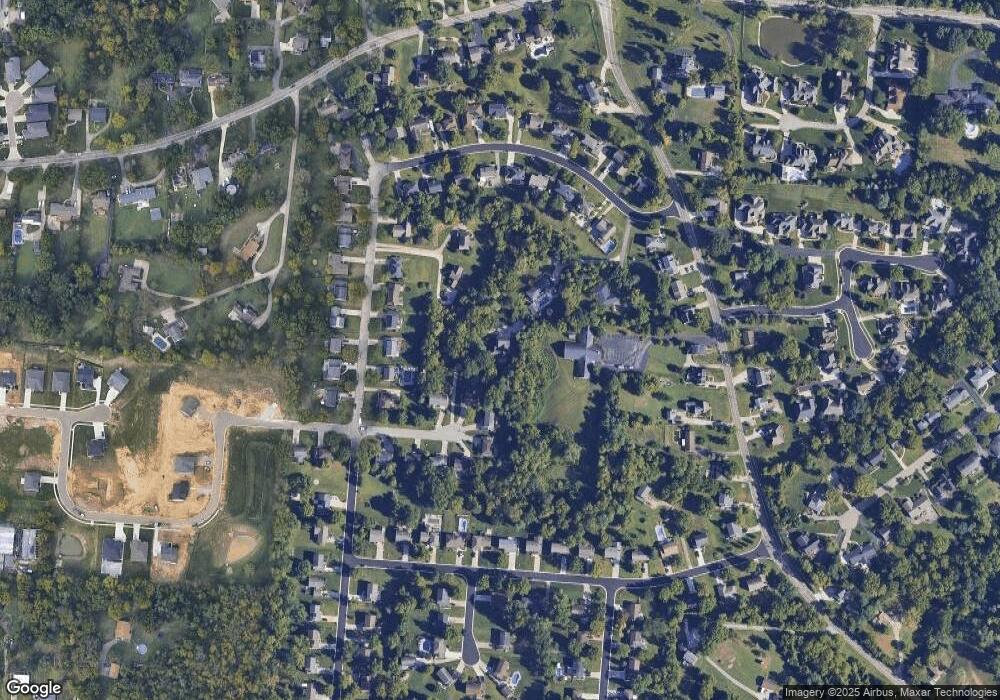

5982 Hickorytree Ct Cincinnati, OH 45233

Cotillion Village NeighborhoodEstimated Value: $482,145 - $571,000

5

Beds

4

Baths

2,592

Sq Ft

$200/Sq Ft

Est. Value

About This Home

This home is located at 5982 Hickorytree Ct, Cincinnati, OH 45233 and is currently estimated at $519,036, approximately $200 per square foot. 5982 Hickorytree Ct is a home located in Hamilton County with nearby schools including John Foster Dulles Elementary School, Rapid Run Middle School, and Oak Hills High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 15, 2010

Sold by

Kelly Kevin P

Bought by

Kelly Jeana C

Current Estimated Value

Purchase Details

Closed on

Sep 19, 2001

Sold by

Pennington Judy A

Bought by

Kelly Kevin P and Kelly Jeana C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$160,000

Outstanding Balance

$59,478

Interest Rate

6.97%

Estimated Equity

$459,558

Purchase Details

Closed on

Dec 2, 1998

Sold by

Jansen Mark H

Bought by

Jansen Cynthia M

Purchase Details

Closed on

Jul 9, 1994

Sold by

Rhodes Dusty

Bought by

Jansen Mark H

Purchase Details

Closed on

Aug 16, 1990

Sold by

Maloney Michael J

Bought by

Jansen Mark H and Jansen Jeffrey C

Purchase Details

Closed on

Nov 16, 1989

Sold by

Wilke Wayne F

Bought by

Jansen Mark H and Brinck Joseph

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kelly Jeana C | -- | Attorney | |

| Kelly Kevin P | -- | Vintage Title Agency Inc | |

| Pennington Judy A | $220,000 | Vintage Title Agency Inc | |

| Jansen Cynthia M | -- | -- | |

| Jansen Mark H | -- | -- | |

| Jansen Mark H | $350 | -- | |

| Jansen Mark H | $1,777 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Kelly Kevin P | $160,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,851 | $132,262 | $25,361 | $106,901 |

| 2023 | $7,682 | $132,262 | $25,361 | $106,901 |

| 2022 | $7,286 | $111,584 | $23,527 | $88,057 |

| 2021 | $7,136 | $111,584 | $23,527 | $88,057 |

| 2020 | $7,237 | $111,584 | $23,527 | $88,057 |

| 2019 | $6,940 | $96,195 | $20,283 | $75,912 |

| 2018 | $6,947 | $96,195 | $20,283 | $75,912 |

| 2017 | $6,270 | $96,195 | $20,283 | $75,912 |

| 2016 | $6,427 | $98,774 | $20,332 | $78,442 |

| 2015 | $6,435 | $98,774 | $20,332 | $78,442 |

| 2014 | $6,442 | $98,774 | $20,332 | $78,442 |

| 2013 | $6,518 | $106,208 | $21,861 | $84,347 |

Source: Public Records

Map

Nearby Homes

- 6009 Cleves Warsaw Pike

- 1287 Heather Ridge

- 1696 Devils Backbone Rd Unit 2

- 835 Neeb Rd

- 1342 Wexford Ln

- 6278 Gardenlake Ct

- 1259 Wexford Ln

- 1006 Pineknot Dr

- 760 Stonebridge Dr

- 5664 Rapid Run Rd

- 5789 Juvene Way

- 5679 Hollowview Ct

- 5773 Fourson Dr

- 5749 Beech Grove Ln

- 625 Conina Dr

- 5528 Cove Ct

- 6551 Cleves Warsaw Pike

- 5600 Antoninus Dr

- 6090 Muddy Creek Rd

- 5449 Dengail Dr

- 5978 Hickorytree Ct

- 1236 Hickorylake Dr

- 5972 Hickorytree Ct

- 5986 Hickorytree Ct

- 1292 Hickorylake Dr

- 1222 Hickorylake Dr

- 1226 Hickorylake Dr

- 1191 Devils Backbone Rd

- 1218 Hickorylake Dr

- 1230 Hickorylake Dr

- 1238 Hickorylake Dr

- 1234 Hickorylake Dr

- 1214 Hickorylake Dr

- 5973 Hickorytree Ct

- 1294 Hickorylake Dr

- 5979 Hickorytree Ct

- 5985 Hickorytree Ct

- 1240 Hickorylake Dr

- 5991 Hickorytree Ct

- 1290 Hickorylake Dr

Your Personal Tour Guide

Ask me questions while you tour the home.