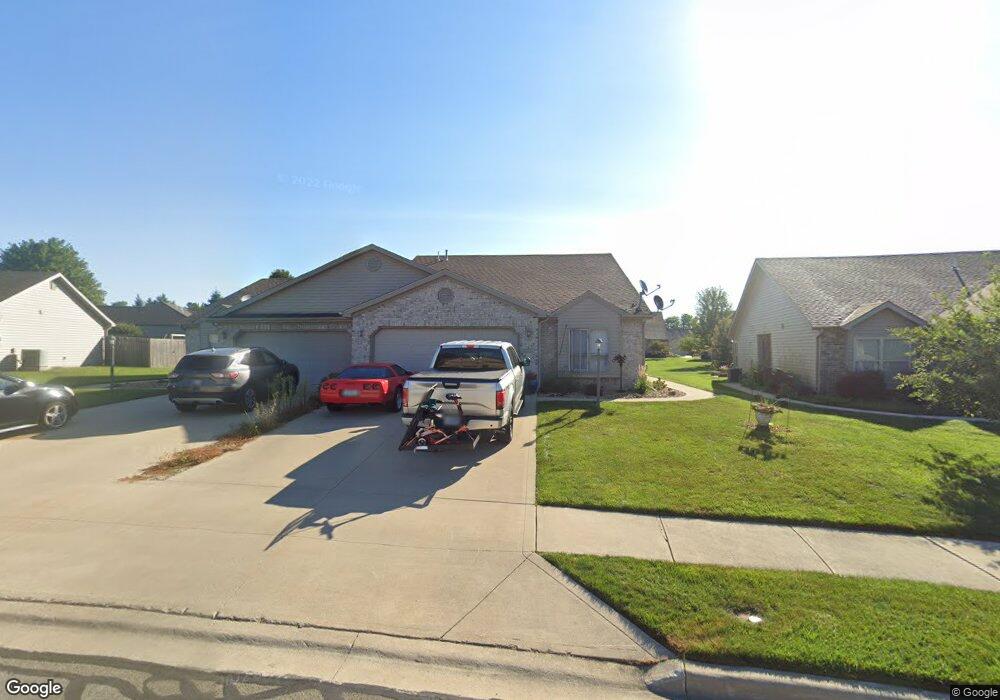

572 Buck Trail Unit 13BPOD Warsaw, IN 46582

Estimated Value: $250,000 - $272,000

2

Beds

2

Baths

1,413

Sq Ft

$183/Sq Ft

Est. Value

About This Home

This home is located at 572 Buck Trail Unit 13BPOD, Warsaw, IN 46582 and is currently estimated at $258,341, approximately $182 per square foot. 572 Buck Trail Unit 13BPOD is a home located in Kosciusko County with nearby schools including Harrison Elementary School, Lakeview Middle School, and Warsaw Community High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 13, 2017

Sold by

Bezenah Robert and Bezenah Marcelyn Sue

Bought by

Nolin Jerry R and Nolin Jane

Current Estimated Value

Purchase Details

Closed on

Nov 30, 2009

Sold by

Ideal Suburban Homes Inc

Bought by

Bezenah Robert J and Bezenah Marcelyn Sue

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$139,634

Interest Rate

5.05%

Mortgage Type

USDA

Purchase Details

Closed on

Nov 3, 2009

Sold by

Biggs Inc

Bought by

Ideal Suburban Homes Inc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$139,634

Interest Rate

5.05%

Mortgage Type

USDA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Nolin Jerry R | -- | None Available | |

| Bezenah Robert J | $139,635 | Ideal Suburban Homes Inc | |

| Ideal Suburban Homes Inc | $22,500 | Ideal Suburban Homes Inc | |

| Benzenah Robert | -- | None Available | |

| Ideal Suburban Homes Inc | -- | None Available | |

| Bezenah Robert | -- | None Available | |

| Ideal Suburban Homes Inc | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Bezenah Robert | $139,634 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,098 | $203,400 | $22,400 | $181,000 |

| 2023 | $1,963 | $186,500 | $22,400 | $164,100 |

| 2022 | $1,834 | $173,600 | $22,400 | $151,200 |

| 2021 | $1,597 | $150,800 | $22,400 | $128,400 |

| 2020 | $1,527 | $143,600 | $22,400 | $121,200 |

| 2019 | $1,457 | $139,200 | $22,400 | $116,800 |

| 2018 | $2,845 | $135,200 | $22,400 | $112,800 |

| 2017 | $1,290 | $128,500 | $22,400 | $106,100 |

| 2016 | $1,268 | $125,100 | $18,800 | $106,300 |

| 2014 | $1,109 | $119,600 | $18,800 | $100,800 |

| 2013 | $1,109 | $117,000 | $18,800 | $98,200 |

Source: Public Records

Map

Nearby Homes

- 1869 E Springfield Dr

- 2710 Patterson Rd

- 939 N Old Orchard Dr

- 435 N 225 E

- 3835 Gregory Ct

- 1199 N Slateview Ct

- 1299 N 175 E

- TBD Superior Ave

- TBD Lake Tahoe Trail

- 354 Lake Placid Dr

- 2645 Nature View Dr

- 2629 Nature View Dr

- 2260 Whitetail Run

- 1901 Bay View Dr

- 1605 E Clark St

- TBD Lot #85 In Lamp Post Manor Estates Rd Unit 85

- TBD Lot #88 In Lamp Post Manor Estates Rd Unit 88

- 615 Park Ave

- TBD N 175 E

- 1506 E Jefferson St

- 572 Buck Trail

- 584 Buck Trail Unit 13A POD

- 584 Buck Trail

- 560 Buck Trail Unit Lot 14APOD

- 548 Buck Trail Unit Lot 14BPOD

- 596 Buck Trail

- 596 Buck Trail Unit 21POD

- 536 Buck Trail Unit 15APOD

- 3219 Doe St

- 585 Deerfield Path Unit 10BPOD

- 573 Deerfield Path Unit 9APOD

- 524 Buck Trail Unit 15BPOD

- 587 Buck Trail

- 575 Buck Trail

- 575 Deerfield Path Unit 9BPOD

- 595 Deerfield Path Unit 11BPOD

- 595 Deerfield Path

- 3233 Doe St

- 565 Deerfield Path

- 565 Deerfield Path Unit 8BPOD