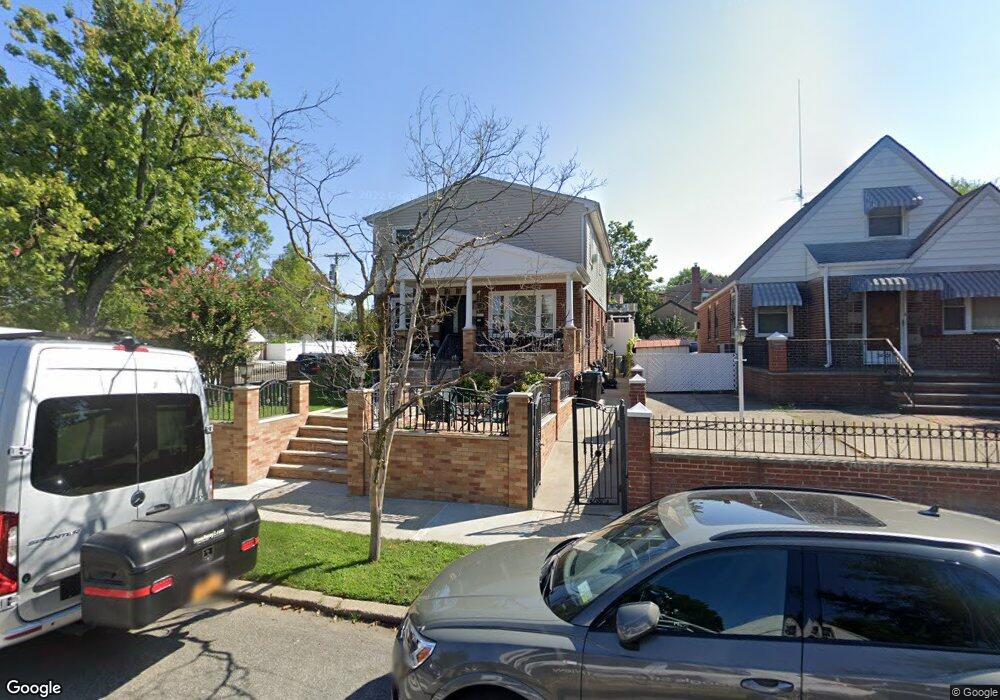

5803 190th St Fresh Meadows, NY 11365

Auburndale NeighborhoodEstimated Value: $1,168,000 - $1,277,000

--

Bed

--

Bath

1,782

Sq Ft

$687/Sq Ft

Est. Value

About This Home

This home is located at 5803 190th St, Fresh Meadows, NY 11365 and is currently estimated at $1,223,400, approximately $686 per square foot. 5803 190th St is a home located in Queens County with nearby schools including P.S. 162 The John Golden School, George J. Ryan Middle School 216, and Francis Lewis High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 2, 2008

Sold by

Liao Yong Hong

Bought by

Galabay Albino and Galabay Jaime

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$417,000

Outstanding Balance

$264,774

Interest Rate

5.93%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$958,626

Purchase Details

Closed on

Jul 18, 2005

Sold by

Arya Pushpa and Arya Ved

Bought by

Liao Yong Hong

Purchase Details

Closed on

Feb 2, 1996

Sold by

Yoshioka Yoshiaki and Yoshioka Yukari

Bought by

Arya Ved and Arya Pushpa

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$170,000

Interest Rate

7%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Galabay Albino | $700,000 | -- | |

| Liao Yong Hong | $770,000 | -- | |

| Arya Ved | $245,000 | Commonwealth Land Title Ins |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Galabay Albino | $417,000 | |

| Previous Owner | Arya Ved | $170,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $10,425 | $55,016 | $14,827 | $40,189 |

| 2024 | $10,425 | $51,905 | $14,900 | $37,005 |

| 2023 | $9,835 | $48,968 | $11,928 | $37,040 |

| 2022 | $9,617 | $63,060 | $18,240 | $44,820 |

| 2021 | $9,983 | $63,840 | $18,240 | $45,600 |

| 2020 | $9,704 | $63,600 | $18,240 | $45,360 |

| 2019 | $6,947 | $59,940 | $18,240 | $41,700 |

| 2018 | $8,318 | $40,807 | $12,909 | $27,898 |

| 2017 | $8,183 | $40,143 | $13,758 | $26,385 |

| 2016 | $7,902 | $40,143 | $13,758 | $26,385 |

| 2015 | $4,348 | $38,206 | $15,864 | $22,342 |

| 2014 | $4,348 | $36,045 | $16,828 | $19,217 |

Source: Public Records

Map

Nearby Homes

- 58-23 192nd St

- 58-33 192nd St

- 5335 192nd St

- 58-39 196th Place

- 50-43 192nd St

- 183-26 Booth Memorial Ave

- 197-20 58th Ave

- 182-15 58th Ave Unit A

- 48-62 188th St

- 5052 Utopia Pkwy

- 50-12 Utopia Pkwy

- 183-11 64th Ave

- 19715 53rd Ave

- 5640 Francis Lewis Blvd

- 4826 193rd St

- 61-31 182nd St

- 56-39 175th Place Unit B

- 49-75 175th Place

- 4818 190th St

- 196-66 67th Ave Unit 1FL