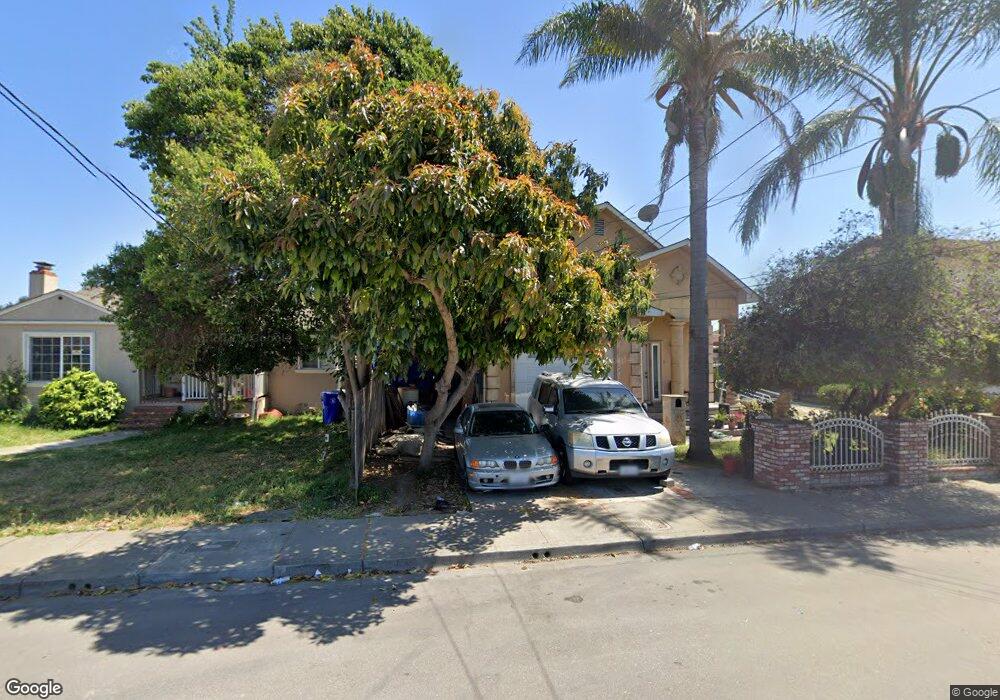

567 Cherry Way Hayward, CA 94541

Estimated Value: $1,402,000 - $1,570,556

6

Beds

5

Baths

4,333

Sq Ft

$343/Sq Ft

Est. Value

About This Home

This home is located at 567 Cherry Way, Hayward, CA 94541 and is currently estimated at $1,486,278, approximately $343 per square foot. 567 Cherry Way is a home located in Alameda County with nearby schools including Winton Middle School, Hayward High School, and St. John Catholic School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 4, 2014

Sold by

Leyva Munoz Jose Luis Perez and Leyva De Perez Maria Agripina

Bought by

Vannostrand David Van and Im Sue

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$615,000

Outstanding Balance

$469,952

Interest Rate

4.09%

Mortgage Type

Commercial

Estimated Equity

$1,016,327

Purchase Details

Closed on

Nov 29, 2000

Sold by

Church Bonnie R

Bought by

Leyua Munoz Jose Luis Perez and Leyua Deperez Maria Aguipina

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$220,312

Interest Rate

7.66%

Mortgage Type

Commercial

Purchase Details

Closed on

Oct 20, 1998

Sold by

Church Bonnie R

Bought by

Church Bonnie R and Bonnie R Church Family Trust

Purchase Details

Closed on

Aug 12, 1997

Sold by

Church Bonnie R

Bought by

Church Bonnie R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$20,000

Interest Rate

7.61%

Mortgage Type

Commercial

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Vannostrand David Van | $863,000 | Pacific Coast Title Company | |

| Leyua Munoz Jose Luis Perez | $235,000 | Commonwealth Land Title Co | |

| Church Bonnie R | -- | -- | |

| Church Bonnie R | -- | First American Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Vannostrand David Van | $615,000 | |

| Previous Owner | Leyua Munoz Jose Luis Perez | $220,312 | |

| Previous Owner | Church Bonnie R | $20,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $13,117 | $1,037,041 | $311,028 | $726,013 |

| 2024 | $13,117 | $1,016,711 | $304,931 | $711,780 |

| 2023 | $12,909 | $996,778 | $298,952 | $697,826 |

| 2022 | $12,632 | $977,234 | $293,091 | $684,143 |

| 2021 | $12,500 | $958,077 | $287,345 | $670,732 |

| 2020 | $12,324 | $948,257 | $284,400 | $663,857 |

| 2019 | $12,400 | $929,670 | $278,825 | $650,845 |

| 2018 | $11,631 | $911,446 | $273,360 | $638,086 |

| 2017 | $11,350 | $893,575 | $268,000 | $625,575 |

| 2016 | $10,726 | $876,058 | $262,746 | $613,312 |

| 2015 | $10,469 | $862,900 | $258,800 | $604,100 |

| 2014 | $9,023 | $761,130 | $196,667 | $564,463 |

Source: Public Records

Map

Nearby Homes

- 550 Blossom Way

- 20923 Haviland Ave

- 436 Grove Way

- 263 Medford Ave

- 19641 Medford Cir Unit 5

- 823 Blossom Way

- 641 Jordan Way

- 19884 Meekland Ave

- 347 Willow Ave Unit 6

- 18905 Standish Ave

- 21564 Meekland Ave Unit 1

- 19539 Meekland Ave

- 19736 Times Ave

- 188 Sunset Blvd

- 21806 Meekland Ave

- 492 Sunset Blvd

- 19837 Waverly Ave

- 20917 Locust St Unit E

- 680 Sunset Blvd

- 20919 Locust St Unit K

- 21033 Mingus Way

- 21077 Mingus Way

- 559 Cherry Way

- 573 Cherry Way

- 547 Cherry Way

- 577 Cherry Way

- 535 Cherry Way

- 523 Cherry Way

- 21031 Western Blvd

- 595 Cherry Way

- 520 Blossom Way

- 526 Blossom Way Unit 526

- 522 Blossom Way Unit 522

- 524 Blossom Way Unit 524

- 528 Blossom Way Unit 528

- 552 Cherry Way

- 584 Cherry Way

- 542 Cherry Way

- 550 Blossom Way Unit G

- 550 Blossom Way Unit F6