585 Aero Ln Bigfork, MT 59911

Estimated Value: $1,087,000 - $1,605,000

3

Beds

3

Baths

2,945

Sq Ft

$444/Sq Ft

Est. Value

About This Home

This home is located at 585 Aero Ln, Bigfork, MT 59911 and is currently estimated at $1,306,834, approximately $443 per square foot. 585 Aero Ln is a home located in Flathead County with nearby schools including Bigfork Elementary School, Bigfork Middle School, and Bigfork High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 16, 2016

Sold by

Richardson Valerie and Ballenger Philip D

Bought by

Hansen Mark J and Hansen Cynthia A

Current Estimated Value

Purchase Details

Closed on

Feb 3, 2010

Sold by

Brunette Richard L and Brunette Jonmi H

Bought by

Richardson Valerie and Ballenger Phillip D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$395,360

Interest Rate

5.11%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 26, 2006

Sold by

Brunette Richard L and Brunette Jonmi H

Bought by

Brunette Richard L and Brunette Jonmi H

Purchase Details

Closed on

Jul 11, 2006

Sold by

Bertrand Henry G and Quian Linda C

Bought by

Brynette Richard L and Brunette Jonmi H

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hansen Mark J | -- | Fidelity National Title | |

| Richardson Valerie | -- | Insured Titles | |

| Brunette Richard L | -- | Alliance Title | |

| Brynette Richard L | -- | Stewart Title Of Flathead Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Richardson Valerie | $395,360 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,146 | $1,186,200 | $0 | $0 |

| 2024 | $2,975 | $904,400 | $0 | $0 |

| 2023 | $4,392 | $904,400 | $0 | $0 |

| 2022 | $4,438 | $656,800 | $0 | $0 |

| 2021 | $4,617 | $656,800 | $0 | $0 |

| 2020 | $4,710 | $642,300 | $0 | $0 |

| 2019 | $4,523 | $642,300 | $0 | $0 |

| 2018 | $4,358 | $586,500 | $0 | $0 |

| 2017 | $4,316 | $586,500 | $0 | $0 |

| 2016 | $29 | $390,800 | $0 | $0 |

| 2015 | $2,685 | $390,800 | $0 | $0 |

| 2014 | $2,502 | $219,102 | $0 | $0 |

Source: Public Records

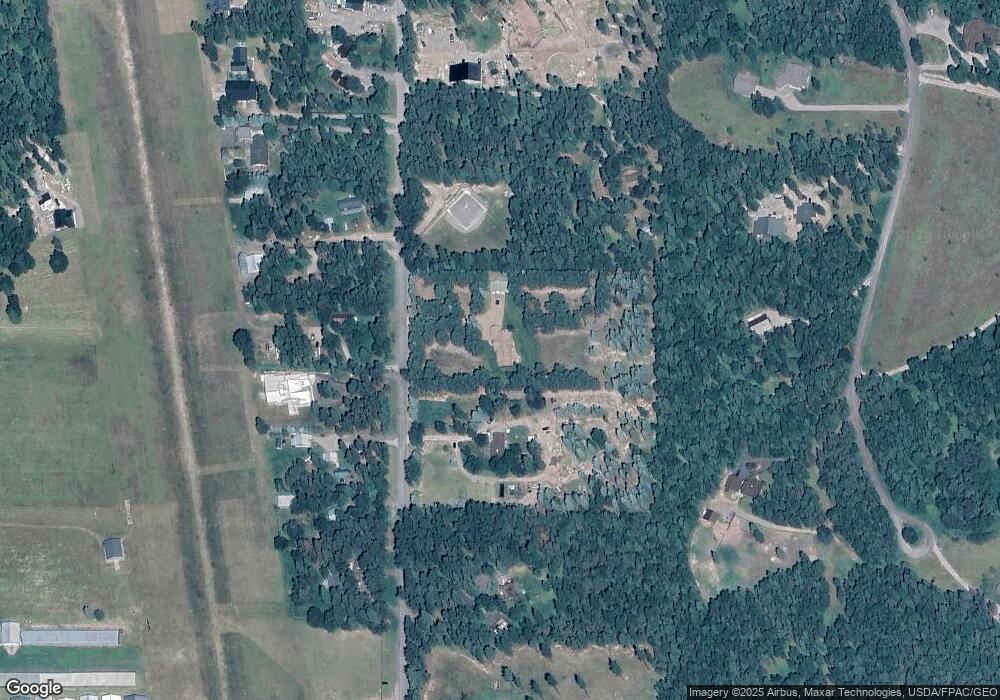

Map

Nearby Homes

- 305 Ferndale Dr Unit 41&42

- 305 Ferndale Dr Unit 42

- 305 Ferndale Dr Unit 41

- 72 Pilots Trail

- 518 Eastman Dr

- 115 Ferndale Dr

- 639 Three Eagle Ln

- 280 Shady Ln

- 172 Swanlea Rd S

- #30 Bear Creek Village

- 11357 Mt Highway 83

- 29545 Drifting Way

- 30580 Cayuse Ln

- 1150 Swan Hill Dr

- NHN Wolf Creek Ranch Rd

- 12022 Mount Highway 83

- 12524 Sunburst Dr

- 1 Red Owl Rd

- Nhn Swan Hill Dr

- 2 Red Owl Rd

Your Personal Tour Guide

Ask me questions while you tour the home.