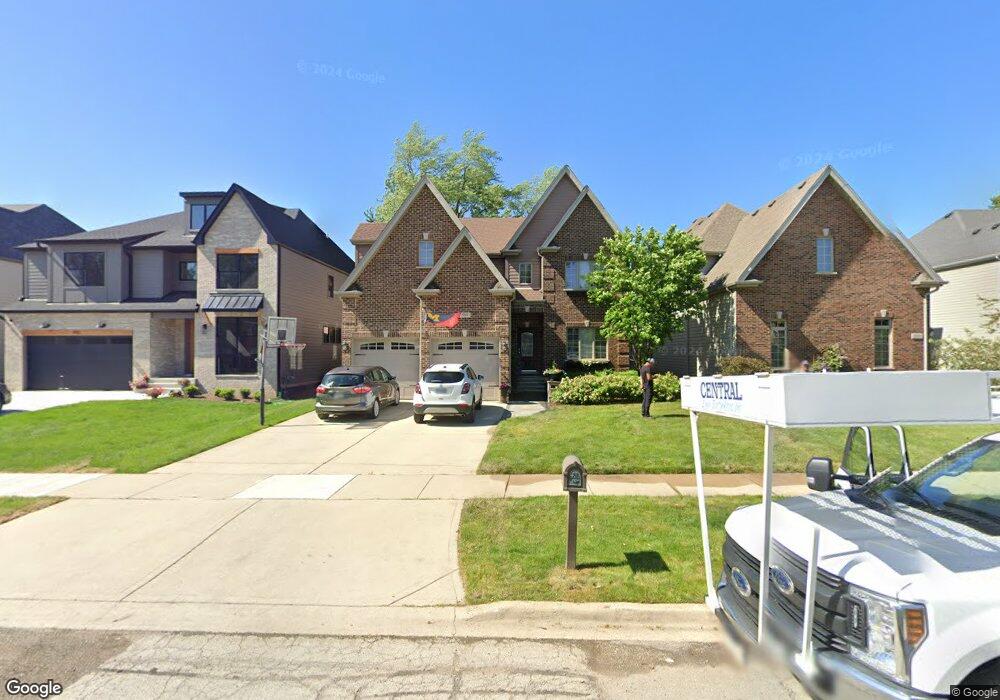

589 W Gladys Ave Elmhurst, IL 60126

Estimated Value: $1,093,604 - $1,205,000

4

Beds

4

Baths

4,085

Sq Ft

$282/Sq Ft

Est. Value

About This Home

This home is located at 589 W Gladys Ave, Elmhurst, IL 60126 and is currently estimated at $1,152,651, approximately $282 per square foot. 589 W Gladys Ave is a home located in DuPage County with nearby schools including Emerson Elementary School, Churchville Middle School, and York Community High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 26, 2006

Sold by

Standard Bank & Trust Co

Bought by

Wright Jason T and Wright Carrie A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$637,600

Outstanding Balance

$381,099

Interest Rate

6.49%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$771,552

Purchase Details

Closed on

Oct 24, 2005

Sold by

Ruggieri Nicola and Ruggieri Lisa

Bought by

Standard Bank & Trust Co and Trust #16681

Purchase Details

Closed on

Oct 31, 2003

Sold by

Dugo Vincent S and Dugo Gina P

Bought by

Ruggeri Nick and Ruggeri Lisa

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$200,000

Interest Rate

6.02%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Feb 19, 1997

Sold by

Dugo Vincent S and Dugo Gina P

Bought by

Dugo Vincent S and Dugo Gina P

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$125,384

Interest Rate

8.01%

Mortgage Type

FHA

Purchase Details

Closed on

Jun 17, 1994

Sold by

Watt Sherry A

Bought by

Dugo Vincent S and Dichiria Gina P

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$126,667

Interest Rate

8.6%

Mortgage Type

FHA

Purchase Details

Closed on

Jun 13, 1994

Sold by

Locke Sara

Bought by

Dugo Vincent S and Dichiria Gina P

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$126,667

Interest Rate

8.6%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wright Jason T | $797,000 | Multiple | |

| Standard Bank & Trust Co | $400,000 | Ctic | |

| Ruggeri Nick | $285,000 | Chicago Title Insurance Co | |

| Dugo Vincent S | -- | -- | |

| Dugo Vincent S | $96,500 | First American Title | |

| Dugo Vincent S | $16,000 | First American Title | |

| Dugo Vincent S | $16,000 | First American Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Wright Jason T | $637,600 | |

| Previous Owner | Ruggeri Nick | $200,000 | |

| Previous Owner | Dugo Vincent S | $125,384 | |

| Previous Owner | Dugo Vincent S | $126,667 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $19,764 | $330,724 | $71,501 | $259,223 |

| 2023 | $18,270 | $304,030 | $65,730 | $238,300 |

| 2022 | $18,591 | $309,490 | $62,300 | $247,190 |

| 2021 | $17,814 | $296,440 | $59,670 | $236,770 |

| 2020 | $16,778 | $283,940 | $57,150 | $226,790 |

| 2019 | $16,830 | $273,020 | $54,950 | $218,070 |

| 2018 | $15,972 | $257,570 | $52,340 | $205,230 |

| 2017 | $15,694 | $246,170 | $50,020 | $196,150 |

| 2016 | $15,087 | $227,280 | $46,180 | $181,100 |

| 2015 | $14,842 | $209,960 | $42,660 | $167,300 |

| 2014 | $14,372 | $187,290 | $35,200 | $152,090 |

| 2013 | $14,312 | $191,110 | $35,920 | $155,190 |

Source: Public Records

Map

Nearby Homes

- 655 W Comstock Ave

- 656 W Comstock Ave

- 901 E Krage Dr

- 724 N Junior Terrace

- 468 N Highland Ave

- 902 E Krage Dr

- 740 N Junior Terrace

- 412 N Ridgeland Ave

- 442 N Oak St

- 600 E Armitage Ave

- 322 N Highland Ave

- 437 E Lorraine Ave

- 407 W North Ave

- 285 N Ridgeland Ave

- 251 W Armitage Ave

- 456 N Elm Ave

- 1101 N Princeton Ave

- 461 S Ardmore Terrace

- 625 S Yale Ave

- 204 E Hill St

- 585 W Gladys Ave

- 581 W Gladys Ave

- 593 W Gladys Ave

- 597 W Gladys Ave

- 577 W Gladys Ave

- 586 W Crockett Ave

- 573 W Gladys Ave

- 582 W Crockett Ave

- 605 W Gladys Ave

- 590 W Gladys Ave

- 580 W Crockett Ave

- 594 W Gladys Ave

- 594 W Crockett Ave

- 588 W Crockett Ave

- 582 W Gladys Ave

- 588 W Gladys Ave

- 592 W Gladys Ave

- 578 W Crockett Ave

- 569 W Gladys Ave

- 596 W Gladys Ave