5831 Cr 5900 Cherryvale, KS 67335

Estimated Value: $241,408 - $289,000

3

Beds

2

Baths

1,542

Sq Ft

$178/Sq Ft

Est. Value

About This Home

This home is located at 5831 Cr 5900, Cherryvale, KS 67335 and is currently estimated at $274,352, approximately $177 per square foot. 5831 Cr 5900 is a home located in Montgomery County.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 15, 2022

Bought by

King Micah C and King Briana M

Current Estimated Value

Purchase Details

Closed on

Oct 1, 2020

Bought by

Springer Patrick L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| King Micah C | -- | -- | |

| Springer Patrick L | $35,000 | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $34 | $28,116 | $2,068 | $26,048 |

| 2024 | $34 | $26,727 | $2,068 | $24,659 |

| 2023 | $2,439 | $25,214 | $2,068 | $23,146 |

| 2022 | $2,439 | $17,901 | $2,010 | $15,891 |

| 2021 | $2,060 | $4,134 | $2,867 | $1,267 |

| 2020 | $2,060 | $4,135 | $2,758 | $1,377 |

| 2019 | $881 | $6,154 | $1,480 | $4,674 |

| 2018 | $786 | $5,730 | $814 | $4,916 |

| 2017 | $671 | $5,060 | $814 | $4,246 |

| 2016 | $646 | $4,871 | $814 | $4,057 |

| 2015 | -- | $4,970 | $781 | $4,189 |

| 2014 | -- | $5,221 | $781 | $4,440 |

Source: Public Records

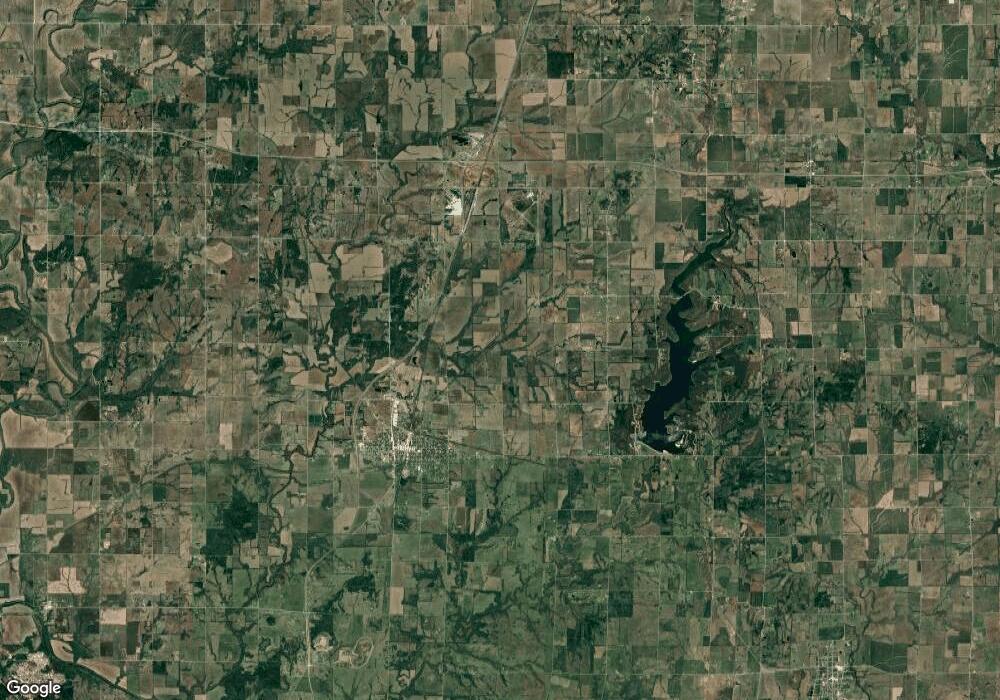

Map

Nearby Homes