5763 Shaker Rd Franklin, OH 45005

Estimated Value: $232,000 - $305,000

2

Beds

1

Bath

1,316

Sq Ft

$198/Sq Ft

Est. Value

About This Home

This home is located at 5763 Shaker Rd, Franklin, OH 45005 and is currently estimated at $260,740, approximately $198 per square foot. 5763 Shaker Rd is a home located in Warren County with nearby schools including Franklin High School, Summit Academy Community School for Alternative Learners - Middletown, and Summit Academy Secondary School - Middletown.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 19, 2008

Sold by

Dunlevey Zachariah M

Bought by

Dunlevey Zachariah M and Dunlevey Joseph Larry

Current Estimated Value

Purchase Details

Closed on

Apr 12, 2007

Sold by

Hud

Bought by

Dunlevey Zachariah M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$102,262

Outstanding Balance

$72,573

Interest Rate

9.59%

Mortgage Type

Stand Alone First

Estimated Equity

$188,167

Purchase Details

Closed on

May 11, 2006

Sold by

Hurt Kenneth S and Case #05Cv64991

Bought by

Hud

Purchase Details

Closed on

Dec 22, 1999

Sold by

Tindale Waldo H

Bought by

Hurt Kenneth S and Hurt Angela L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$119,530

Interest Rate

7.7%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Dunlevey Zachariah M | -- | Attorney | |

| Dunlevey Zachariah M | $113,625 | Lakeside Title & Escrow | |

| Hud | $160,300 | None Available | |

| Hurt Kenneth S | $129,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Dunlevey Zachariah M | $102,262 | |

| Previous Owner | Hurt Kenneth S | $119,530 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,008 | $89,050 | $22,720 | $66,330 |

| 2023 | $3,565 | $71,358 | $12,701 | $58,656 |

| 2022 | $3,487 | $71,358 | $12,702 | $58,657 |

| 2021 | $3,290 | $71,358 | $12,702 | $58,657 |

| 2020 | $3,041 | $58,013 | $10,325 | $47,688 |

| 2019 | $2,752 | $58,013 | $10,325 | $47,688 |

| 2018 | $2,746 | $58,013 | $10,325 | $47,688 |

| 2017 | $2,714 | $52,014 | $9,471 | $42,543 |

| 2016 | $2,772 | $52,014 | $9,471 | $42,543 |

| 2015 | $2,773 | $52,014 | $9,471 | $42,543 |

| 2014 | $2,573 | $46,860 | $8,530 | $38,330 |

| 2013 | $2,188 | $56,700 | $10,330 | $46,370 |

Source: Public Records

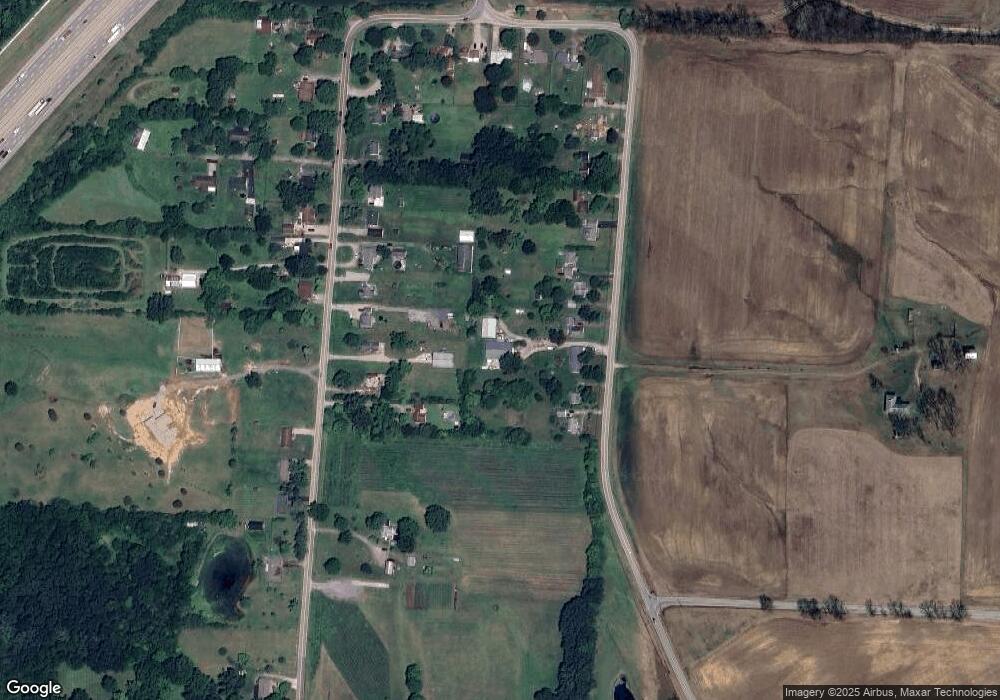

Map

Nearby Homes

- 25 Timber Creek Dr

- 65 Timber Creek Dr

- 5845 Manchester Rd

- 5757 S Dixie Hwy

- 5925 Millbrook Dr

- 6645 Rivulet Dr

- 5696 Woodcreek Dr

- 5865 Hayden Dr

- 4650 Shaker Rd

- 4640 Shaker Rd

- 6104 State Route 123

- 6104 Ohio 123

- 6777 Crystal Harbour Dr

- 31 Sprucewood Ct

- 0 Kathy Ln Unit 1834240

- 0 Kathy Ln Unit 930066

- 5760 Autumn Dr

- 6745 Catskill Dr

- 6334 Bevis Ln

- 5019 Waterford Dr

- 5777 Shaker Rd

- 5774 Union Rd

- 5745 Shaker Rd

- 5820 Union Rd

- 5799 Shaker Rd

- 5731 Shaker Rd

- 5813 Shaker Rd

- 5840 Union Rd

- 5742 Union Rd

- 0 St Rt 123 Unit 1437733

- 27 Tama Lot 27 Ln

- 29 Tama Lot 29 Ln

- 0 Lot #93 Angelas Cove Unit 579848

- 0 Lot #91 Angelas Cove Unit 579847

- 0 Lot #95 Angelas Cove Unit 579802

- 0 St Rt 123 Unit 603072

- 76 Timbewild Way

- 5782 Union Rd

- 5804 Union Rd

- 5825 Shaker Rd