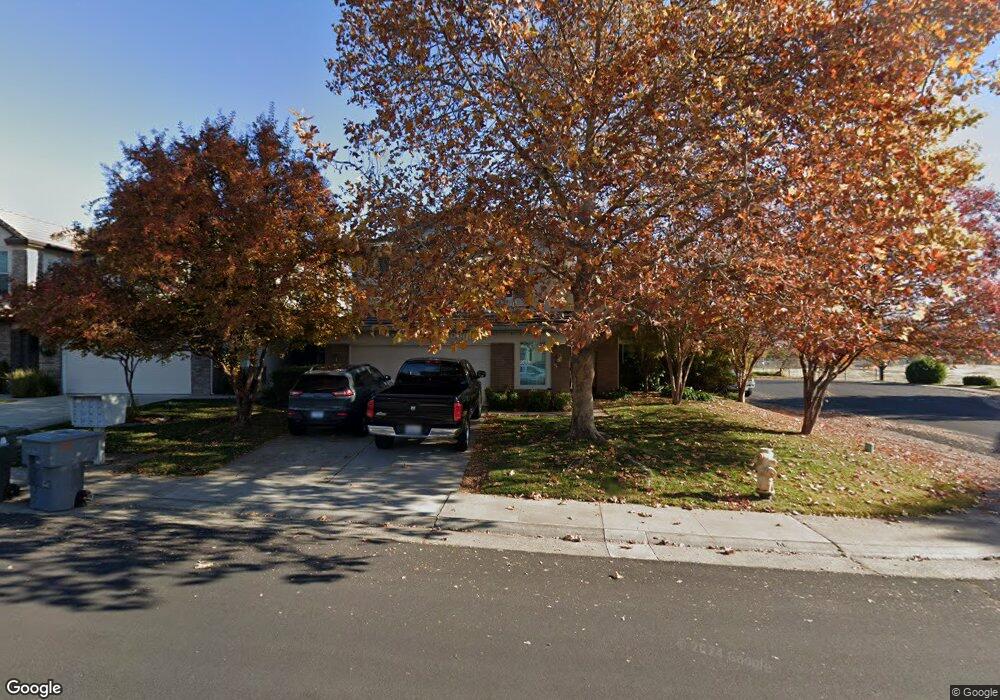

5511 Tripp Way Rocklin, CA 95765

Stanford Ranch NeighborhoodEstimated Value: $406,000 - $620,000

3

Beds

3

Baths

1,939

Sq Ft

$289/Sq Ft

Est. Value

About This Home

This home is located at 5511 Tripp Way, Rocklin, CA 95765 and is currently estimated at $559,690, approximately $288 per square foot. 5511 Tripp Way is a home located in Placer County with nearby schools including Twin Oaks Elementary, Granite Oaks Middle, and Rocklin High.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 9, 2008

Sold by

Escoto Mike F and Escoto Barbara Jean

Bought by

Escoto Mike F

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$172,000

Interest Rate

6.22%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 3, 1999

Sold by

Smc Development Corp

Bought by

Escoto Michael F

Purchase Details

Closed on

Dec 20, 1998

Sold by

Smc Development Corp

Bought by

Escoto Michael F

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$163,000

Interest Rate

6.82%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Escoto Mike F | -- | Chicago Title Co | |

| Escoto Michael F | -- | Placer Title Company | |

| Escoto Michael F | $175,000 | Placer Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Escoto Mike F | $172,000 | |

| Previous Owner | Escoto Michael F | $163,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,153 | $274,244 | $101,887 | $172,357 |

| 2023 | $3,153 | $263,597 | $97,932 | $165,665 |

| 2022 | $3,056 | $258,429 | $96,012 | $162,417 |

| 2021 | $3,025 | $253,363 | $94,130 | $159,233 |

| 2020 | $3,021 | $250,766 | $93,165 | $157,601 |

| 2019 | $3,981 | $245,850 | $91,339 | $154,511 |

| 2018 | $3,879 | $241,031 | $89,549 | $151,482 |

| 2017 | $3,854 | $236,306 | $87,794 | $148,512 |

| 2016 | $3,748 | $231,673 | $86,073 | $145,600 |

| 2015 | $3,688 | $228,194 | $84,781 | $143,413 |

| 2014 | $4,001 | $223,725 | $83,121 | $140,604 |

Source: Public Records

Map

Nearby Homes

- 5615 Darby Rd

- 5401 Sandpiper Ct

- 1914 Harvest Ct

- 5563 Cabrillo Ct

- 5919 Blackstone Dr

- 2024 Archer Cir

- 5704 Byron Ct

- 5362 Delta Dr

- 5406 Sage Ct

- 5403 Sage Ct

- 5405 Sage Ct

- 2920 Avon Rd

- 1404 Indiana Way Unit 72

- 1402 Skibbereen Way

- 1405 Indiana Way

- 1816 Illinois Way Unit 48

- 5248 Bay St

- 3324 Sandalwood Rd

- 5317 Clipper Ct

- 5651 Blackrock Rd