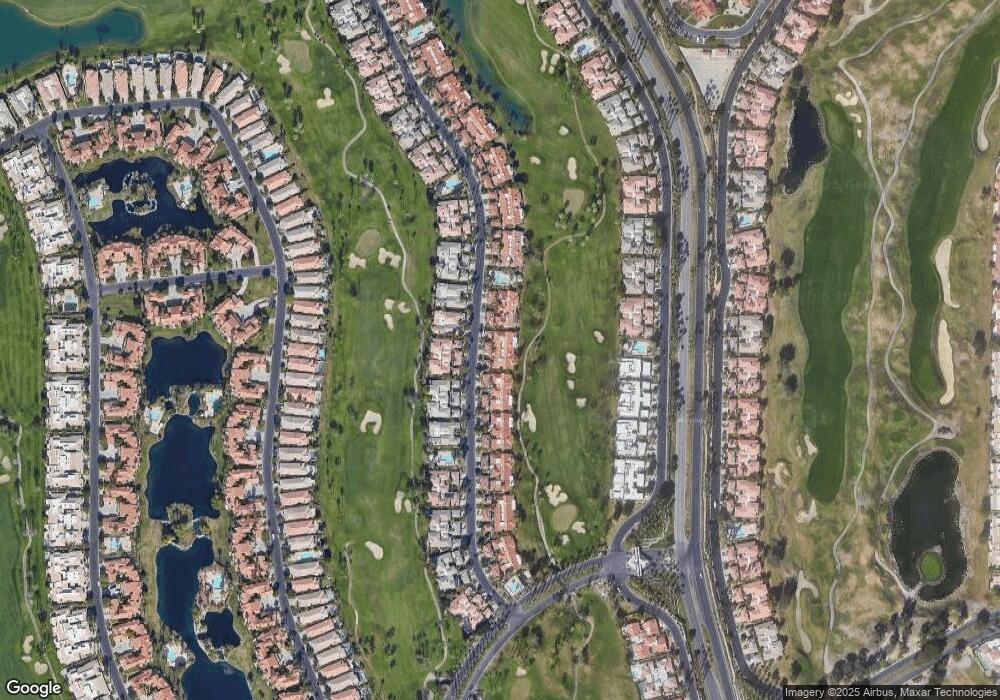

54948 Shoal Creek Unit A262 La Quinta, CA 92253

PGA West NeighborhoodEstimated Value: $503,498 - $672,000

2

Beds

2

Baths

1,549

Sq Ft

$370/Sq Ft

Est. Value

About This Home

This home is located at 54948 Shoal Creek Unit A262, La Quinta, CA 92253 and is currently estimated at $572,625, approximately $369 per square foot. 54948 Shoal Creek Unit A262 is a home located in Riverside County with nearby schools including Harry S. Truman Elementary School, La Quinta Middle School, and La Quinta High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 19, 2002

Sold by

Raider Keith and Raider Brenda

Bought by

Johnson Millard T and Johnson Eleonora E

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$180,000

Outstanding Balance

$76,320

Interest Rate

7.13%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$496,305

Purchase Details

Closed on

Jun 14, 1999

Sold by

Raider Keith and Raider Brenda

Bought by

Raider Keith and Raider Brenda

Purchase Details

Closed on

Mar 26, 1999

Sold by

Rheams Jerald W and Rheams Patricia J

Bought by

Raider Keith L and Raider Brenda L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$145,600

Interest Rate

6.96%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jan 13, 1998

Sold by

Hiroko Kawakami

Bought by

Rheams Jerald W and Rheams Patricia J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$124,800

Interest Rate

6.98%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Johnson Millard T | $200,000 | American Title Co | |

| Raider Keith | -- | -- | |

| Raider Keith L | $182,000 | Fidelity National Title Co | |

| Rheams Jerald W | $156,000 | Old Republic Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Johnson Millard T | $180,000 | |

| Previous Owner | Raider Keith L | $145,600 | |

| Previous Owner | Rheams Jerald W | $124,800 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,483 | $295,434 | $88,619 | $206,815 |

| 2023 | $4,483 | $283,964 | $85,179 | $198,785 |

| 2022 | $4,189 | $278,397 | $83,509 | $194,888 |

| 2021 | $3,996 | $272,939 | $81,872 | $191,067 |

| 2020 | $3,924 | $270,141 | $81,033 | $189,108 |

| 2019 | $3,846 | $264,845 | $79,445 | $185,400 |

| 2018 | $3,764 | $259,653 | $77,891 | $181,762 |

| 2017 | $3,711 | $254,563 | $76,364 | $178,199 |

| 2016 | $3,645 | $249,572 | $74,867 | $174,705 |

| 2015 | $3,582 | $245,826 | $73,744 | $172,082 |

| 2014 | $3,527 | $241,012 | $72,300 | $168,712 |

Source: Public Records

Map

Nearby Homes

- 54912 Shoal Creek

- 55113 Shoal Creek

- 55174 Shoal Creek

- 55105 Oakhill

- 55069 Oakhill

- 54961 Oakhill

- 54624 Shoal Creek

- 55156 Tanglewood Unit 17

- 54613 Oakhill

- 51927 Marquessa Ln

- 55336 Tanglewood

- 54970 Firestone

- 55438 Firestone

- 54580 Tanglewood

- 54440 W Residence Club Dr

- 55456 Firestone

- 55504 Firestone

- 54741 Firestone

- 55649 Pinehurst

- 54880 Inverness Way

- 54936 Shoal Creek

- 54924 Shoal Creek

- 54984 Shoal Creek

- 54996 Shoal Creek

- 54900 Shoal Creek

- 55008 Shoal Creek

- 55019 Shoal Creek

- 54971 Shoal Creek

- 54959 Shoal Creek

- 54875 Shoal Creek

- 54923 Shoal Creek

- 55020 Shoal Creek

- 54899 Shoal Creek

- 54887 Shoal Creek

- 54935 Shoal Creek

- 54863 Shoal Creek

- 54876 Shoal Creek

- 54995 Shoal Creek

- 54851 Shoal Creek

- 55066 Shoal Creek