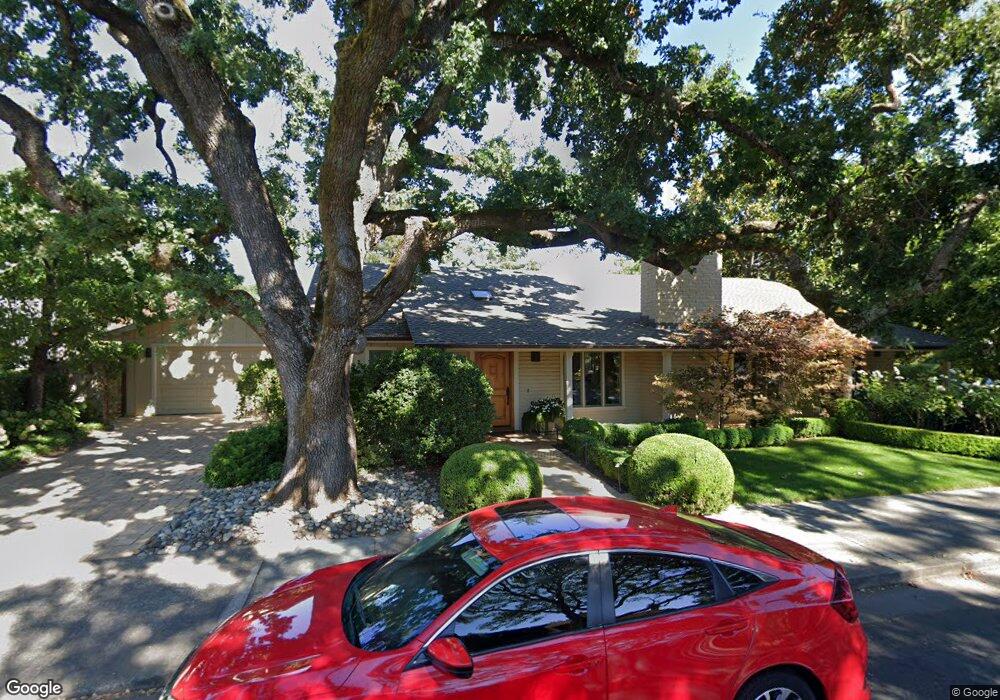

590 4th St E Sonoma, CA 95476

Estimated Value: $1,683,000 - $1,743,000

3

Beds

2

Baths

2,033

Sq Ft

$841/Sq Ft

Est. Value

About This Home

This home is located at 590 4th St E, Sonoma, CA 95476 and is currently estimated at $1,709,670, approximately $840 per square foot. 590 4th St E is a home located in Sonoma County with nearby schools including Prestwood Elementary School, Adele Harrison Middle School, and Creekside High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 11, 2007

Sold by

Ruggles Allison

Bought by

Ruggles Robert N and Ruggles Allison

Current Estimated Value

Purchase Details

Closed on

May 27, 2005

Sold by

Ruggles Robert N and Robert N Ruggles Trust

Bought by

Ruggles Allison

Purchase Details

Closed on

Mar 23, 2004

Sold by

Revx-269 Inc

Bought by

Ruggles Robert N and Robert N Ruggles Trust

Purchase Details

Closed on

Sep 24, 2003

Sold by

Barnett Grant and Barnett Phyllis

Bought by

Revx-269 Inc

Purchase Details

Closed on

Aug 25, 1994

Sold by

White Alan B and White Sandra J

Bought by

Barnett Kelso Grant and Barnett Phyllis R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$308,800

Interest Rate

6.35%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ruggles Robert N | -- | None Available | |

| Ruggles Allison | -- | -- | |

| Ruggles Robert N | $917,500 | Fidelity National Title Co | |

| Revx-269 Inc | $727,500 | Fidelity Natl Title Co | |

| Barnett Kelso Grant | $343,500 | First American Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Barnett Kelso Grant | $308,800 | |

| Closed | Revx-269 Inc | $0 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $16,882 | $1,411,973 | $604,252 | $807,721 |

| 2024 | $16,882 | $1,384,288 | $592,404 | $791,884 |

| 2023 | $16,882 | $1,357,146 | $580,789 | $776,357 |

| 2022 | $16,874 | $1,330,536 | $569,401 | $761,135 |

| 2021 | $16,287 | $1,304,448 | $558,237 | $746,211 |

| 2020 | $16,243 | $1,291,073 | $552,513 | $738,560 |

| 2019 | $15,885 | $1,265,759 | $541,680 | $724,079 |

| 2018 | $16,288 | $1,240,941 | $531,059 | $709,882 |

| 2017 | $15,320 | $1,216,610 | $520,647 | $695,963 |

| 2016 | $14,707 | $1,192,756 | $510,439 | $682,317 |

| 2015 | $14,235 | $1,174,840 | $502,772 | $672,068 |

| 2014 | $13,825 | $1,151,828 | $492,924 | $658,904 |

Source: Public Records

Map

Nearby Homes

- 690 Hudson Ct

- 760 5th St E

- 255 E Napa St

- 856 4th St E

- 230 E Napa St

- 183 France St

- 745 E Napa St

- 151 E Napa St

- 883 Cordilleras Dr

- 851 2nd St E

- 1005 Ray Ct

- 400 Eastin Dr

- 254 1st St E

- 649 1st St W Unit 1

- 805 1st St W Unit G

- 226 1st St E

- 195 Guadalupe Dr Unit 2

- 216 1st St E

- 818 2nd St W

- 159 Guadalupe Dr