Estimated Value: $751,000 - $947,000

3

Beds

2

Baths

2,388

Sq Ft

$364/Sq Ft

Est. Value

About This Home

This home is located at 5560 Petersen Ln, Lotus, CA 95651 and is currently estimated at $869,421, approximately $364 per square foot. 5560 Petersen Ln is a home located in El Dorado County with nearby schools including Sutter's Mill Elementary School, Gold Trail School, and El Dorado High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 31, 2013

Sold by

Vanderpol John W and Vanderpol Sandra M

Bought by

Vanderpol John W and Vanderpol Sandra M

Current Estimated Value

Purchase Details

Closed on

Oct 3, 2013

Sold by

Vanderpol John W and Bunch Sandra Sandra M

Bought by

Vanderpol John W and Vanderpol Sandra M

Purchase Details

Closed on

Feb 19, 1998

Sold by

Kwachak George and Kwachak Donna L

Bought by

Vanderpol John W and Bunch Sandra M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$74,900

Outstanding Balance

$13,224

Interest Rate

6.97%

Mortgage Type

Seller Take Back

Estimated Equity

$856,197

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Vanderpol John W | -- | None Available | |

| Vanderpol John W | -- | None Available | |

| Vanderpol John W | $107,000 | Old Republic Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Vanderpol John W | $74,900 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,599 | $644,998 | $170,840 | $474,158 |

| 2024 | $6,599 | $632,352 | $167,491 | $464,861 |

| 2023 | $6,468 | $619,954 | $164,207 | $455,747 |

| 2022 | $6,375 | $607,799 | $160,988 | $446,811 |

| 2021 | $6,287 | $595,882 | $157,832 | $438,050 |

| 2020 | $6,203 | $589,773 | $156,214 | $433,559 |

| 2019 | $6,109 | $578,209 | $153,151 | $425,058 |

| 2018 | $5,931 | $566,873 | $150,149 | $416,724 |

| 2017 | $5,830 | $555,758 | $147,205 | $408,553 |

| 2016 | $5,735 | $544,862 | $144,319 | $400,543 |

| 2015 | $5,543 | $536,680 | $142,152 | $394,528 |

| 2014 | $5,543 | $526,168 | $139,368 | $386,800 |

Source: Public Records

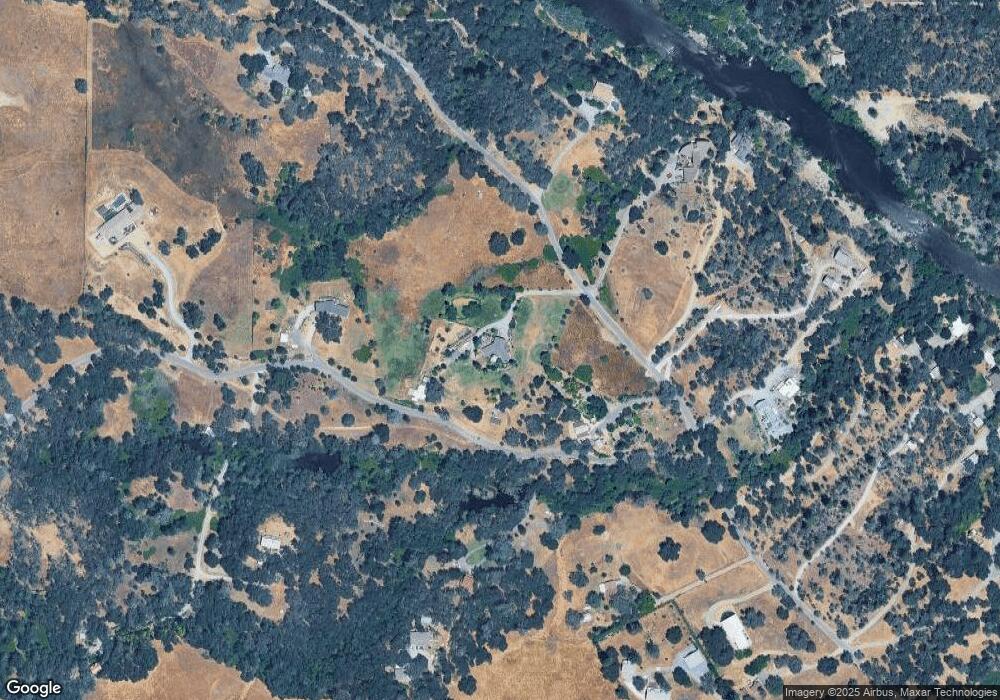

Map

Nearby Homes

- 7162 Amoloc Ln

- 7101 Amoloc Ln

- 6400 State Highway 49

- 994 Lotus Rd

- 4644 Bakers Mountain Rd

- 5050 Glory View Dr

- 1110 Trails End Dr

- 4740 Glory View Dr

- 1363 Crooked Mile Ct

- 0 Sagebrush Rd

- 581 Cold Springs Rd

- 6104 Bayne Rd

- 4890 Thompson Hill Rd

- 4950 Thompson Hill Rd

- 5080 Thompson Hill Rd

- 710 Cold Springs Rd

- 5661 Thompson Hill Rd

- 4371 Luneman Rd

- 1240 Los Robles Rd

- 6371 Johntown Creek Rd

- 5600 Petersen Ln

- 5691 Clark Mountain Rd

- 5632 Clark Mountain Rd

- 5624 Petersen Ln

- 5569 Petersen Ln

- 5527 Petersen Ln

- 5609 Petersen Ln

- 5681 Bassi Rd

- 5579 Petersen Ln

- 5480 Petersen Ln

- 5601 Petersen Ln

- 5595 Bassi Rd

- 5715 Clark Mountain Rd

- 1988 Lullaby Ln

- 5661 Bassi Rd

- 0 Peterson Ln Unit 80121202

- 0 Peterson Ln Unit 90080643

- 0 Peterson Ln Unit 11081808

- 0 Peterson Ln Unit 15056366

- 0 Petersen Ln Unit 16020381

Your Personal Tour Guide

Ask me questions while you tour the home.