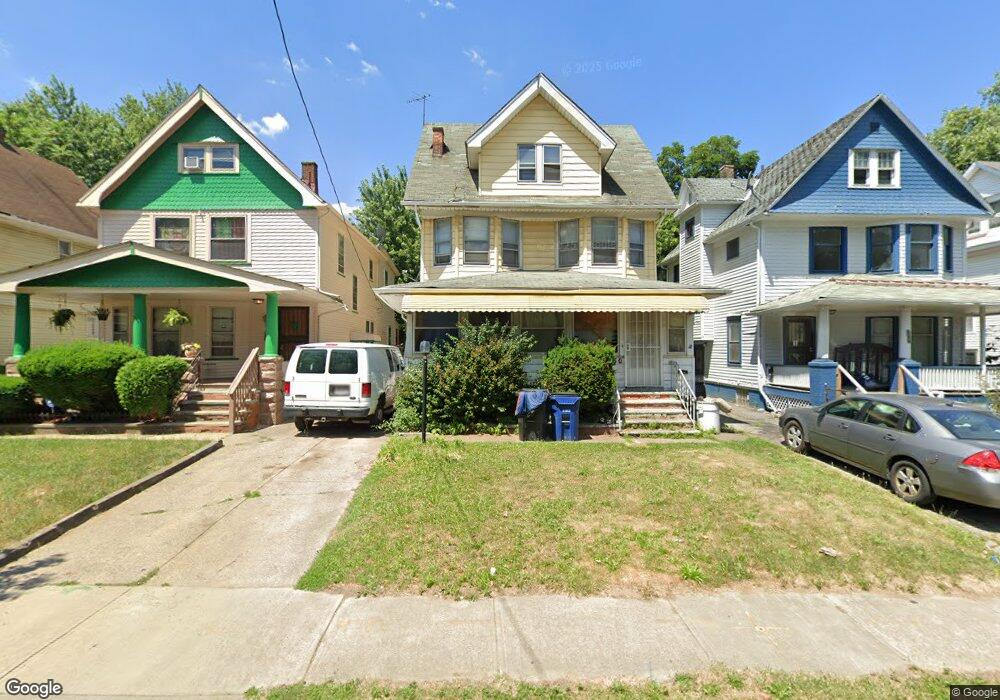

550 E 108th St Cleveland, OH 44108

Glenville NeighborhoodEstimated Value: $69,762 - $131,000

4

Beds

1

Bath

1,607

Sq Ft

$56/Sq Ft

Est. Value

About This Home

This home is located at 550 E 108th St, Cleveland, OH 44108 and is currently estimated at $89,441, approximately $55 per square foot. 550 E 108th St is a home located in Cuyahoga County with nearby schools including Bolton, Anton Grdina School, and Andrew J. Rickoff School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 11, 2020

Sold by

Johnson Maurice

Bought by

Strong Jayson

Current Estimated Value

Purchase Details

Closed on

Apr 18, 2018

Sold by

Grace And Company Of Ohio Llc

Bought by

Johnson Maurice

Purchase Details

Closed on

May 20, 2013

Sold by

Rogers Michele Y

Bought by

Grace & Company Of Ohio Llc

Purchase Details

Closed on

Mar 18, 2009

Sold by

Fannie Mae

Bought by

Rogers Steven S

Purchase Details

Closed on

Jul 17, 2008

Sold by

Stewart Dionna A and Everhome Mortgage Co

Bought by

Federal National Mortgage Association

Purchase Details

Closed on

Oct 20, 2004

Sold by

Williams Ronald and Williams Doris A

Bought by

Stewart Dionna A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$90,000

Interest Rate

8.24%

Mortgage Type

Stand Alone First

Purchase Details

Closed on

May 29, 2004

Sold by

Murray Maudie Mae and Bell Zena

Bought by

Williams Ronald

Purchase Details

Closed on

Jan 1, 1975

Bought by

Bell Zena

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Strong Jayson | $28,000 | Accommodation | |

| Johnson Maurice | $47,300 | None Available | |

| Grace & Company Of Ohio Llc | -- | Attorney | |

| Rogers Steven S | $8,500 | Accutitle Agency Inc | |

| Federal National Mortgage Association | $33,334 | Attorney | |

| Stewart Dionna A | $90,000 | Renaissance | |

| Williams Ronald | $49,000 | Heights Title Agency | |

| Bell Zena | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Stewart Dionna A | $90,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,210 | $18,095 | $3,010 | $15,085 |

| 2023 | $933 | $12,040 | $2,380 | $9,660 |

| 2022 | $928 | $12,040 | $2,380 | $9,660 |

| 2021 | $899 | $12,040 | $2,380 | $9,660 |

| 2020 | $852 | $9,870 | $1,960 | $7,910 |

| 2019 | $1,085 | $28,200 | $5,600 | $22,600 |

| 2018 | $1,102 | $9,870 | $1,960 | $7,910 |

| 2017 | $1,400 | $16,560 | $2,170 | $14,390 |

| 2016 | $1,389 | $16,560 | $2,170 | $14,390 |

| 2015 | -- | $16,560 | $2,170 | $14,390 |

| 2014 | -- | $18,420 | $2,420 | $16,000 |

Source: Public Records

Map

Nearby Homes

- 10811 Sprague Ave

- 550 E 107th St

- 529 E 109th St

- 10626 Dupont Ave

- 10639 Dupont Ave

- 656 E 106th St

- 666 Parkwood Dr

- 10523 Helena Ave

- 735 Parkwood Dr

- 10307 Marlowe Ave

- 742 Linn Dr

- 519 E 103rd St

- 448 E 114th St

- 10703 Kimberley Ave

- 634 E 117th St

- 461 E 115th St Unit 4

- 617 E 117th St

- 569 E 101st St

- 647 E 117th St

- 554 E 101st St