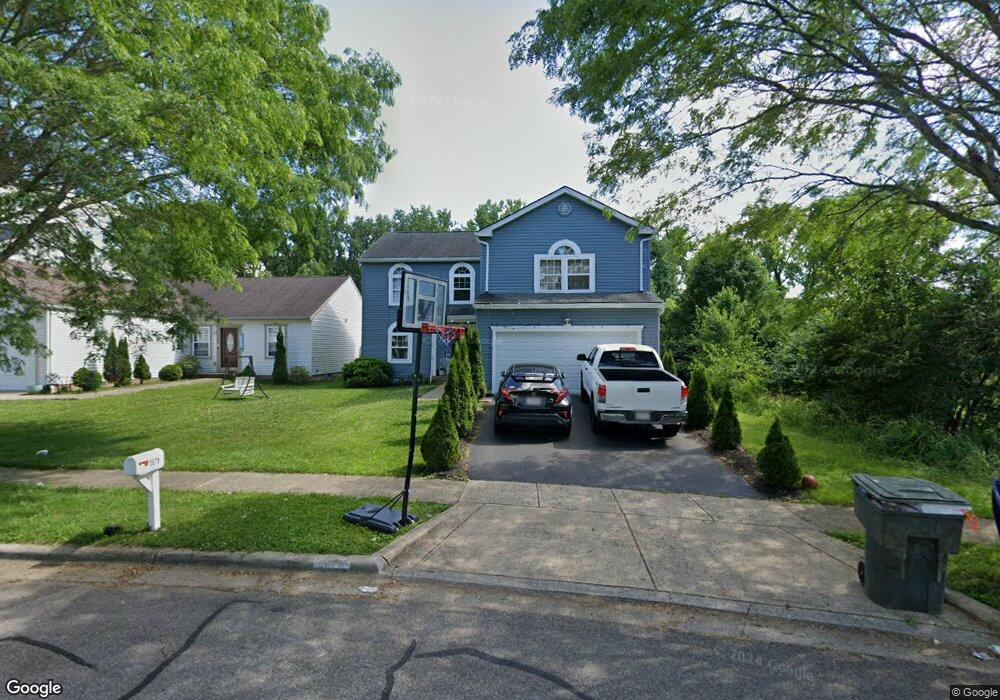

5679 Mouzon Dr Columbus, OH 43232

East Columbus-White Ash NeighborhoodEstimated Value: $342,000 - $386,000

4

Beds

3

Baths

2,640

Sq Ft

$137/Sq Ft

Est. Value

About This Home

This home is located at 5679 Mouzon Dr, Columbus, OH 43232 and is currently estimated at $362,771, approximately $137 per square foot. 5679 Mouzon Dr is a home located in Franklin County with nearby schools including Liberty Elementary School, Yorktown Middle School, and Independence High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 17, 2015

Sold by

Secretary Of Hud

Bought by

Aguilar Moises

Current Estimated Value

Purchase Details

Closed on

Jan 14, 2015

Sold by

Citimortgage Inc

Bought by

Secretary Of Hud

Purchase Details

Closed on

Nov 18, 2014

Sold by

Secretary Of Hud

Bought by

Citimortgage Inc

Purchase Details

Closed on

Jan 7, 2014

Sold by

Citimortgage Inc

Bought by

The Secretary Of Hud

Purchase Details

Closed on

Feb 13, 2004

Sold by

Maronda Homes Inc Of Ohio

Bought by

Obey Carol L and Obey Deron F

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$161,131

Interest Rate

5.96%

Mortgage Type

FHA

Purchase Details

Closed on

May 20, 2003

Sold by

Affordable Housing Associates Inc

Bought by

Maronda Homes Inc Of Ohio

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Aguilar Moises | $41,150 | Attorney | |

| Secretary Of Hud | -- | Nova Title | |

| Citimortgage Inc | -- | None Available | |

| The Secretary Of Hud | -- | Independent Title Box | |

| Obey Carol L | $162,500 | Chicago Title | |

| Maronda Homes Inc Of Ohio | $1,695,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Obey Carol L | $161,131 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,965 | $110,640 | $23,280 | $87,360 |

| 2023 | $4,902 | $110,635 | $23,275 | $87,360 |

| 2022 | $3,638 | $70,140 | $6,300 | $63,840 |

| 2021 | $3,644 | $70,140 | $6,300 | $63,840 |

| 2020 | $3,649 | $70,140 | $6,300 | $63,840 |

| 2019 | $3,512 | $57,890 | $5,250 | $52,640 |

| 2018 | $1,752 | $57,890 | $5,250 | $52,640 |

| 2017 | $3,567 | $57,890 | $5,250 | $52,640 |

| 2016 | $3,624 | $54,150 | $5,850 | $48,300 |

| 2015 | $1,675 | $54,150 | $5,850 | $48,300 |

| 2014 | $3,357 | $54,150 | $5,850 | $48,300 |

| 2013 | $1,990 | $63,665 | $6,860 | $56,805 |

Source: Public Records

Map

Nearby Homes

- 3289 Kady Ln

- 3148 Aldgate St

- 5397 Jack Russell Way

- 3198 Gallant Dr

- 3387 Retriever Rd

- St Martin Plan at Chatterton Commons

- 3310 Joshstock Dr

- 3304 Joshstock Dr

- 3298 Joshstock Dr

- 5999 Bears Run Rd

- 5882 Abernathy Ln Unit 5882F

- 5936 Abernathy Ln

- 5938 Abernathy Ln

- 5944 Abernathy Ln

- 5946 Abernathy Ln

- 5960 Abernathy Ln

- 5962 Abernathy Ln

- 5968 Abernathy Ln

- 5970 Abernathy Ln

- 5976 Abernathy Ln