5958 Shaw Lopez Row San Diego, CA 92121

Sorrento Valley NeighborhoodEstimated Value: $1,789,934 - $1,953,000

4

Beds

3

Baths

2,732

Sq Ft

$690/Sq Ft

Est. Value

About This Home

This home is located at 5958 Shaw Lopez Row, San Diego, CA 92121 and is currently estimated at $1,884,484, approximately $689 per square foot. 5958 Shaw Lopez Row is a home located in San Diego County with nearby schools including Hickman Elementary School, Challenger Middle School, and Mira Mesa High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 2, 2025

Sold by

Friedman Miron and Friedman Arlene

Bought by

Miron And Arlene Friedman Trust and Friedman

Current Estimated Value

Purchase Details

Closed on

Feb 5, 2016

Sold by

Friedman Ivor and Friedman Edith

Bought by

Ivor Friedman & Edith Friedman Living Tr and Friedman Edith

Purchase Details

Closed on

Oct 19, 2015

Sold by

Friedman Edith A

Bought by

Friedman Ivor

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$658,235

Interest Rate

3.76%

Mortgage Type

New Conventional

Purchase Details

Closed on

Oct 14, 2015

Sold by

Sorrento Valley 23 Llc

Bought by

Friedman Ivor

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$658,235

Interest Rate

3.76%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 24, 2013

Sold by

Environmental Dwellings Inc

Bought by

Sorrento Valley 23 Llc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Miron And Arlene Friedman Trust | -- | None Listed On Document | |

| Friedman Miron | -- | None Listed On Document | |

| Ivor Friedman & Edith Friedman Living Tr | -- | None Available | |

| Friedman Ivor | -- | None Available | |

| Friedman Ivor | -- | Fidelity Title | |

| Friedman Ivor | $908,500 | Fidelity National Title Nb | |

| Sorrento Valley 23 Llc | $960,000 | Chicago Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Friedman Ivor | $658,235 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $12,990 | $1,075,158 | $414,325 | $660,833 |

| 2024 | $12,990 | $1,054,077 | $406,201 | $647,876 |

| 2023 | $12,700 | $1,720,000 | $1,083,000 | $637,000 |

| 2022 | $12,442 | $1,013,148 | $390,429 | $622,719 |

| 2021 | $12,352 | $993,283 | $382,774 | $610,509 |

| 2020 | $12,202 | $983,099 | $378,850 | $604,249 |

| 2019 | $11,984 | $963,823 | $371,422 | $592,401 |

| 2018 | $11,206 | $944,926 | $364,140 | $580,786 |

| 2017 | $10,936 | $926,399 | $357,000 | $569,399 |

| 2016 | $10,764 | $908,235 | $350,000 | $558,235 |

| 2015 | $2,742 | $225,413 | $225,413 | $0 |

| 2014 | $2,700 | $220,998 | $220,998 | $0 |

Source: Public Records

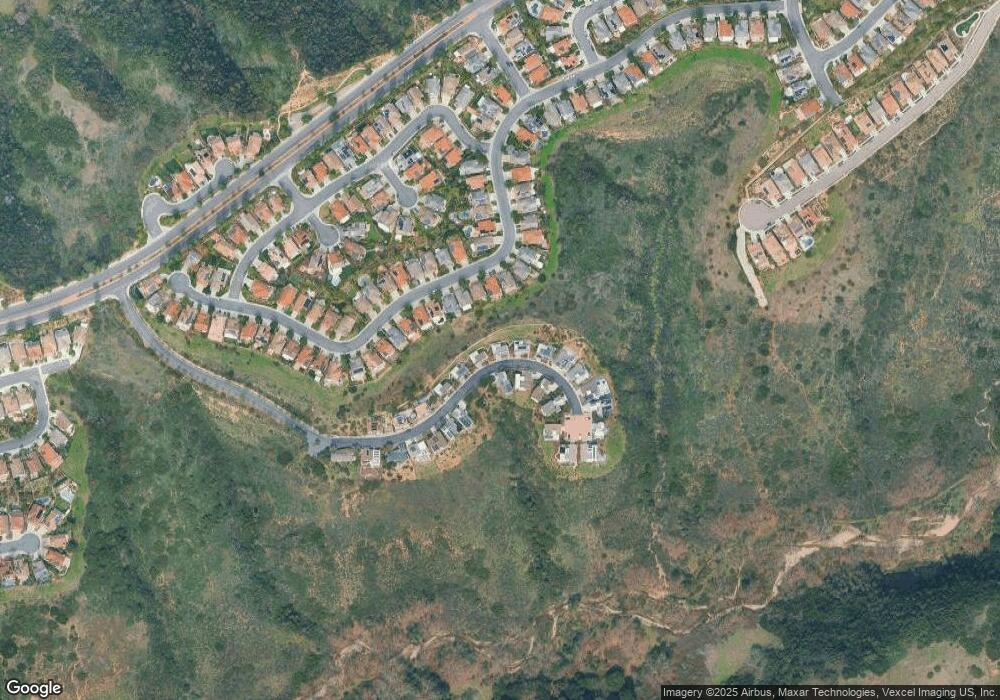

Map

Nearby Homes

- 6181 Sunset Crest Way

- 0 Magee Rd Unit IG25221588

- 7220 Calle Cristobal Unit 12

- 11265 Caminito Aclara

- 7360 Calle Cristobal Unit 108

- 11318 Caminito Rodar

- 11324 Caminito Rodar

- 11311 Caminito Rodar

- 7212 Canyon Hill Way

- 7349 Calle Cristobal Unit 181

- 11026 Eka Way

- 7387 New Salem St

- 10774 Dabney Dr Unit 20

- 11050 Solstice Way

- 10668 Dabney Dr Unit 125

- 0 Grand Del Mar Place Unit VU 8-4-9

- 10416 Adamson Way

- Plan 3 at

- Plan 2 at

- 14006 Lemurine Way

- 5962 Shaw Lopez Row

- 5954 Shaw Lopez Row

- 5947 Shaw Lopez Row

- 5959 Shaw Lopez Row

- 5950 Shaw Lopez Row

- 5939 Seacrest View Rd

- 5935 Seacrest View Rd

- 5943 Seacrest View Rd

- 5966 Shaw Lopez Row

- 5931 Seacrest View Rd

- 5947 Seacrest View Rd

- 5967 Shaw Lopez Row

- 5970 Shaw Lopez Row

- 5927 Seacrest View Rd

- 5944 Shaw Lopez Row

- 5951 Seacrest View Rd

- 5923 Seacrest View Rd

- 5941 Shaw Lopez Row

- 5975 Shaw Lopez Row

- 5919 Seacrest View Rd