575 Summerhill Dr Unit 1 Roswell, GA 30075

Estimated Value: $765,691 - $862,000

4

Beds

4

Baths

2,686

Sq Ft

$300/Sq Ft

Est. Value

About This Home

This home is located at 575 Summerhill Dr Unit 1, Roswell, GA 30075 and is currently estimated at $806,673, approximately $300 per square foot. 575 Summerhill Dr Unit 1 is a home located in Fulton County with nearby schools including Sweet Apple Elementary School, Elkins Pointe Middle School, and Milton High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 14, 2022

Sold by

Hartman Robert

Bought by

Hartman Teresa R

Current Estimated Value

Purchase Details

Closed on

Feb 15, 2001

Sold by

Mott David M and Mott Maureen B

Bought by

Hartman Robert and Hartman Teresa R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$249,200

Interest Rate

7%

Mortgage Type

New Conventional

Purchase Details

Closed on

Apr 30, 1997

Sold by

S P Casey Const Inc

Bought by

Mott David M and Mott Maureen

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$185,000

Interest Rate

7.98%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hartman Teresa R | -- | -- | |

| Hartman Robert | $311,500 | -- | |

| Mott David M | $249,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Hartman Robert | $249,200 | |

| Previous Owner | Hartman Robert | $46,725 | |

| Previous Owner | Mott David M | $185,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $975 | $280,680 | $93,960 | $186,720 |

| 2023 | $975 | $207,440 | $51,080 | $156,360 |

| 2022 | $4,124 | $207,440 | $51,080 | $156,360 |

| 2021 | $4,901 | $193,400 | $54,760 | $138,640 |

| 2020 | $4,961 | $166,800 | $37,080 | $129,720 |

| 2019 | $803 | $163,880 | $36,440 | $127,440 |

| 2018 | $4,447 | $182,360 | $51,880 | $130,480 |

| 2017 | $4,070 | $155,440 | $36,840 | $118,600 |

| 2016 | $4,049 | $155,440 | $36,840 | $118,600 |

| 2015 | $4,912 | $155,440 | $36,840 | $118,600 |

| 2014 | $4,192 | $155,440 | $36,840 | $118,600 |

Source: Public Records

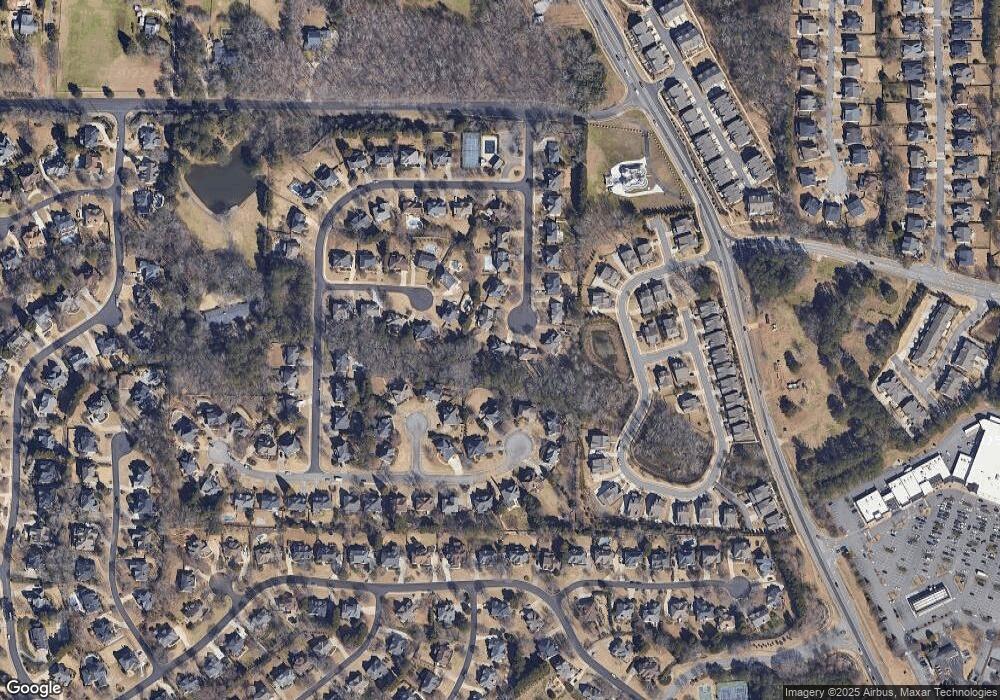

Map

Nearby Homes

- 161 Brook Ln

- 113 Quinn Way

- 127 Quinn Way

- 137 Quinn Way

- 580 Stillhouse Ln Unit 2

- 12655 New Providence Rd

- 1565 Parkside Dr

- 666 Abbey Ct

- 12867 Etris Walk

- 406 Sweet Apple Cir

- 12842 Waterside Dr Unit 2

- 13125 Morningpark Cir

- 13025 Morningpark Cir

- 13015 Morningpark Cir Unit 1

- 105 Kensington Pond Ct

- 4404 Orchard Trace

- 285 N Farm Dr

- 216 Lask Ln

- 233 Lask Ln

- 237 Lask Ln

- 565 Summerhill Dr Unit 1

- 580 Summerhill Dr

- 500 Brook Cir

- 345 Babcock Ln

- 125 Babcock Ct

- 335 Babcock Ln Unit 1

- 510 Brook Cir Unit 2

- 555 Summerhill Dr

- 570 Summerhill Dr

- 560 Summerhill Dr Unit 1

- 115 Babcock Ct

- 340 Babcock Ln

- 545 Summerhill Dr

- 490 Brook Cir Unit 2

- 550 Summerhill Dr

- 520 Brook Cir Unit 2

- 325 Babcock Ln Unit 1

- 120 Babcock Ct Unit 2

- 480 Brook Cir

- 330 Babcock Ln