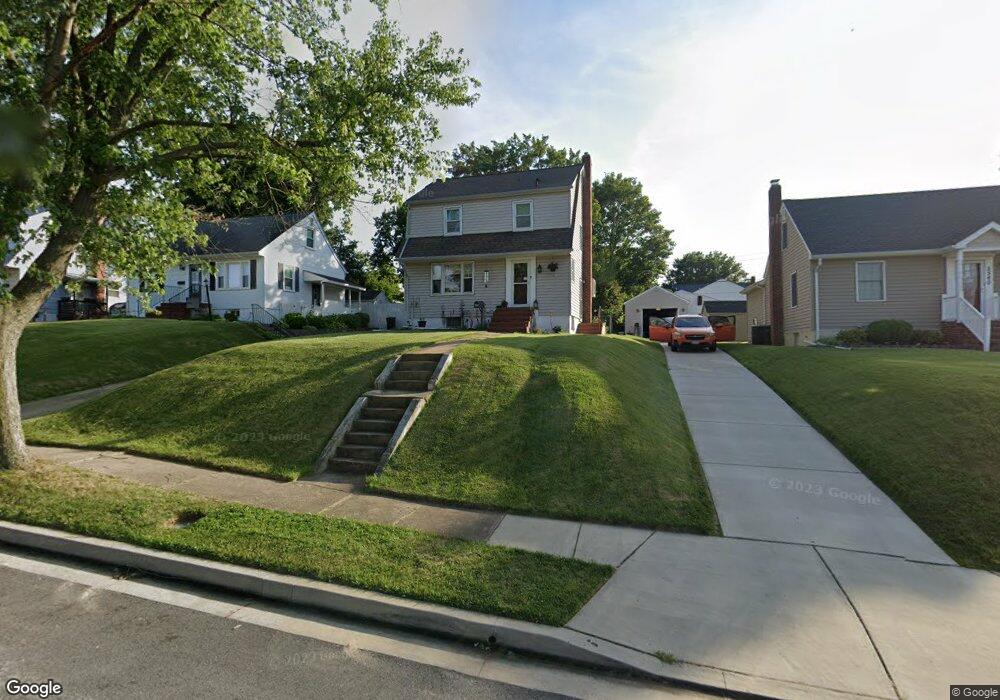

5542 Gayland Rd Halethorpe, MD 21227

Estimated Value: $288,788 - $382,000

--

Bed

2

Baths

1,152

Sq Ft

$307/Sq Ft

Est. Value

About This Home

This home is located at 5542 Gayland Rd, Halethorpe, MD 21227 and is currently estimated at $353,697, approximately $307 per square foot. 5542 Gayland Rd is a home located in Baltimore County with nearby schools including Arbutus Elementary School, Arbutus Middle School, and Lansdowne High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 2, 2007

Sold by

Berman Marc A

Bought by

Berman Marc A and Berman Patti L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$200,000

Outstanding Balance

$129,129

Interest Rate

6.78%

Mortgage Type

Stand Alone Refi Refinance Of Original Loan

Estimated Equity

$224,568

Purchase Details

Closed on

Aug 13, 2007

Sold by

Berman Marc A

Bought by

Berman Marc A and Berman Patti L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$200,000

Interest Rate

6.78%

Mortgage Type

New Conventional

Purchase Details

Closed on

Nov 9, 1992

Sold by

Fischer George

Bought by

Berman Marc A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Berman Marc A | $40,000 | -- | |

| Berman Marc A | $40,000 | -- | |

| Berman Marc A | $120,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Berman Marc A | $200,000 | |

| Previous Owner | Berman Marc A | $200,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,358 | $247,300 | -- | -- |

| 2024 | $3,358 | $230,300 | $72,700 | $157,600 |

| 2023 | $1,723 | $226,200 | $0 | $0 |

| 2022 | $3,414 | $222,100 | $0 | $0 |

| 2021 | $3,108 | $218,000 | $72,700 | $145,300 |

| 2020 | $3,108 | $213,833 | $0 | $0 |

| 2019 | $3,031 | $209,667 | $0 | $0 |

| 2018 | $2,905 | $205,500 | $72,700 | $132,800 |

| 2017 | $2,741 | $201,000 | $0 | $0 |

| 2016 | $2,401 | $196,500 | $0 | $0 |

| 2015 | $2,401 | $192,000 | $0 | $0 |

| 2014 | $2,401 | $192,000 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 1207 Oakland Terrace Rd

- 1260 June Rd

- 1243 Linden Ave

- 5523 Council St

- 5514 Council St

- 1148 Elm Rd

- 1246 Elm Rd

- 5602 Huntsmoor Rd

- 5509 Willys Ave

- 1016 Downton Rd

- 1025 Downton Rd

- 1263 Birch Ave

- 5627 Oakland Rd

- 5512 Carville Ave

- 7 Ingate Terrace

- 1132 Ingate Rd

- 1127 Ingate Rd

- 1256 Locust Ave

- 1250 Francis Ave

- 1231 Poplar Ave

- 5544 Gayland Rd

- 5540 Gayland Rd

- 5546 Gayland Rd

- 5538 Gayland Rd

- 5513 Heatherwood Rd

- 5511 Heatherwood Rd

- 5515 Heatherwood Rd

- 5509 Heatherwood Rd

- 5548 Gayland Rd

- 5517 Heatherwood Rd

- 5536 Gayland Rd

- 5537 Gayland Rd

- 5541 Gayland Rd

- 5535 Gayland Rd

- 5543 Gayland Rd

- 5519 Heatherwood Rd

- 5550 Gayland Rd

- 5505 Heatherwood Rd

- 5534 Gayland Rd

- 5533 Gayland Rd