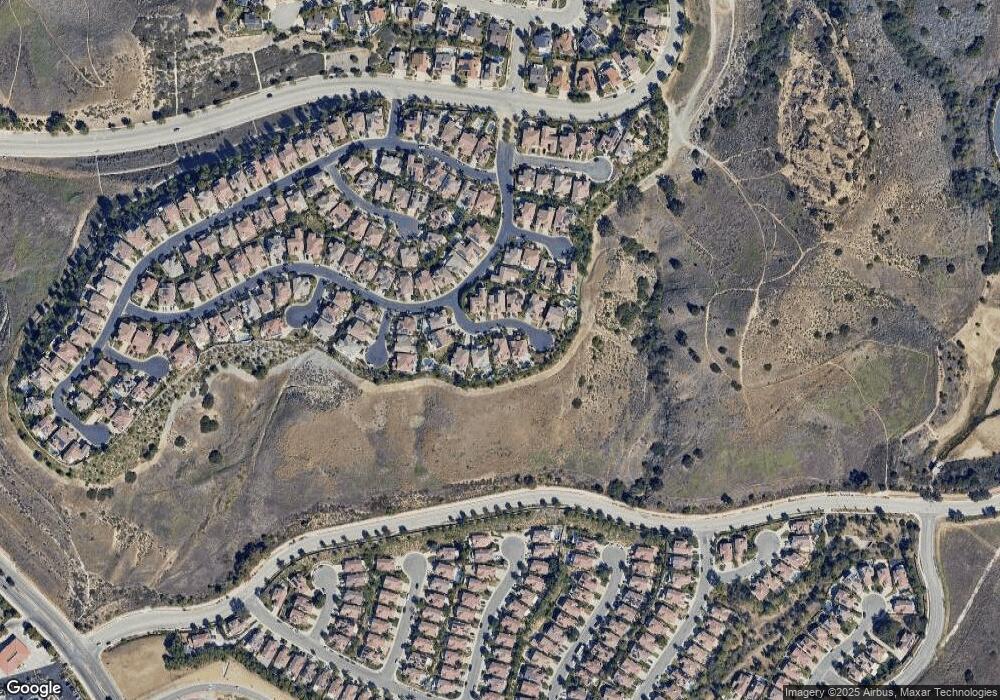

5984 Maidu Ct Simi Valley, CA 93063

East Simi Valley NeighborhoodEstimated Value: $1,375,000 - $1,604,000

4

Beds

5

Baths

4,091

Sq Ft

$362/Sq Ft

Est. Value

About This Home

This home is located at 5984 Maidu Ct, Simi Valley, CA 93063 and is currently estimated at $1,482,887, approximately $362 per square foot. 5984 Maidu Ct is a home located in Ventura County with nearby schools including White Oak Elementary School, Valley View Middle School, and Simi Valley High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 7, 2007

Sold by

Rogers Ralph W and Rogers Brenda L

Bought by

Rogers Ralph W and Rogers Brenda L

Current Estimated Value

Purchase Details

Closed on

Dec 7, 2001

Sold by

Rogers Ralph W and Rogers Brenda L

Bought by

Rogers Ralph W and Rogers Brenda L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$560,000

Outstanding Balance

$211,505

Interest Rate

6.12%

Estimated Equity

$1,271,382

Purchase Details

Closed on

Mar 13, 2000

Sold by

Rogers Ralph W and Rogers Brenda W

Bought by

Rogers Ralph W and Rogers Brenda L

Purchase Details

Closed on

Jun 21, 1999

Sold by

Trimark Pacific Indian Hills Llc

Bought by

Rogers Ralph W and Rogers Brenda L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$441,200

Interest Rate

7.12%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Rogers Ralph W | -- | None Available | |

| Rogers Ralph W | -- | -- | |

| Rogers Ralph W | -- | -- | |

| Rogers Ralph W | $552,000 | Lawyers Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Rogers Ralph W | $560,000 | |

| Closed | Rogers Ralph W | $441,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $10,539 | $908,503 | $339,048 | $569,455 |

| 2024 | $10,539 | $890,690 | $332,400 | $558,290 |

| 2023 | $9,914 | $873,226 | $325,882 | $547,344 |

| 2022 | $9,910 | $856,104 | $319,492 | $536,612 |

| 2021 | $9,870 | $839,318 | $313,227 | $526,091 |

| 2020 | $9,688 | $830,714 | $310,016 | $520,698 |

| 2019 | $9,253 | $814,427 | $303,938 | $510,489 |

| 2018 | $9,197 | $798,459 | $297,979 | $500,480 |

| 2017 | $9,009 | $782,804 | $292,137 | $490,667 |

| 2016 | $8,613 | $767,456 | $286,409 | $481,047 |

| 2015 | $8,449 | $755,929 | $282,107 | $473,822 |

| 2014 | $8,351 | $741,124 | $276,582 | $464,542 |

Source: Public Records

Map

Nearby Homes

- 6125 Grapevine Ct

- 6004 Rothko Ln

- 2367 Saint Clair Ave

- 2450 Stow St

- 2448 Stow St

- 2331 Welcome Ct

- 6417 Keystone St

- 2125 Yosemite Ave

- 5635 Evening Sky Dr

- 3286 Indian Creek Place

- 2224 Alscot Ave

- 2239 Homewood Ave

- 0 American Cut Off (Apn 649-0-020-010) Rd Unit SR25060657

- 28 Chivo

- 62 Las Lljas Canyon Rd

- 125 Fern Dr

- 25 Chivo

- 26 Chivo

- 27 Chivo

- 5421 Moonshadow St

- 5976 Maidu Ct

- 5992 Maidu Ct

- 5968 Maidu Ct

- 5983 Maidu Ct

- 5989 Maidu Ct

- 5957 Maidu Ct

- 5991 Maidu Ct

- 5960 Maidu Ct

- 5997 Maidu Ct

- 5952 Maidu Ct

- 5934 Indian Terrace Dr

- 5968 Yana Ct

- 2774 Karoc Ct

- 5925 Indian Terrace Dr

- 2790 Karoc Ct

- 5960 Yana Ct

- 5952 Yana Ct

- 5929 Indian Terrace Dr

- 5913 Indian Terrace Dr

- 2758 Karoc Ct