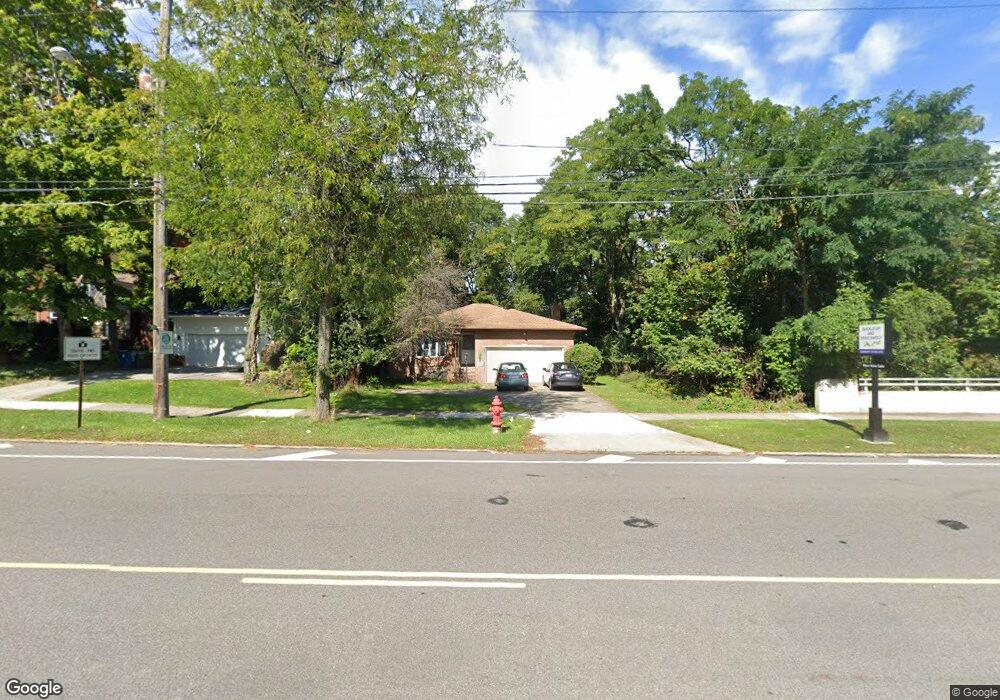

5836 Pearl Rd Parma Heights, OH 44130

Estimated Value: $225,000 - $261,000

3

Beds

2

Baths

1,542

Sq Ft

$159/Sq Ft

Est. Value

About This Home

This home is located at 5836 Pearl Rd, Parma Heights, OH 44130 and is currently estimated at $244,861, approximately $158 per square foot. 5836 Pearl Rd is a home located in Cuyahoga County with nearby schools including Ridge-Brook Elementary School, Greenbriar Middle School, and Valley Forge High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 5, 1999

Sold by

Mash Robert and Mash Sandra

Bought by

Aujla Gagan

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$118,550

Outstanding Balance

$29,645

Interest Rate

6.89%

Estimated Equity

$215,216

Purchase Details

Closed on

Mar 22, 1984

Sold by

Mash Robert

Bought by

Mash Robert and Mash Sandra

Purchase Details

Closed on

Jan 28, 1983

Sold by

Matheis Katarina

Bought by

Mash Robert

Purchase Details

Closed on

Apr 18, 1980

Sold by

Stephanie C Styrcula

Bought by

Matheis Katarina

Purchase Details

Closed on

Jan 17, 1980

Sold by

Styroula Stephanie C

Bought by

Stephanie C Styrcula

Purchase Details

Closed on

Jan 1, 1975

Bought by

Kross Adelle

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Aujla Gagan | $131,800 | Ohio Title Corporation | |

| Mash Robert | -- | -- | |

| Mash Robert | $77,000 | -- | |

| Matheis Katarina | $12,000 | -- | |

| Stephanie C Styrcula | -- | -- | |

| Styroula Stephanie C | -- | -- | |

| Carolina Krzyzanowski | -- | -- | |

| Kross Adelle | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Aujla Gagan | $118,550 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,187 | $65,730 | $12,390 | $53,340 |

| 2023 | $3,927 | $53,560 | $13,200 | $40,360 |

| 2022 | $3,905 | $53,550 | $13,200 | $40,360 |

| 2021 | $3,939 | $53,550 | $13,200 | $40,360 |

| 2020 | $3,548 | $43,190 | $10,640 | $32,550 |

| 2019 | $3,451 | $123,400 | $30,400 | $93,000 |

| 2018 | $3,313 | $43,190 | $10,640 | $32,550 |

| 2017 | $3,108 | $36,160 | $7,840 | $28,320 |

| 2016 | $3,161 | $36,160 | $7,840 | $28,320 |

| 2015 | $3,267 | $36,160 | $7,840 | $28,320 |

| 2014 | $3,267 | $37,670 | $8,160 | $29,510 |

Source: Public Records

Map

Nearby Homes

- 5860 Pearl Rd

- 5906 Twin Lakes Dr

- 5845 Lotusdale Dr

- 5972 Westminster Dr

- 5717 Chestnut Dr

- 9621 Elsmere Dr

- 7906 Bertha Ave

- 7910 Dresden Ave

- 0 Parkhill Dr Unit 5116837

- 7615 Bertha Ave

- 8514 Deerfield Dr

- 7514 Spring Garden Rd

- 7609 Wooster Pkwy

- 6111 Denison Blvd

- 9118 Fernhill Ave

- 9417 Fernhill Ave

- 7706 Renwood Dr

- 10172 Keswick Dr

- 7915 Fernhill Ave

- 5440 W 84th St Unit 42