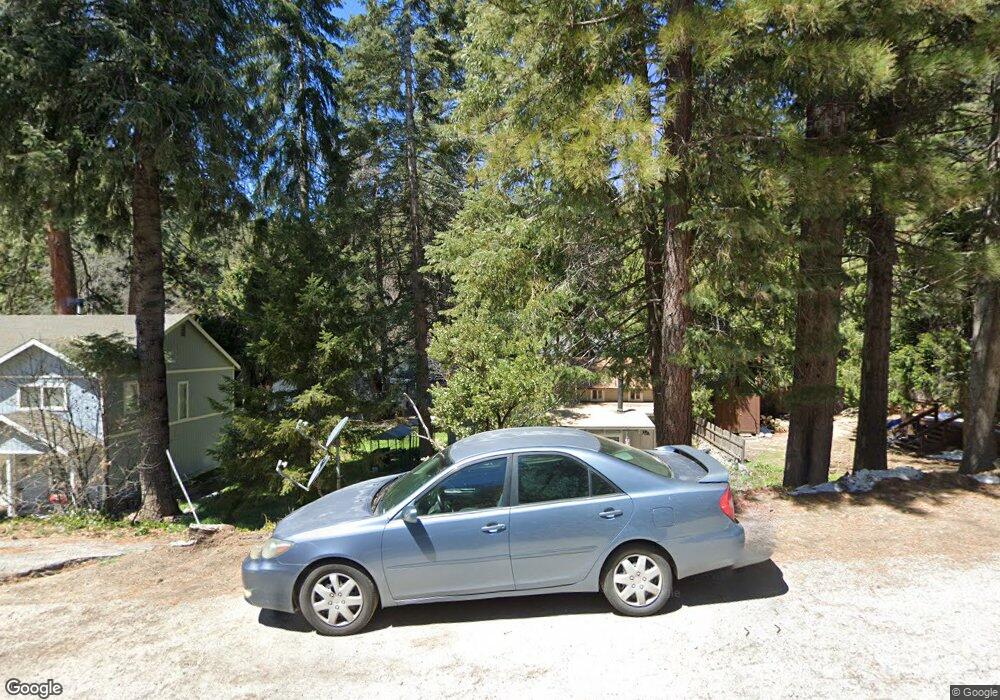

5994 Mountain Home Canyon Rd Angelus Oaks, CA 92305

Estimated Value: $245,000 - $321,000

2

Beds

1

Bath

950

Sq Ft

$295/Sq Ft

Est. Value

About This Home

This home is located at 5994 Mountain Home Canyon Rd, Angelus Oaks, CA 92305 and is currently estimated at $280,422, approximately $295 per square foot. 5994 Mountain Home Canyon Rd is a home located in San Bernardino County with nearby schools including Big Bear Middle School and Big Bear High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 22, 2011

Sold by

Fcdb Snpwl Reo Llc

Bought by

Goss James Franklin

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$42,800

Interest Rate

4.71%

Mortgage Type

New Conventional

Purchase Details

Closed on

Aug 20, 2010

Sold by

Sherman Ina Marie

Bought by

Fcdb Snpwl Reo Llc

Purchase Details

Closed on

Aug 22, 2000

Sold by

Mestre Louise J

Bought by

Sherman Ina Marie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$98,190

Interest Rate

7.9%

Mortgage Type

FHA

Purchase Details

Closed on

Sep 19, 1997

Sold by

Mestre Rene

Bought by

Mestre Louise J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$54,450

Interest Rate

7.54%

Mortgage Type

Seller Take Back

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Goss James Franklin | $53,500 | Chicago Title Company | |

| Fcdb Snpwl Reo Llc | $118,000 | Accommodation | |

| Sherman Ina Marie | $99,000 | American Title Co | |

| Mestre Louise J | -- | Commonwealth Land Title Co | |

| Mestre Louise J | $60,500 | Commonwealth Land Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Goss James Franklin | $42,800 | |

| Previous Owner | Sherman Ina Marie | $98,190 | |

| Previous Owner | Mestre Louise J | $54,450 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $971 | $68,542 | $13,709 | $54,833 |

| 2024 | $971 | $67,198 | $13,440 | $53,758 |

| 2023 | $958 | $65,880 | $13,176 | $52,704 |

| 2022 | $939 | $64,589 | $12,918 | $51,671 |

| 2021 | $1,529 | $63,323 | $12,665 | $50,658 |

| 2020 | $2,537 | $62,674 | $12,535 | $50,139 |

| 2019 | $918 | $61,445 | $12,289 | $49,156 |

| 2018 | $738 | $60,240 | $12,048 | $48,192 |

| 2017 | $724 | $59,059 | $11,812 | $47,247 |

| 2016 | $1,162 | $57,901 | $11,580 | $46,321 |

| 2015 | $706 | $57,031 | $11,406 | $45,625 |

| 2014 | $694 | $55,914 | $11,183 | $44,731 |

Source: Public Records

Map

Nearby Homes

- 6020 Lake Dr

- 0 Robin Oak Dr Unit IG25161466

- 6031 Tripp Ln

- 6005 Marie's Alley

- 37590 Live Oak St

- 37751 Foxfield Rd

- 6070 Manzanita Ct

- 37667 Live Oak St

- 6287 Spruce Ave

- 7 Oak Ct Unit 78

- 6204 Spruce Ave

- 6301 Cedar Ave

- 6307 Cedar Ct

- 6314 Sugar Pines Cir

- 6392 Sugar Pines Cir

- 6302 Spruce Ave

- 0 Cedar Ct

- 6429 Cedar Ave

- 6461 Cedar Ave

- 6011 Mountain Home Creek Rd

- 5994 Mtn Home Cyn Rd

- 5994 Mountain Home Creek Rd

- 5994 Mountain Home Creek Rd

- 6004 Mountain Home Creek Rd

- 5973 Lake Dr

- 5983 Lake Dr

- 5993 Lake Dr

- 0 Lake Dr Unit E11044625

- 0 Lake Dr Unit E11156231

- 5910 Lake Dr

- 37590 Lake Dr

- 5974 Mt Home Canyon Rd

- 5951 Lake Dr

- 6003 Lake Dr

- 5982 Lake Dr

- 5970 Lake Dr

- 5941 Lake Dr

- 6011 Lake Dr

- 5962 Lake Dr

- 5571 Mountain Home Creek Rd