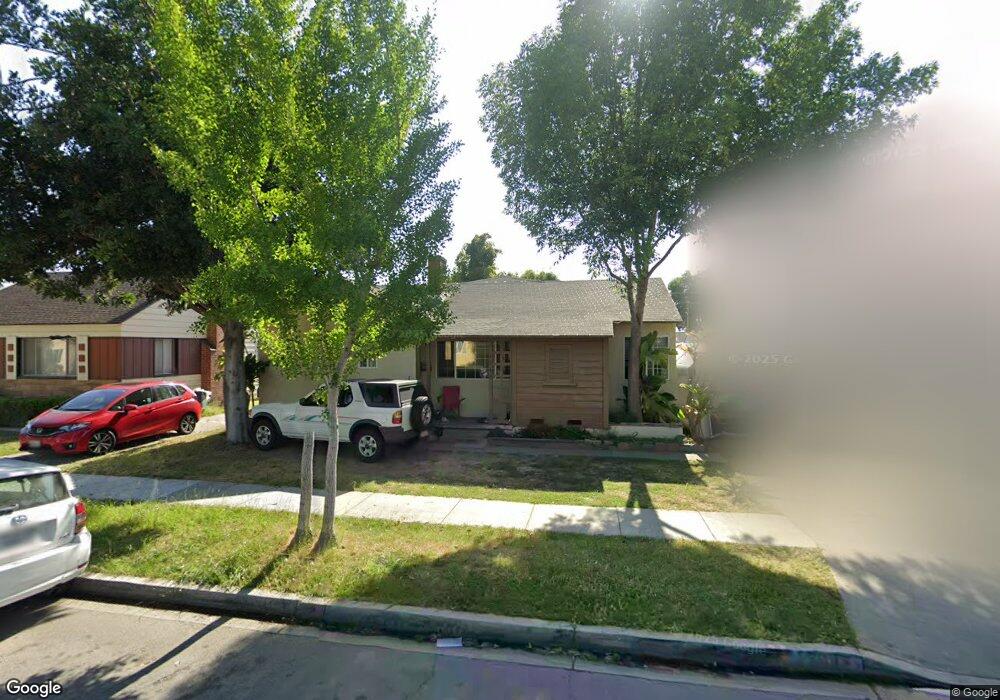

5945 Hayter Ave Lakewood, CA 90712

Collins NeighborhoodEstimated Value: $884,000 - $957,000

3

Beds

3

Baths

1,935

Sq Ft

$476/Sq Ft

Est. Value

About This Home

This home is located at 5945 Hayter Ave, Lakewood, CA 90712 and is currently estimated at $921,667, approximately $476 per square foot. 5945 Hayter Ave is a home located in Los Angeles County with nearby schools including Captain Raymond Collins School, Leona Jackson Middle School, and Buena Vista High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 12, 2014

Sold by

Thr California Lp

Bought by

2014-3 Ih Borrower Lp

Current Estimated Value

Purchase Details

Closed on

Dec 14, 2012

Sold by

The Bank Of New York Mellon

Bought by

Thr California Lp

Purchase Details

Closed on

Aug 1, 2012

Sold by

Redjai Ramin

Bought by

The Bank Of New York Mellon and The Bank Of New York

Purchase Details

Closed on

Nov 9, 2010

Sold by

Apex Funding Inc

Bought by

Redjai Ramin

Purchase Details

Closed on

Nov 6, 2007

Sold by

Redjai Ramin

Bought by

Apex Funding Inc

Purchase Details

Closed on

Dec 20, 2006

Sold by

Palaita Alailevai Ala and Palaita Opeta Uele

Bought by

Redjai Ramin

Purchase Details

Closed on

Apr 22, 2005

Sold by

Herrera Fernando and Herrera Maria

Bought by

Palaita Alailevai Ala

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$427,500

Interest Rate

7.37%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| 2014-3 Ih Borrower Lp | -- | None Available | |

| Thr California Lp | $352,000 | Fnt Lb | |

| The Bank Of New York Mellon | $382,500 | None Available | |

| Redjai Ramin | -- | None Available | |

| Apex Funding Inc | -- | Accommodation | |

| Redjai Ramin | -- | Accommodation | |

| Redjai Ramin | -- | Accommodation | |

| Palaita Alailevai Ala | $584,000 | Alliance Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Palaita Alailevai Ala | $427,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $9,261 | $725,360 | $551,275 | $174,085 |

| 2024 | $9,261 | $711,138 | $540,466 | $170,672 |

| 2023 | $9,084 | $697,195 | $529,869 | $167,326 |

| 2022 | $8,835 | $683,526 | $519,480 | $164,046 |

| 2021 | $8,846 | $688,521 | $525,589 | $162,932 |

| 2020 | $8,643 | $681,462 | $520,200 | $161,262 |

| 2019 | $5,531 | $388,571 | $275,975 | $112,596 |

| 2018 | $5,127 | $380,953 | $270,564 | $110,389 |

| 2016 | $6,141 | $502,548 | $304,575 | $197,973 |

| 2015 | $5,784 | $360,662 | $256,152 | $104,510 |

| 2014 | $4,444 | $353,598 | $251,135 | $102,463 |

Source: Public Records

Map

Nearby Homes

- 3806 E Arabella St

- 3711 E Hedda St

- 6062 Pimenta Ave

- 6034 Pepperwood Ave

- 6142 Oliva Ave

- 4342 Arabella St

- 5944 Blackthorne Ave

- 5672 Pepperwood Ave

- 5602 Verdura Ave

- 5839 Faculty Ave

- 6107 Faculty Ave

- 4814 Hedda St

- 17820 Lakewood Blvd Unit 30

- 17820 Lakewood Blvd Unit 3

- 6324 Johnson Ave

- 3340 E Poppy St

- 6023 Whitewood Ave

- 9112 Cedar St

- 9253 Rose St

- 5503 Sunfield Ave

- 5949 Hayter Ave

- 5939 Hayter Ave

- 5955 Hayter Ave

- 5933 Hayter Ave

- 5948 Coke Ave

- 5944 Coke Ave

- 5954 Coke Ave

- 5938 Coke Ave

- 5959 Hayter Ave

- 5929 Hayter Ave

- 5942 Hayter Ave

- 5960 Coke Ave

- 5948 Hayter Ave

- 5952 Hayter Ave

- 5934 Coke Ave

- 5932 Hayter Ave

- 5964 Coke Ave

- 5965 Hayter Ave

- 5923 Hayter Ave

- 5958 Hayter Ave