5516 Roundtree Dr Unit F Concord, CA 94521

The Highlands NeighborhoodEstimated Value: $391,000 - $516,000

2

Beds

2

Baths

914

Sq Ft

$466/Sq Ft

Est. Value

About This Home

This home is located at 5516 Roundtree Dr Unit F, Concord, CA 94521 and is currently estimated at $425,543, approximately $465 per square foot. 5516 Roundtree Dr Unit F is a home located in Contra Costa County with nearby schools including Highlands Elementary School, Mt. Diablo Elementary School, and Pine Hollow Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 1, 2005

Sold by

Stewart Barbara Dee

Bought by

Jones Myrna K

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$284,800

Outstanding Balance

$157,924

Interest Rate

6.14%

Mortgage Type

Fannie Mae Freddie Mac

Estimated Equity

$267,619

Purchase Details

Closed on

Sep 21, 2001

Sold by

Hill Stanley G and Hill Velma R

Bought by

Hill Stanley G and Hill Velma R

Purchase Details

Closed on

Dec 12, 1995

Sold by

Gangi Robert R

Bought by

Hill Stanley G and Hill Velma R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$59,000

Interest Rate

7.38%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jones Myrna K | $356,000 | Alliance Title Company | |

| Hill Stanley G | -- | -- | |

| Hill Stanley G | $84,000 | Chicago Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Jones Myrna K | $284,800 | |

| Previous Owner | Hill Stanley G | $59,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,216 | $486,483 | $229,576 | $256,907 |

| 2024 | $5,925 | $476,945 | $225,075 | $251,870 |

| 2023 | $5,925 | $467,594 | $220,662 | $246,932 |

| 2022 | $5,834 | $458,427 | $216,336 | $242,091 |

| 2021 | $4,920 | $381,000 | $180,000 | $201,000 |

| 2019 | $4,625 | $353,000 | $166,584 | $186,416 |

| 2018 | $4,299 | $333,500 | $157,382 | $176,118 |

| 2017 | $3,913 | $306,000 | $144,404 | $161,596 |

| 2016 | $3,589 | $276,000 | $130,247 | $145,753 |

| 2015 | $3,089 | $238,500 | $112,550 | $125,950 |

| 2014 | $2,688 | $205,000 | $96,741 | $108,259 |

Source: Public Records

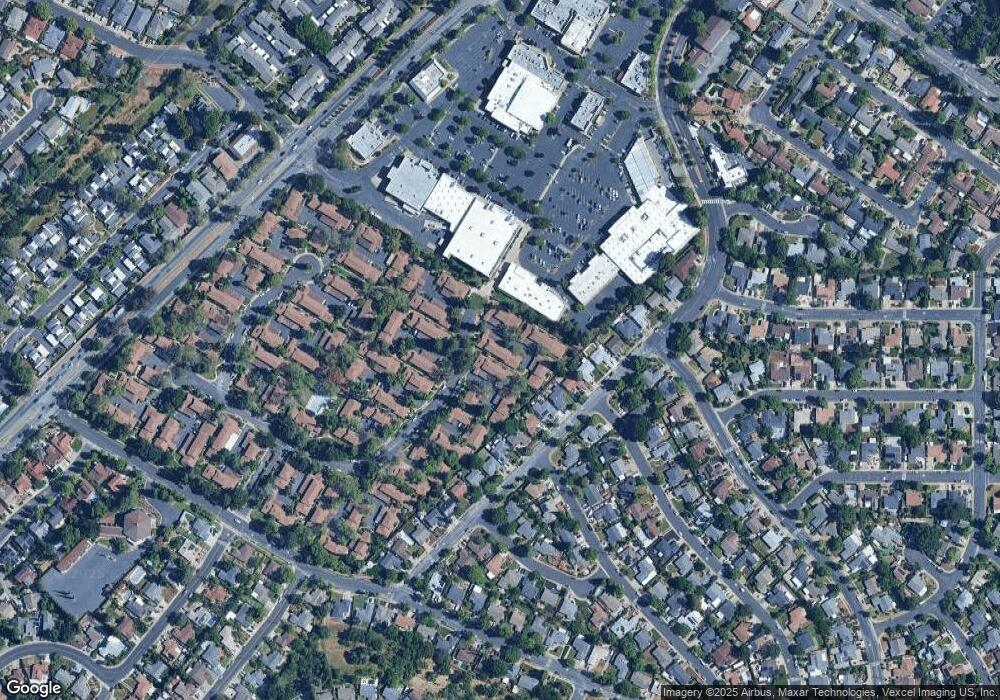

Map

Nearby Homes

- 5503 Nebraska Dr

- 5506 Alaska Dr

- 5510 Alaska Dr

- 5451 Roundtree Place

- 5333 Park Highlands Blvd Unit 27

- 1395 Kenwal Rd Unit A

- 5434 Roundtree Ct Unit A

- 1160 Kenwal Rd Unit D

- 1493 Delaware Dr

- 1120 Kenwal Rd Unit C

- 5549 Pennsylvania Blvd

- 1498 Delaware Dr

- 1271 Kentucky Dr

- 1520 Schenone Ct Unit 7

- 1520 Schenone Ct Unit 15

- 1505 Kirker Pass Rd Unit 122

- 1505 Kirker Pass Rd Unit 170

- 1640 Allegro Ave

- 1506 Garcez Dr

- 5150 Brookside Ln

- 5516 Roundtree Dr Unit A

- 5516 Roundtree Dr Unit E

- 5516 Roundtree Dr Unit D

- 5516 Roundtree Dr Unit C

- 5508 Roundtree Dr Unit F

- 5508 Roundtree Dr Unit E

- 5508 Roundtree Dr Unit D

- 5508 Roundtree Dr Unit C

- 5508 Roundtree Dr Unit B

- 5508 Roundtree Dr Unit A

- 5518 Roundtree Dr Unit D

- 5518 Roundtree Dr Unit C

- 5518 Roundtree Dr Unit B

- 5518 Roundtree Dr Unit A

- 5514 Roundtree Dr

- 5514 Roundtree Dr Unit C

- 5514 Roundtree Dr Unit B

- 5514 Roundtree Dr Unit A

- 5510 Roundtree Dr

- 5510 Roundtree Dr Unit F