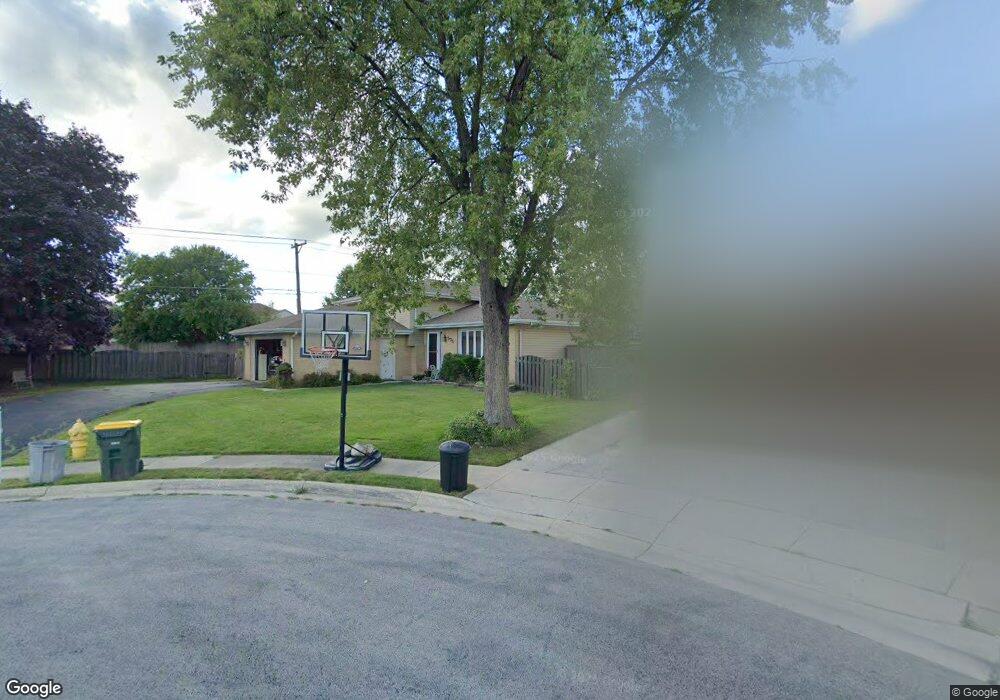

575 Fawn Ct Carol Stream, IL 60188

Estimated Value: $384,189 - $398,000

3

Beds

2

Baths

1,985

Sq Ft

$196/Sq Ft

Est. Value

About This Home

This home is located at 575 Fawn Ct, Carol Stream, IL 60188 and is currently estimated at $390,047, approximately $196 per square foot. 575 Fawn Ct is a home located in DuPage County with nearby schools including Field Kindergarten Center, Western Trails Elementary School, and Jay Stream Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 24, 2005

Sold by

Pietanza Jenny N and Pietanza Vito

Bought by

Vazquez Rodrigo and Vazquez Maria C

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$187,500

Outstanding Balance

$97,571

Interest Rate

5.71%

Mortgage Type

Fannie Mae Freddie Mac

Estimated Equity

$292,476

Purchase Details

Closed on

Jan 31, 2002

Sold by

Lukowski Leo J and Lukowski Shirley C

Bought by

Kaufman Jenny N and Pietanza Vito

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$175,950

Interest Rate

7.14%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Vazquez Rodrigo | $287,500 | Pntn | |

| Kaufman Jenny N | $207,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Vazquez Rodrigo | $187,500 | |

| Previous Owner | Kaufman Jenny N | $175,950 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $8,580 | $116,009 | $32,903 | $83,106 |

| 2023 | $8,050 | $106,090 | $30,090 | $76,000 |

| 2022 | $8,709 | $105,400 | $29,890 | $75,510 |

| 2021 | $8,280 | $100,140 | $28,400 | $71,740 |

| 2020 | $8,133 | $97,700 | $27,710 | $69,990 |

| 2019 | $7,805 | $93,890 | $26,630 | $67,260 |

| 2018 | $7,315 | $84,740 | $25,930 | $58,810 |

| 2017 | $6,913 | $78,540 | $24,030 | $54,510 |

| 2016 | $6,543 | $72,690 | $22,240 | $50,450 |

| 2015 | $6,390 | $67,830 | $20,750 | $47,080 |

| 2014 | $6,349 | $66,320 | $20,290 | $46,030 |

| 2013 | $6,386 | $68,590 | $20,980 | $47,610 |

Source: Public Records

Map

Nearby Homes

- 852 Napa St

- 351 Juniper Ct

- 720 Hoover Dr Unit 124

- 654 Tacoma Dr

- 911 Hampton Dr

- 975 Merbach Ct

- 312 Dancing Water Ct

- 1065 Brighton Dr

- 787 Daybreak Ln Unit 207

- 515 Dakota Ct

- 526 Alton Ct

- 969 Dearborn Cir

- 848 Birchbark Trail

- 601 Bluff St

- 716 Sand Creek Dr

- 686 Legends Dr

- 552 Cochise Place

- 716 Shining Water Dr

- 332 El Paso Ln

- 403 Arrowhead Trail

- 569 Fawn Ct

- 828 Yellowstone St

- 574 Fawn Ct

- 563 Fawn Ct

- 568 Fawn Ct

- 836 Yellowstone St

- 829 Yellowstone St

- 825 Renaissance Dr

- 821 Renaissance Dr

- 562 Fawn Ct

- 559 Fawn Ct

- 829 Renaissance Dr

- 842 Yellowstone St

- 790 Erie Ct

- 837 Yellowstone St

- 556 Fawn Ct

- 788 Erie Ct

- 831 Renaissance Dr

- 555 Fawn Ct

- 604 Chestnut Dr