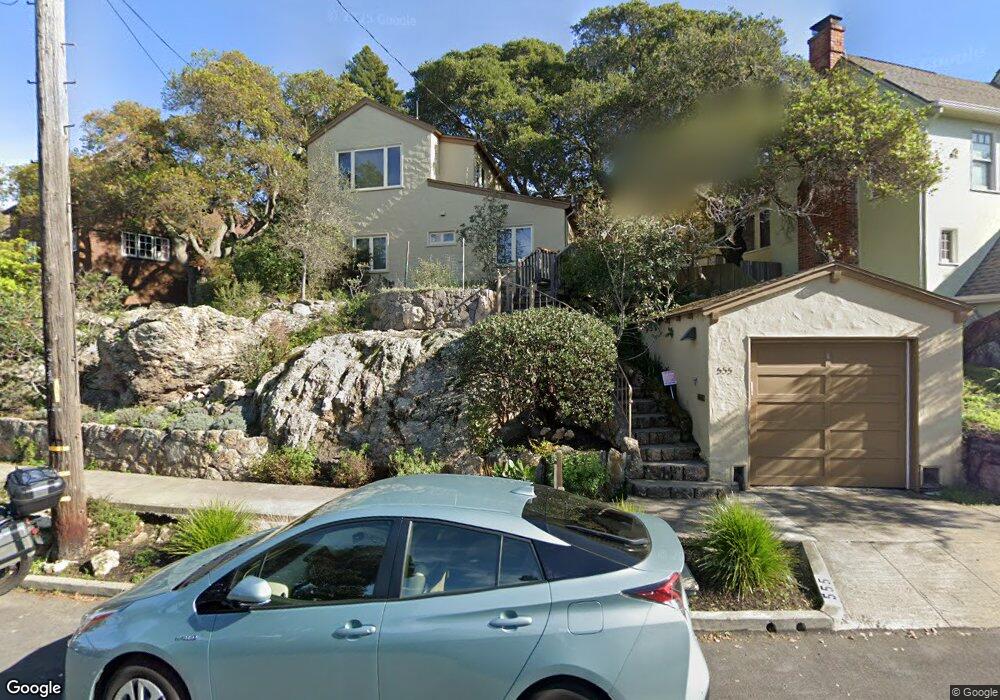

555 Vincente Ave Berkeley, CA 94707

Thousand Oaks NeighborhoodEstimated Value: $1,174,000 - $1,942,000

2

Beds

1

Bath

1,932

Sq Ft

$845/Sq Ft

Est. Value

About This Home

This home is located at 555 Vincente Ave, Berkeley, CA 94707 and is currently estimated at $1,632,417, approximately $844 per square foot. 555 Vincente Ave is a home located in Alameda County with nearby schools including Thousand Oaks Elementary School, Ruth Acty Elementary, and Berkeley Arts Magnet at Whittier School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 1, 2020

Sold by

Quint Richard and Quint Richard

Bought by

Quint Richard and Quint Richard

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$65,500

Interest Rate

3.1%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 17, 2015

Sold by

Quint Richard and Quint Richard

Bought by

Quint Richard and Richard Quint Trust

Purchase Details

Closed on

May 18, 2004

Sold by

Bell Quint Richard David and Bell Quint Julia

Bought by

Bell Quint Richard and Bell Quint Julia

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Quint Richard | -- | Old Republic Title Company | |

| Quint Richard | -- | None Available | |

| Bell Quint Richard | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Quint Richard | $65,500 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,875 | $279,657 | $134,920 | $151,737 |

| 2024 | $7,875 | $274,036 | $132,274 | $148,762 |

| 2023 | $7,618 | $275,526 | $129,681 | $145,845 |

| 2022 | $7,346 | $263,124 | $127,138 | $142,986 |

| 2021 | $7,314 | $257,828 | $124,646 | $140,182 |

| 2020 | $6,776 | $262,113 | $123,368 | $138,745 |

| 2019 | $6,340 | $256,974 | $120,949 | $136,025 |

| 2018 | $6,177 | $251,936 | $118,578 | $133,358 |

| 2017 | $5,938 | $246,996 | $116,253 | $130,743 |

| 2016 | $5,617 | $242,154 | $113,974 | $128,180 |

| 2015 | $5,513 | $238,517 | $112,262 | $126,255 |

| 2014 | $5,366 | $233,845 | $110,063 | $123,782 |

Source: Public Records

Map

Nearby Homes

- 1563 Thousand Oaks Blvd

- 600 San Luis Rd

- 1983 Yosemite Rd

- 549 Santa Barbara Rd

- 46 Ardmore Rd

- 483 Boynton Ave

- 225 Arlington Ave

- 720 Key Route Blvd

- 1266 Washington Ave

- 201 Amherst Ave

- 417 Evelyn Ave Unit 205

- 820 Key Route Blvd

- 770 Santa Barbara Rd

- 479 Kentucky Ave

- 305 Coronado St

- 614 Cragmont Ave

- 826 Indian Rock Ave

- 535 Ashbury Ave

- 938 Masonic Ave

- 1150 Washington Ave

- 547 Vincente Ave

- 563 Vincente Ave

- 543 Vincente Ave

- 571 Vincente Ave

- 27 Menlo Place

- 533 Vincente Ave

- 25 Menlo Place

- 575 Vincente Ave

- 548 Vincente Ave

- 544 Vincente Ave

- 31 Menlo Place

- 556 Vincente Ave

- 560 Vincente Ave

- 552 Vincente Ave

- 531 Vincente Ave

- 21 Menlo Place

- 538 Vincente Ave

- 566 Vincente Ave

- 579 Vincente Ave

- 574 Vincente Ave

Your Personal Tour Guide

Ask me questions while you tour the home.