Estimated Value: $324,000 - $473,283

3

Beds

2

Baths

1,750

Sq Ft

$242/Sq Ft

Est. Value

About This Home

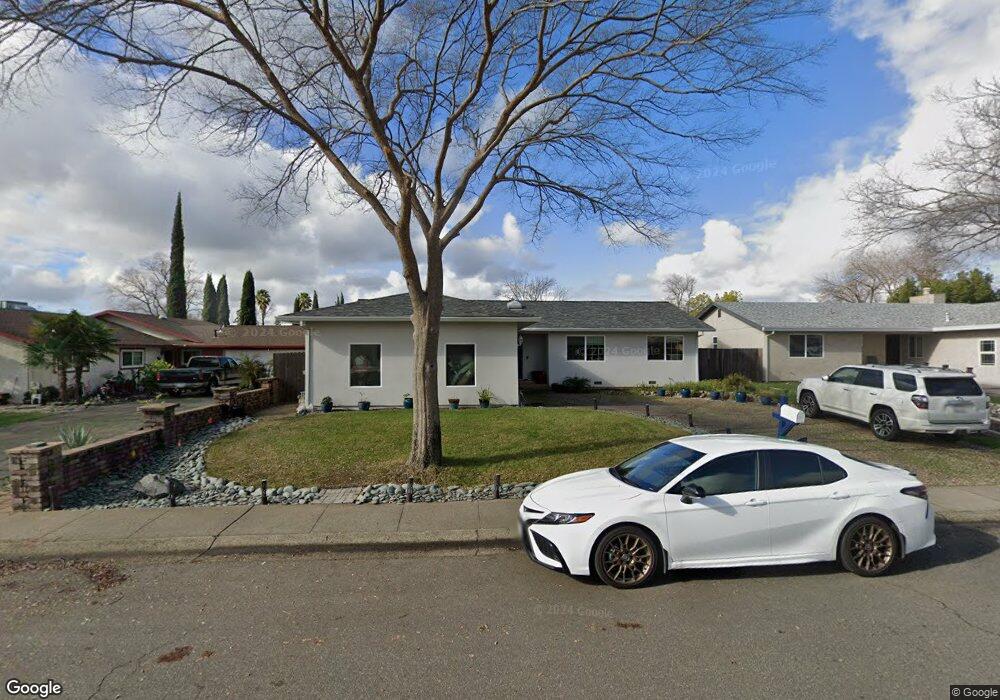

This home is located at 55 New Dawn Cir, Chico, CA 95928 and is currently estimated at $423,321, approximately $241 per square foot. 55 New Dawn Cir is a home located in Butte County with nearby schools including Little Chico Creek Elementary School, Harry M. Marsh Junior High School, and Chico High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 3, 2004

Sold by

Hubbard Robert F and Hubbard Marie A

Bought by

Castillo Keith M and Castillo Wendy C

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$235,200

Outstanding Balance

$116,400

Interest Rate

5.97%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$306,921

Purchase Details

Closed on

Jun 4, 1999

Sold by

Schaffer Jerry L and Schaffer Brenda D

Bought by

Hubbard Robert F and Hubbard Marie A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$108,896

Interest Rate

6.9%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Castillo Keith M | $294,000 | Mid Valley Title & Escrow Co | |

| Hubbard Robert F | $110,000 | Bidwell Title & Escrow Compa |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Castillo Keith M | $235,200 | |

| Previous Owner | Hubbard Robert F | $108,896 | |

| Closed | Castillo Keith M | $44,100 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,391 | $409,789 | $146,351 | $263,438 |

| 2024 | $4,391 | $401,755 | $143,482 | $258,273 |

| 2023 | $4,337 | $393,878 | $140,669 | $253,209 |

| 2022 | $4,270 | $386,156 | $137,911 | $248,245 |

| 2021 | $4,184 | $378,585 | $135,207 | $243,378 |

| 2020 | $4,174 | $374,704 | $133,821 | $240,883 |

| 2019 | $4,100 | $367,358 | $131,198 | $236,160 |

| 2018 | $3,343 | $300,000 | $120,000 | $180,000 |

| 2017 | $3,337 | $300,000 | $115,000 | $185,000 |

| 2016 | $2,899 | $280,000 | $95,000 | $185,000 |

| 2015 | $2,781 | $265,000 | $95,000 | $170,000 |

| 2014 | $2,529 | $242,000 | $95,000 | $147,000 |

Source: Public Records

Map

Nearby Homes

- 18 Jasper Dr

- 2375 Notre Dame Blvd Unit 1

- 1 Parkhurst St

- 12 Wrangler Ct

- 123 Raley Blvd

- 2234 Hutchinson St

- 171 Remington Dr

- 1814 Roth St

- 2066 Chadwick Dr

- 2050 Springfield Dr Unit 143

- 2050 Springfield Dr Unit 315

- 2509 England St

- 0 Bruce Rd Unit SN25051893

- 0 Bruce Rd Unit SN25051885

- 2099 Hartford Dr Unit 8

- 13 Betsey Way

- 1971 Potter Rd

- 2055 Amanda Way Unit 40

- 2865 Beaumont Ave

- 2869 Longwood Dr

- 53 New Dawn Cir

- 57 New Dawn Cir

- 4 Roxanne Ct

- 51 New Dawn Cir

- 5 Roxanne Ct

- 3 Roxanne Ct

- 59 New Dawn Cir

- 54 New Dawn Cir

- 56 New Dawn Cir

- 14 Webster Dr

- 58 New Dawn Cir

- 52 New Dawn Cir

- 49 New Dawn Cir

- 6 Roxanne Ct

- 12 Webster Dr

- 50 New Dawn Cir

- 60 New Dawn Cir

- 2 Roxanne Ct

- 47 New Dawn Cir

- 48 New Dawn Cir