5742 Los Coyotes Dr Unit 6 Palm Springs, CA 92264

Estimated Value: $392,000 - $422,000

2

Beds

3

Baths

1,380

Sq Ft

$297/Sq Ft

Est. Value

About This Home

This home is located at 5742 Los Coyotes Dr Unit 6, Palm Springs, CA 92264 and is currently estimated at $409,673, approximately $296 per square foot. 5742 Los Coyotes Dr Unit 6 is a home located in Riverside County with nearby schools including Cahuilla Elementary School, Raymond Cree Middle School, and Palm Springs High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 13, 2016

Sold by

Swenson Norma J

Bought by

Swenson Norma J

Current Estimated Value

Purchase Details

Closed on

Nov 4, 2005

Sold by

Swenson Norma J

Bought by

Swenson Norma J and Shepard Christopher M

Purchase Details

Closed on

Sep 22, 2005

Sold by

Finley Steven C and Finley Dana M

Bought by

Swenson Norma J

Purchase Details

Closed on

Jul 22, 2003

Sold by

Miller Edward J and Miller Kaye

Bought by

Miller Edward J and Miller Mary Kathleen

Purchase Details

Closed on

Apr 10, 2003

Sold by

Finley Steven C and Finley Dana M

Bought by

Finley Steven C and Finley Dana M

Purchase Details

Closed on

Jun 21, 1999

Sold by

Peck Joseph W and Peck Sheila J

Bought by

Peck Joseph W and Peck Sheila J

Purchase Details

Closed on

Sep 25, 1996

Sold by

Trevillyan Edwin Jenkins and Trevillyan Jean Jolliffe

Bought by

Peck Joseph W and Peck Sheila J

Purchase Details

Closed on

Nov 16, 1993

Sold by

Stoffel David R

Bought by

Rue James J and Rue Catherine M

Purchase Details

Closed on

May 22, 1990

Sold by

Stoffel David R

Bought by

Stoffel David R

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Swenson Norma J | -- | None Available | |

| Swenson Norma J | -- | United Title Company | |

| Swenson Norma J | $488,000 | Lawyers Title | |

| Miller Edward J | -- | -- | |

| Finley Steven C | -- | -- | |

| Peck Joseph W | -- | -- | |

| Peck Joseph W | $26,500 | -- | |

| Rue James J | $110,000 | -- | |

| Stoffel David R | -- | First American Title Ins Co |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,144 | $326,549 | $88,160 | $238,389 |

| 2023 | $4,144 | $313,871 | $84,738 | $229,133 |

| 2022 | $4,225 | $307,718 | $83,077 | $224,641 |

| 2021 | $3,823 | $276,905 | $74,234 | $202,671 |

| 2020 | $3,380 | $251,732 | $67,486 | $184,246 |

| 2019 | $3,295 | $244,400 | $65,520 | $178,880 |

| 2018 | $3,179 | $235,000 | $63,000 | $172,000 |

| 2017 | $3,143 | $231,000 | $62,000 | $169,000 |

| 2016 | $3,000 | $222,000 | $60,000 | $162,000 |

| 2015 | $2,915 | $222,000 | $60,000 | $162,000 |

| 2014 | $2,861 | $217,000 | $59,000 | $158,000 |

Source: Public Records

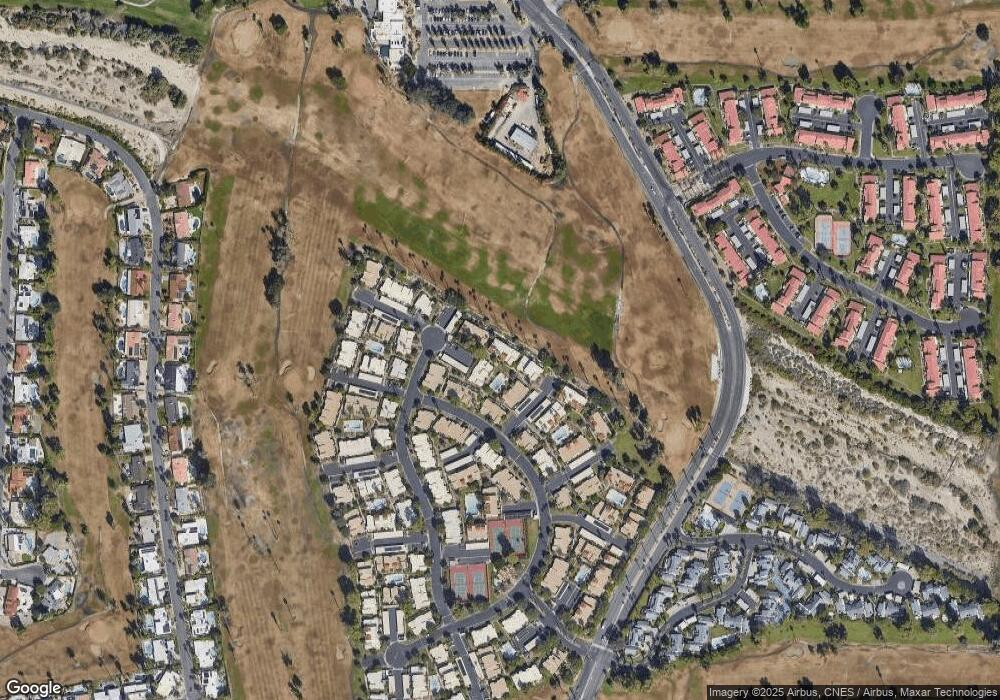

Map

Nearby Homes

- 2201 Los Patos Dr

- 5723 Los Coyotes Dr

- 2306 Los Patos Dr

- 2303 Los Patos Dr

- 5300 Los Coyotes Dr

- 2396 Los Coyotes Dr

- 2088 S Pebble Beach Dr

- 47 Portola Dr

- 6000 Montecito Dr Unit 4

- 2176 S Bobolink Ln

- 6117 Arroyo Rd Unit 4

- 1797 Firestone Plaza

- 6087 Montecito Cir Unit 4

- 6134 Arroyo Rd Unit 3

- 2615 E East Palm Oasis St

- 6135 Montecito Dr Unit 5

- 2700 Lawrence Crossley Rd Unit 90

- 2700 Lawrence Crossley Rd Unit 37

- 2700 Lawrence Crossley Rd Unit 83

- 2700 Lawrence Crossley Rd Unit 65

- 5744 Los Coyotes Dr

- 5740 Los Coyotes Dr

- 5746 Los Coyotes Dr

- 5738 Los Coyotes Dr

- 5772 Los Coyotes Dr

- 5714 Los Coyotes Dr

- 5734 Los Coyotes Dr

- 5774 Los Coyotes Dr

- 5712 Los Coyotes Dr

- 5730 Los Coyotes Dr

- 5776 Los Coyotes Dr

- 5710 Los Coyotes Dr Unit 1

- 5764 Los Coyotes Dr

- 5762 Los Coyotes Dr

- 5760 Los Coyotes Dr

- 5728 Los Coyotes Dr

- 5726 Los Coyotes Dr

- 5754 Los Coyotes Dr

- 5724 Los Coyotes Dr

- 5756 Los Coyotes Dr