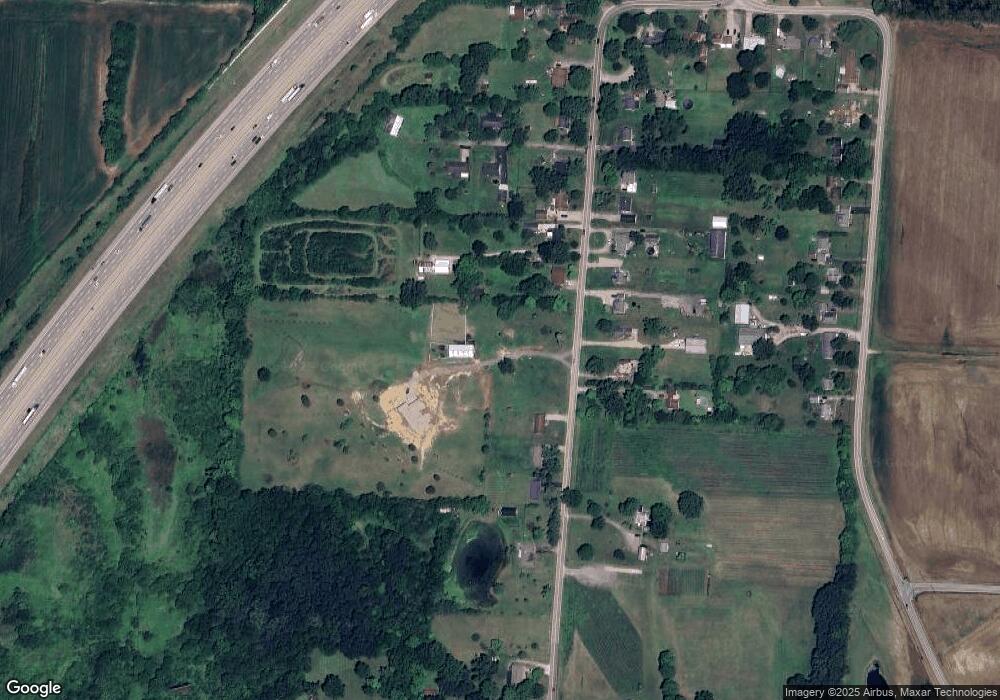

5769 Union Rd Franklin, OH 45005

Estimated Value: $270,000 - $381,000

3

Beds

1

Bath

1,359

Sq Ft

$238/Sq Ft

Est. Value

About This Home

This home is located at 5769 Union Rd, Franklin, OH 45005 and is currently estimated at $323,016, approximately $237 per square foot. 5769 Union Rd is a home located in Warren County with nearby schools including Franklin High School, Summit Academy Community School for Alternative Learners - Middletown, and Summit Academy Secondary School - Middletown.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 25, 2023

Sold by

Mcnabb Jeffrey Allen

Bought by

Acosta Gerardo

Current Estimated Value

Purchase Details

Closed on

Jan 21, 2014

Sold by

Stamper Betty J

Bought by

Stamper Betty J and Gay Dorothy

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$198,921

Interest Rate

4.37%

Mortgage Type

FHA

Purchase Details

Closed on

Oct 10, 1984

Sold by

Wilson Douglas W and Wilson Mild

Bought by

Stamper and Stamper Frank

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Acosta Gerardo | $265,000 | Absolute Title Agency | |

| Stamper Betty J | -- | None Available | |

| Stamper | $75,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Stamper Betty J | $198,921 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,881 | $86,210 | $74,900 | $11,310 |

| 2023 | $4,557 | $91,318 | $48,310 | $43,008 |

| 2022 | $4,459 | $91,319 | $48,311 | $43,008 |

| 2021 | $4,207 | $91,319 | $48,311 | $43,008 |

| 2020 | $3,888 | $74,242 | $39,277 | $34,965 |

| 2019 | $3,074 | $74,242 | $39,277 | $34,965 |

| 2018 | $3,069 | $74,242 | $39,277 | $34,965 |

| 2017 | $3,164 | $70,004 | $38,409 | $31,595 |

| 2016 | $3,232 | $70,004 | $38,409 | $31,595 |

| 2015 | $3,233 | $70,004 | $38,409 | $31,595 |

| 2014 | $3,099 | $65,920 | $37,450 | $28,460 |

| 2013 | $2,640 | $73,720 | $39,280 | $34,440 |

Source: Public Records

Map

Nearby Homes

- 5756 Union Rd

- 25 Timber Creek Dr

- 220 Pleasant Hill Blvd

- 5845 Manchester Rd

- 60 Pleasant Hill Blvd

- 5696 Woodcreek Dr

- 5667 Woodcreek Dr

- 5714 Millbrook Dr

- 6772 Rivulet Dr

- 6777 Crystal Harbour Dr

- 6795 Crystal Harbour Dr

- 5760 Autumn Dr

- 4640 Shaker Rd

- 5019 Waterford Ln

- 0 Kathy Ln Unit 1834240

- 0 Kathy Ln Unit 930066

- Creekside Paired Villa Plan at Waterford Place

- 4964 Timberline Dr Unit 81

- 5031 Gerber Dr

- 4840 Shannon Way

- 5723 Union Rd

- 5803 Union Rd

- 5707 Union Rd

- 5819 Union Rd

- 5782 Union Rd

- 5853 Union Rd

- 5839 Union Rd

- 5804 Union Rd

- 5855 Union Rd

- 5742 Union Rd

- 5851 Union Rd

- 5657 Union Rd

- 0 St Rt 123 Unit 1437733

- 27 Tama Lot 27 Ln

- 29 Tama Lot 29 Ln

- 0 Lot #93 Angelas Cove Unit 579848

- 0 Lot #91 Angelas Cove Unit 579847

- 0 Lot #95 Angelas Cove Unit 579802

- 0 St Rt 123 Unit 603072

- 76 Timbewild Way