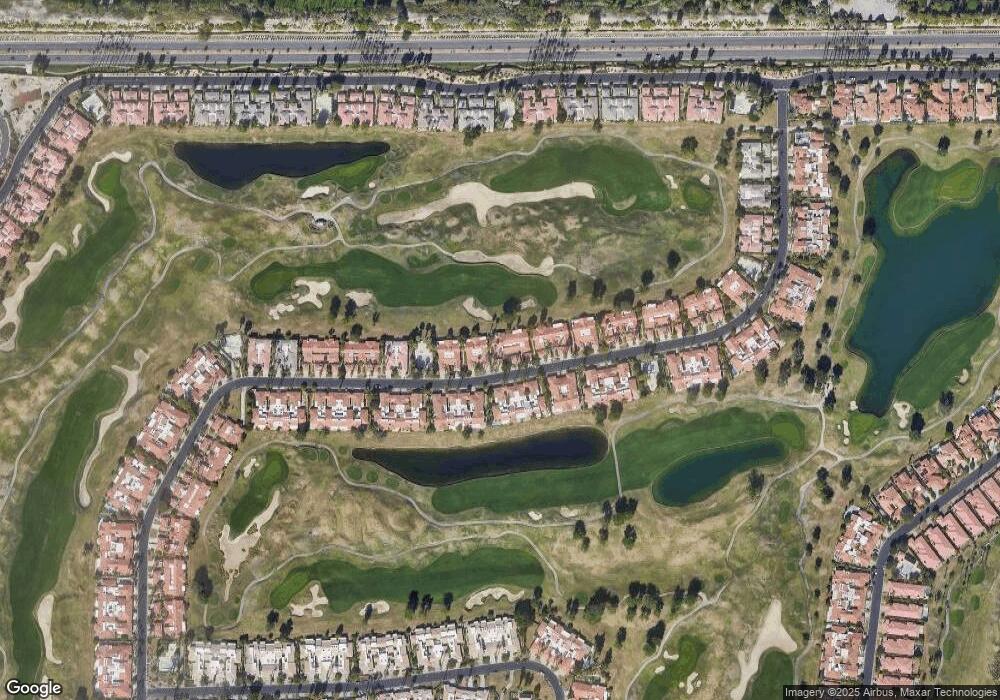

Map

Nearby Homes

- 54648 Inverness Way

- 54671 Inverness Way

- 54524 Inverness Way

- 80613 Oak Tree

- 80679 Oaktree

- 54808 Inverness Way

- 54821 Inverness Way

- 54860 Inverness Way

- 80393 Pebble Beach

- 80385 Pebble Beach

- 54880 Inverness Way

- 80432 Pebble Beach

- 80218 Whisper Rock Way

- 55729 Isleworth

- 80215 Whisper Rock Way

- 54374 Oak Tree

- 54125 E Residence Club Dr Unit 22-02

- 55525 Cherry Hills Dr

- 80256 Redstone Way Unit V93

- 55830 Cherry Hills Dr

- 54685 Inverness Way Unit 467

- 54697 Inverness Way

- 54681 Inverness Way

- 54685 Inverness Way

- 54701 Inverness Way

- 54713 Inverness Way

- 54717 Inverness Way

- 54673 Inverness Way

- 54677 Inverness Way

- 54705 Inverness Way

- 54689 Inverness Way

- 54644 Inverness Way

- 54652 Inverness Way

- 54656 Inverness Way

- 54721 Inverness Way

- 54636 Inverness Way

- 54725 Inverness Way

- 54660 Inverness Way

- 54664 Inverness Way

- 54 Inverness Way