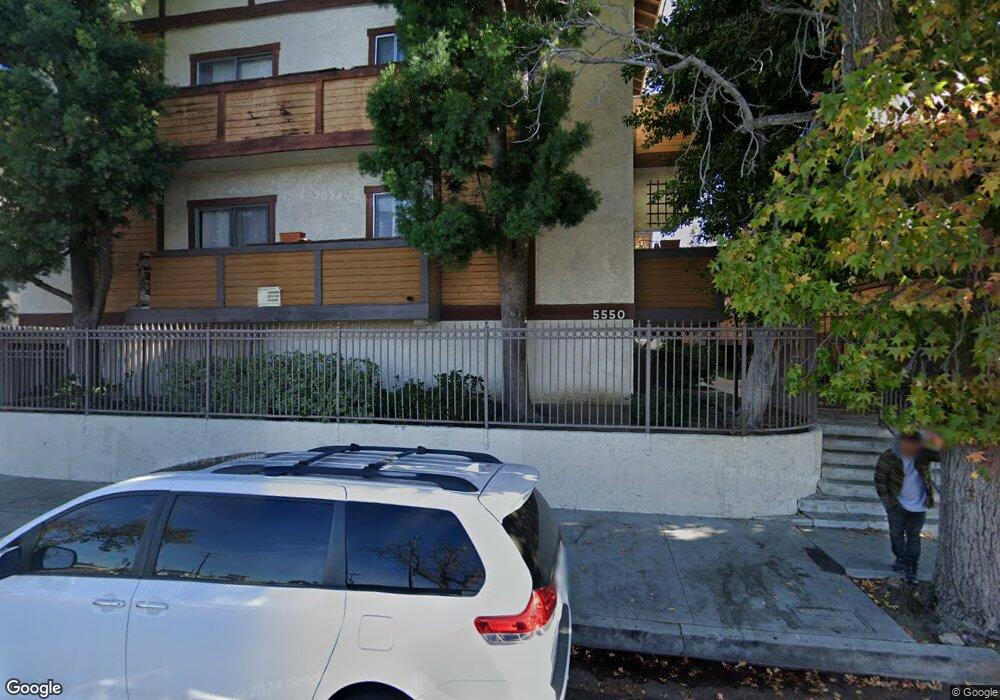

5550 Sylmar Ave Unit 1 Sherman Oaks, CA 91401

Estimated Value: $623,000 - $710,000

3

Beds

2

Baths

1,414

Sq Ft

$472/Sq Ft

Est. Value

About This Home

This home is located at 5550 Sylmar Ave Unit 1, Sherman Oaks, CA 91401 and is currently estimated at $666,733, approximately $471 per square foot. 5550 Sylmar Ave Unit 1 is a home located in Los Angeles County with nearby schools including Chandler Elementary, Van Nuys High School, and Ararat Charter School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 18, 2007

Sold by

Skay Izabella

Bought by

Skay Izabella and The Skay Family Revocable Livi

Current Estimated Value

Purchase Details

Closed on

Mar 24, 1999

Sold by

Rodriguez Oscar and Castillo Jose

Bought by

Kvyatkovskaya Izabella

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$105,400

Interest Rate

8.5%

Purchase Details

Closed on

Jul 28, 1995

Sold by

Federal Home Loan Mortgage Corporation

Bought by

Rodriguez Oscar and Castillo Jose

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$89,050

Interest Rate

7.61%

Purchase Details

Closed on

Feb 8, 1995

Sold by

First Federal Bank Of California

Bought by

Federal Home Loan Mortgage Corporation

Purchase Details

Closed on

Dec 22, 1994

Sold by

Shelley Martha S

Bought by

First Federal Bank Of California

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Skay Izabella | -- | None Available | |

| Kvyatkovskaya Izabella | $124,000 | Chicago Title | |

| Rodriguez Oscar | $94,000 | Chicago Title Insurance Co | |

| Federal Home Loan Mortgage Corporation | -- | Chicago Title Insurance Co | |

| First Federal Bank Of California | -- | Chicago Title Insurance Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Kvyatkovskaya Izabella | $105,400 | |

| Previous Owner | Rodriguez Oscar | $89,050 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,398 | $194,369 | $47,019 | $147,350 |

| 2024 | $2,398 | $190,559 | $46,098 | $144,461 |

| 2023 | $2,353 | $186,824 | $45,195 | $141,629 |

| 2022 | $2,244 | $183,161 | $44,309 | $138,852 |

| 2021 | $2,208 | $179,571 | $43,441 | $136,130 |

| 2019 | $2,141 | $174,247 | $42,153 | $132,094 |

| 2018 | $2,113 | $170,831 | $41,327 | $129,504 |

| 2016 | $2,002 | $164,199 | $39,723 | $124,476 |

| 2015 | $1,973 | $161,734 | $39,127 | $122,607 |

| 2014 | $1,984 | $158,567 | $38,361 | $120,206 |

Source: Public Records

Map

Nearby Homes

- 14343 Burbank Blvd Unit 301

- 14362 Collins St

- 14242 Burbank Blvd Unit 103

- 14412 Killion St Unit 205

- 5707 Tilden Ave

- 5481 Katherine Ave

- 14347 Albers St Unit 206

- 5527 Calhoun Ave

- 5420 Sylmar Ave Unit 105

- 5701 Vista Del Monte Ave

- 14354 Emelita St

- 14328 Emelita St

- 5655 Hazeltine Ave

- 5744 Stansbury Ave

- 5634 Hazeltine Ave

- 14560 Clark St Unit 215

- 14560 Clark St Unit 202

- 14535 Margate St Unit 13

- 14334 Tiara St

- 14310 Tiara St

- 5550 Sylmar Ave Unit 2

- 5550 Sylmar Ave Unit 10

- 5550 Sylmar Ave Unit 6

- 5550 Sylmar Ave Unit 3

- 5550 Sylmar Ave Unit 4

- 5550 Sylmar Ave Unit 5

- 14348 Burbank Blvd Unit 7

- 14348 Burbank Blvd Unit 8

- 14348 Burbank Blvd Unit 4

- 14348 Burbank Blvd Unit 3

- 5534 Sylmar Ave Unit 7

- 5534 Sylmar Ave Unit 8

- 5534 Sylmar Ave Unit 3

- 5534 Sylmar Ave Unit 4

- 5534 Sylmar Ave Unit 6

- 5534 Sylmar Ave Unit 5

- 5534 Sylmar Ave Unit 2

- 5534 Sylmar Ave Unit 1

- 14348 Burbank Blvd Unit 5

- 14348 Burbank Blvd Unit 6