5671 Troy Villa Blvd Unit 20083 Dayton, OH 45424

Estimated Value: $108,000 - $122,090

3

Beds

2

Baths

1,133

Sq Ft

$102/Sq Ft

Est. Value

About This Home

This home is located at 5671 Troy Villa Blvd Unit 20083, Dayton, OH 45424 and is currently estimated at $116,023, approximately $102 per square foot. 5671 Troy Villa Blvd Unit 20083 is a home located in Montgomery County with nearby schools including Wayne High School and Huber Heights Christian Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 9, 2017

Sold by

Sampson Dow and Anderson Alice V

Bought by

Anderson Alice V

Current Estimated Value

Purchase Details

Closed on

Dec 12, 2014

Sold by

Anderson Alice V

Bought by

Sampson Dow and Anderson Alice V

Purchase Details

Closed on

Dec 5, 2014

Sold by

Secretary Of Hud

Bought by

Anderson Alice V

Purchase Details

Closed on

Oct 3, 2013

Sold by

Bank Of America Na

Bought by

The Secretary Of Hud

Purchase Details

Closed on

Sep 26, 2013

Sold by

Larman Christopher J

Bought by

Bank Of America Na

Purchase Details

Closed on

Sep 12, 2013

Sold by

Larman Christopher J

Bought by

Bank Of America Na

Purchase Details

Closed on

Jan 30, 1997

Sold by

Smith Bonnie K

Bought by

Larman Christopher J

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Anderson Alice V | -- | None Available | |

| Sampson Dow | -- | Chicago Title | |

| Anderson Alice V | $32,000 | Chicago Title Company Llc | |

| The Secretary Of Hud | -- | None Available | |

| Bank Of America Na | $57,803 | None Available | |

| Bank Of America Na | $26,000 | None Available | |

| Larman Christopher J | $64,900 | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,452 | $27,320 | $4,090 | $23,230 |

| 2023 | $1,452 | $27,320 | $4,090 | $23,230 |

| 2022 | $1,267 | $18,710 | $2,800 | $15,910 |

| 2021 | $1,281 | $18,710 | $2,800 | $15,910 |

| 2020 | $1,282 | $18,710 | $2,800 | $15,910 |

| 2019 | $1,148 | $14,770 | $2,800 | $11,970 |

| 2018 | $1,152 | $14,770 | $2,800 | $11,970 |

| 2017 | $1,145 | $14,770 | $2,800 | $11,970 |

| 2016 | $1,405 | $17,760 | $2,800 | $14,960 |

| 2015 | $1,387 | $17,760 | $2,800 | $14,960 |

| 2014 | $1,387 | $17,760 | $2,800 | $14,960 |

| 2012 | -- | $21,140 | $4,200 | $16,940 |

Source: Public Records

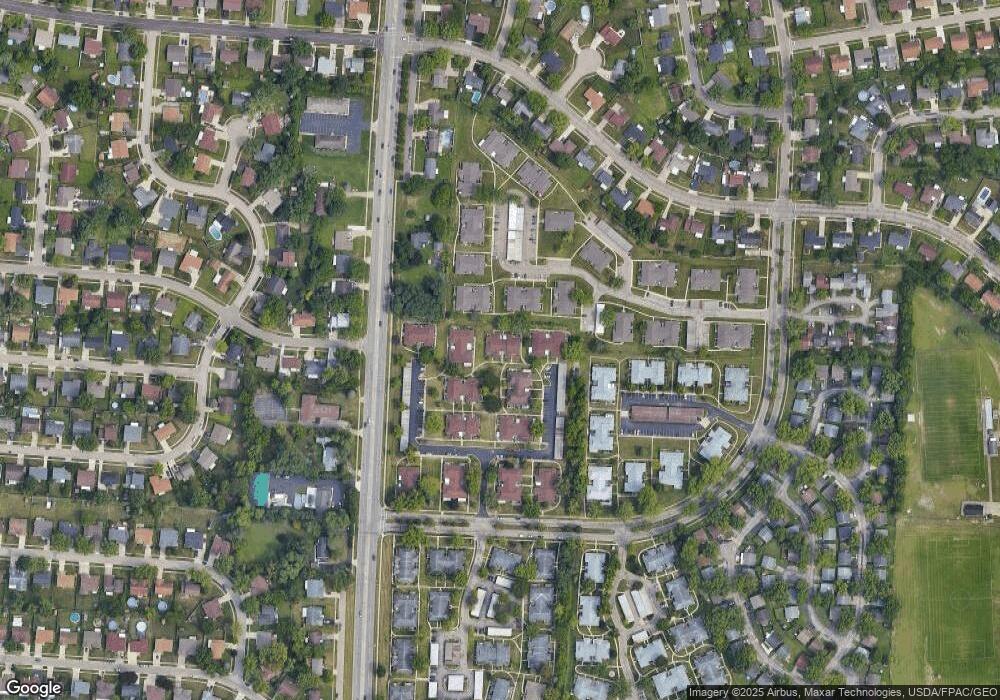

Map

Nearby Homes

- 5637 Troy Villa Blvd Unit 20088

- 5873 Troy Villa Blvd Unit 20174

- 5631 Longford Rd

- 6851 Locustview Dr

- 5904 Troy Villa Blvd Unit 20051

- 6600 Green Lee Ct

- 5582 Camerford Dr

- 5580 Clagston Ct

- 6514 Wrenview Ct

- 6529 Harshmanville Rd

- 6246 Old Troy Pike

- 4944 Chesham Dr

- 7500 Mount Ranier Unit 12077

- 5135 Chesham Dr

- 6150 Taylorsville Rd

- 7126 Mandrake Dr

- 7077 Sandalview Dr

- 4931 Longford Rd

- 5248 Tilbury Rd

- 7157 Montague Rd

- 5667 Troy Villa Blvd Unit 20081

- 5665 Troy Villa Blvd Unit 20082

- 5669 Troy Villa Blvd Unit 20080

- 5675 Troy Villa Blvd Unit 20085

- 5677 Troy Villa Blvd Unit 20084

- 5835 Troy Villa Blvd Unit 20217

- 5673 Troy Villa Blvd Unit 20086

- 5661 Troy Villa Blvd Unit 20092

- 5663 Troy Villa Blvd Unit 20095

- 5833 Troy Villa Blvd Unit 20218

- 5631 Troy Villa Blvd Unit 20079

- 5679 Troy Villa Blvd Unit 20087

- 5837 Troy Villa Blvd Unit 20216

- 5629 Troy Villa Blvd Unit 20076

- 5657 Troy Villa Blvd Unit 20094

- 5847 Troy Villa Blvd

- 5839 Troy Villa Blvd Unit 20219

- 5841 Troy Villa Blvd Unit 20158

- 5843 Troy Villa Blvd Unit 20157

- 5659 Troy Villa Blvd Unit 20093