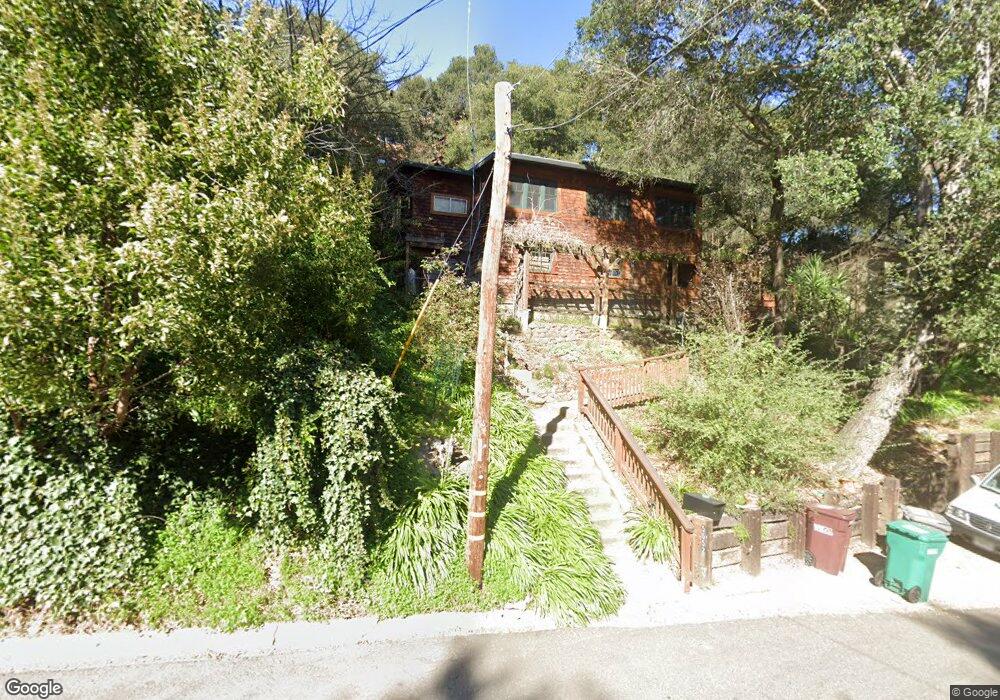

5552 Merriewood Dr Oakland, CA 94611

Merriewood NeighborhoodEstimated Value: $907,000 - $1,147,000

2

Beds

1

Bath

1,404

Sq Ft

$710/Sq Ft

Est. Value

About This Home

This home is located at 5552 Merriewood Dr, Oakland, CA 94611 and is currently estimated at $997,202, approximately $710 per square foot. 5552 Merriewood Dr is a home located in Alameda County with nearby schools including Thornhill Elementary School, Montera Middle School, and Skyline High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 28, 2023

Sold by

Elizabeth A Berry Living Trust

Bought by

Obrien James and Engelson Mara

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$855,000

Outstanding Balance

$841,158

Interest Rate

7.63%

Mortgage Type

New Conventional

Estimated Equity

$156,044

Purchase Details

Closed on

Jan 23, 2019

Sold by

Berry Elizabeth A

Bought by

Berry Elizabeth A and Elizabeth A Berry Living Trust

Purchase Details

Closed on

Oct 9, 2009

Sold by

Ashton Jon Lloyd

Bought by

Berry Elizabeth A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$79,500

Interest Rate

5.02%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Obrien James | $900,000 | Old Republic Title Company | |

| Berry Elizabeth A | -- | None Available | |

| Berry Elizabeth A | -- | First American Title Lenders |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Obrien James | $855,000 | |

| Previous Owner | Berry Elizabeth A | $79,500 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $13,195 | $911,000 | $275,400 | $642,600 |

| 2024 | $13,195 | $893,000 | $270,000 | $630,000 |

| 2023 | $5,424 | $282,578 | $177,052 | $105,526 |

| 2022 | $5,225 | $270,038 | $173,581 | $103,457 |

| 2021 | $5,128 | $264,605 | $170,177 | $101,428 |

| 2020 | $5,068 | $268,822 | $168,433 | $100,389 |

| 2019 | $4,816 | $263,551 | $165,131 | $98,420 |

| 2018 | $4,715 | $258,384 | $161,893 | $96,491 |

| 2017 | $4,511 | $253,318 | $158,719 | $94,599 |

| 2016 | $4,302 | $248,352 | $155,607 | $92,745 |

| 2015 | $4,274 | $244,622 | $153,270 | $91,352 |

| 2014 | $4,202 | $239,832 | $150,269 | $89,563 |

Source: Public Records

Map

Nearby Homes

- 5900 Marden Ln

- 5914 Thornhill Dr

- 6165 Doncaster Place

- 6406 Valley View Rd

- 268 Capricorn Ave

- 6070 Mazuela Dr

- 6194 Mazuela Dr

- 104 Capricorn Ave

- 6257 Virgo Rd

- 233 Capricorn Ave

- 6002 Mazuela Dr

- 6507 Heather Ridge Way

- 6411 Snake Rd

- 1101 Mountain Blvd

- 6344 Snake Rd

- 6842 Armour Dr

- 0 Thorndale Dr Unit 41115333

- 936 Mountain Blvd

- 6357 Fairlane Dr

- 15010 Broadway Terrace

- 5544 Merriewood Dr

- 5558 Merriewood Dr

- 6034 Valley View Rd

- 6040 Valley View Rd

- 5945 Marden Ln

- 5549 Merriewood Dr

- 6004 Valley View Rd

- 5534 Merriewood Dr

- 5557 Merriewood Dr

- 6018 Valley View Rd

- 5573 Merriewood Dr

- 6048 Valley View Rd

- 5944 Marden Ln

- 5939 Marden Ln

- 5545 Merriewood Dr

- 6037 Valley View Rd

- 6043 Valley View Rd

- 5531 Merriewood Dr

- 5969 Thornhill Dr

- 6056 Valley View Rd

Your Personal Tour Guide

Ask me questions while you tour the home.