Estimated Value: $125,237 - $149,000

1

Bed

1

Bath

703

Sq Ft

$197/Sq Ft

Est. Value

About This Home

This home is located at 5711 Som Center Rd Unit 37, Solon, OH 44139 and is currently estimated at $138,809, approximately $197 per square foot. 5711 Som Center Rd Unit 37 is a home located in Cuyahoga County with nearby schools including Orchard Middle School, Parkside Elementary School, and Solon Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 11, 2012

Sold by

Kvacek Kenneth C

Bought by

Svette John C and Svette Theresa

Current Estimated Value

Purchase Details

Closed on

Jul 27, 2007

Sold by

Legan Thomas J and Legan Arlene F

Bought by

Kvacek Dolores K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$28,500

Interest Rate

6.73%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Apr 12, 2001

Sold by

Kessell Heather L

Bought by

Legan Thomas J and Legan Arlene F

Purchase Details

Closed on

Mar 31, 1995

Sold by

Braming Ronald B

Bought by

Kessell Heather L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$53,125

Interest Rate

8.91%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 2, 1990

Sold by

Arsena Vito J

Bought by

Braming Ronald B

Purchase Details

Closed on

Oct 1, 1987

Sold by

Travers John M and Travers Beulah M

Bought by

Aresena Dina M

Purchase Details

Closed on

Jan 1, 1975

Bought by

Travers John M and Travers Beulah M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Svette John C | $60,000 | Chicago Title Insurance Co | |

| Kvacek Dolores K | $95,000 | Blvd Title | |

| Legan Thomas J | $74,900 | -- | |

| Kessell Heather L | $62,500 | -- | |

| Braming Ronald B | $65,000 | -- | |

| Arsena Vito J | -- | -- | |

| Aresena Dina M | $54,000 | -- | |

| Travers John M | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Kvacek Dolores K | $28,500 | |

| Previous Owner | Kessell Heather L | $53,125 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,892 | $33,845 | $3,395 | $30,450 |

| 2023 | $1,638 | $23,980 | $2,420 | $21,560 |

| 2022 | $1,635 | $23,980 | $2,420 | $21,560 |

| 2021 | $1,617 | $23,980 | $2,420 | $21,560 |

| 2020 | $1,538 | $20,860 | $2,100 | $18,760 |

| 2019 | $1,491 | $59,600 | $6,000 | $53,600 |

| 2018 | $1,338 | $20,860 | $2,100 | $18,760 |

| 2017 | $1,426 | $21,010 | $2,840 | $18,170 |

| 2016 | $1,413 | $21,010 | $2,840 | $18,170 |

| 2015 | $1,413 | $21,010 | $2,840 | $18,170 |

| 2014 | $1,465 | $21,010 | $2,840 | $18,170 |

Source: Public Records

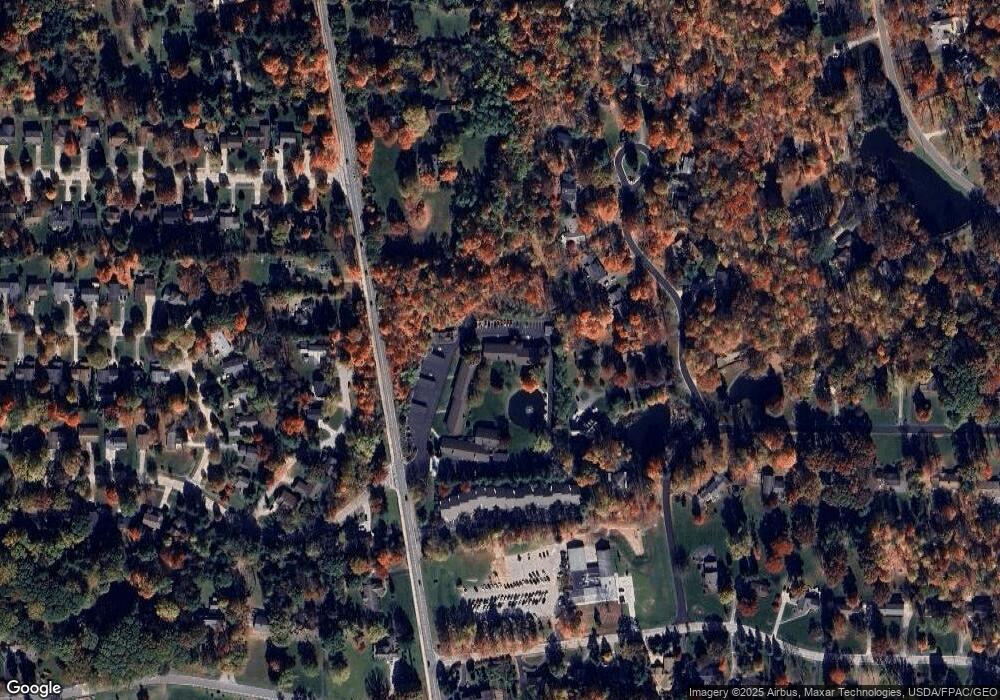

Map

Nearby Homes

- 5721 Som Center Rd Unit 25

- 5575 Hummingbird Cir

- 32775 Ledge Hill Dr

- 5929 Som Center Rd

- 32650 Stony Brook Ln

- 34600 Mcafee Dr

- 112 Meadow Ln

- 35906 Solon Rd

- 5241 Som Center Rd

- 36265 Timberlane Dr

- 5151 Som Center Rd

- 32560 Wintergreen Dr

- 5158 Lansdowne Dr

- V/L (1.32 Acres) Aurora Rd

- 5130 Cheswick Dr

- 5009 Lansdowne Dr

- 6454 Huntington Dr

- 36767 Meadowdale Dr

- 38280 Fox Run Dr

- 5225 Harper Rd

- 5711 Som Center Rd Unit 35

- 5711 Som Center Rd Unit 40

- 5711 Som Center Rd Unit 27

- 5711 Som Center Rd Unit 30

- 5711 Som Center Rd Unit 34

- 5711 Som Center Rd Unit 32

- 5711 Som Center Rd Unit 33

- 5711 Som Center Rd Unit 42

- 5711 Som Center Rd

- 5711 Som Center Rd Unit 36

- 5711 Som Center Rd Unit 29

- 5711 Som Center Rd

- 5711 Som Center Rd

- 5711 Som Center Rd

- 5711 Som Center Rd Unit 38

- 5711 Som Center Rd Unit 39

- 5711 Som Center Rd

- 5711 Som Center #35 Rd Unit 35

- 5721 Som Center Rd Unit 20

- 5721 Som Center Rd Unit 23