55 Levanno Dr Crown Point, IN 46307

Porter County NeighborhoodEstimated Value: $526,000 - $1,035,993

4

Beds

5

Baths

2,840

Sq Ft

$269/Sq Ft

Est. Value

About This Home

This home is located at 55 Levanno Dr, Crown Point, IN 46307 and is currently estimated at $762,664, approximately $268 per square foot. 55 Levanno Dr is a home located in Porter County with nearby schools including Porter Lakes Elementary School, Boone Grove Elementary School, and Boone Grove Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 23, 2018

Sold by

Cuellar Luis and Cuellar Sandra

Bought by

Babekoski Mirko and Babekoski Izabela

Current Estimated Value

Purchase Details

Closed on

Apr 27, 2006

Sold by

Pampalone A J

Bought by

Cuellar Luis and Cuellar Sandra

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$115,000

Interest Rate

8%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Feb 15, 2005

Sold by

Smith David J and Smith Kathryn B

Bought by

Pampalone A J

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Babekoski Mirko | -- | Meridian Title Corp | |

| Cuellar Luis | -- | Community Title Company | |

| Pampalone A J | -- | Stewart Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Cuellar Luis | $115,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $9,780 | $1,109,900 | $74,900 | $1,035,000 |

| 2023 | $3,350 | $451,500 | $74,900 | $376,600 |

| 2022 | $672 | $43,400 | $43,400 | $0 |

| 2021 | $901 | $43,400 | $43,400 | $0 |

| 2020 | $796 | $39,500 | $39,500 | $0 |

| 2019 | $833 | $39,500 | $39,500 | $0 |

| 2018 | $829 | $39,500 | $39,500 | $0 |

| 2017 | $803 | $39,500 | $39,500 | $0 |

| 2016 | $1,429 | $84,800 | $84,800 | $0 |

| 2014 | $3,431 | $74,800 | $74,800 | $0 |

| 2013 | -- | $73,600 | $73,600 | $0 |

Source: Public Records

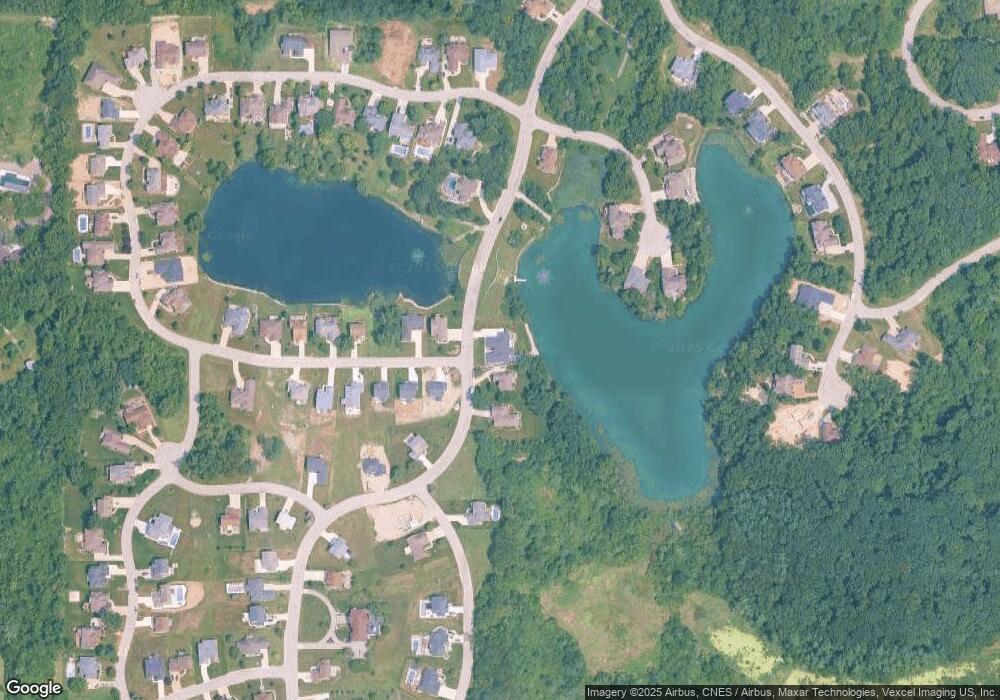

Map

Nearby Homes

- 738 Cirque Ct

- 783 Cirque Dr

- 76 Bergamo Ln E

- 60 Bergamo Ln

- 53, 55, & 57 Morena Terrace

- 81 Morena Terrace

- 59 & 61 Morena Terrace

- 67 & 69 Morena Terrace

- 50 Morena Terrace

- 46 Levanno Dr

- 748 Verdano Terrace

- 746 Verdano Terrace

- 71 Morena Terrace

- 759 Verdano Terrace

- 96 & 99 Cambe Ct

- Broadmoor Plan at Falling Waters

- Cumberland Plan at Falling Waters

- Sutherland Plan at Falling Waters

- Victoria Plan at Falling Waters

- Yosemite Plan at Falling Waters