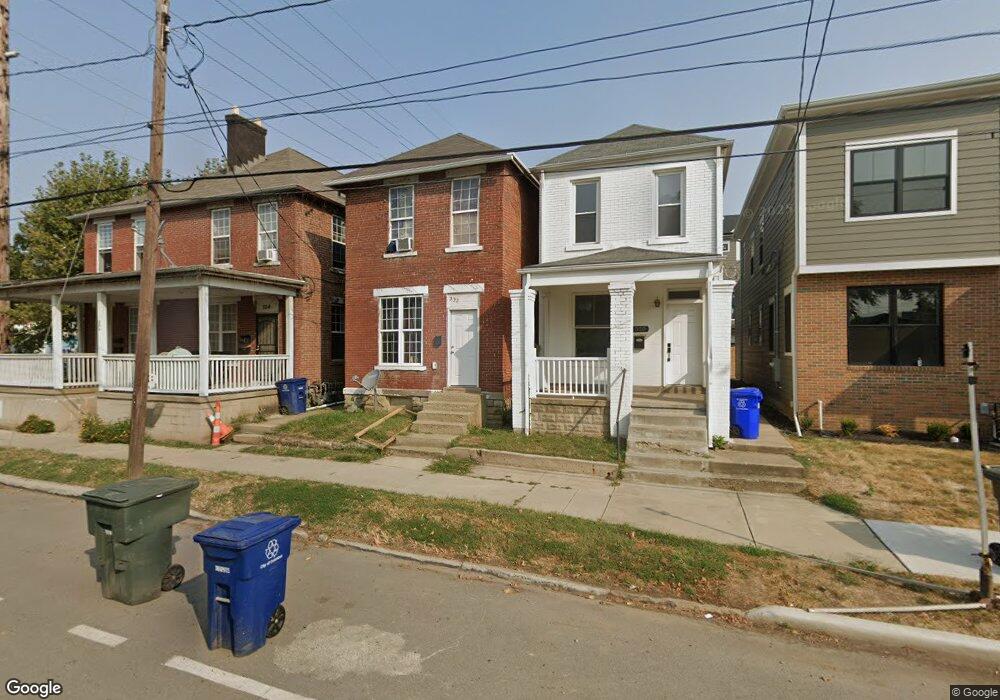

552 W Town St Columbus, OH 43215

East Franklinton NeighborhoodEstimated Value: $190,869 - $358,000

3

Beds

1

Bath

1,536

Sq Ft

$179/Sq Ft

Est. Value

About This Home

This home is located at 552 W Town St, Columbus, OH 43215 and is currently estimated at $274,967, approximately $179 per square foot. 552 W Town St is a home located in Franklin County with nearby schools including Starling PK-8, Sullivant Elementary School, and West High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 9, 2005

Sold by

Scott Franklin C and Scott Rita

Bought by

Blue Grass Properties Llc

Current Estimated Value

Purchase Details

Closed on

Nov 9, 2004

Sold by

Vance Betty and Ripley Helen

Bought by

Scott Franklin C

Purchase Details

Closed on

Sep 15, 2004

Sold by

Estate Of Leona Scott

Bought by

Mullin Gwyn Scott

Purchase Details

Closed on

Sep 14, 2004

Sold by

Estate Of George R Scott

Bought by

Estate Of Leona Scott

Purchase Details

Closed on

Feb 5, 2003

Sold by

Estate Of Raymond Scott

Bought by

Scott Franklin C and Vance Betty

Purchase Details

Closed on

Jan 2, 2003

Sold by

Estate Of Leona Scott

Bought by

Bradley Tim

Purchase Details

Closed on

Oct 15, 1975

Bought by

Scott Raymond and Scott Jane

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Blue Grass Properties Llc | $18,500 | -- | |

| Scott Franklin C | -- | -- | |

| Mullin Gwyn Scott | -- | -- | |

| Estate Of Leona Scott | -- | -- | |

| Scott Franklin C | -- | -- | |

| Scott Raymond C | -- | -- | |

| Bradley Tim | -- | -- | |

| Scott Leona | -- | -- | |

| Scott Franklin C | -- | -- | |

| Scott Raymond W | -- | -- | |

| Scott Raymond | -- | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,922 | $40,180 | $18,900 | $21,280 |

| 2023 | $1,818 | $40,180 | $18,900 | $21,280 |

| 2022 | $653 | $12,290 | $670 | $11,620 |

| 2021 | $814 | $12,290 | $670 | $11,620 |

| 2020 | $710 | $12,290 | $670 | $11,620 |

| 2019 | $636 | $10,230 | $530 | $9,700 |

| 2018 | $573 | $10,230 | $530 | $9,700 |

| 2017 | $575 | $10,230 | $530 | $9,700 |

| 2016 | $514 | $7,560 | $840 | $6,720 |

| 2015 | $468 | $7,560 | $840 | $6,720 |

| 2014 | $469 | $7,560 | $840 | $6,720 |

| 2013 | $257 | $8,400 | $945 | $7,455 |

Source: Public Records

Map

Nearby Homes

- 550 W Town St

- 546 W Town St

- 536 W Town St

- 538 W Town St

- 502 W Town St

- 642 W State St

- 601 W Rich St Unit 601

- 609 W Rich St Unit 609

- 245 S Skidmore St

- 251 S Skidmore St Unit 251

- 273 S Grubb St Unit 273

- 763 W Rich St

- 772 Sullivant Ave Unit 772

- 839 W Rich St

- 45 N Hartford Ave

- 765 Campbell Ave

- 49 S Hartford Ave

- 45 S Hartford Ave

- The Summit Plan at Homes on Hartford - Single Family

- 760 Thomas Ave