6 Cogswells Grant Unit 6 Fairfield, OH 45014

Estimated Value: $218,000 - $272,000

2

Beds

4

Baths

1,860

Sq Ft

$135/Sq Ft

Est. Value

About This Home

This home is located at 6 Cogswells Grant Unit 6, Fairfield, OH 45014 and is currently estimated at $251,516, approximately $135 per square foot. 6 Cogswells Grant Unit 6 is a home located in Butler County with nearby schools including Compass Elementary School, Creekside Middle School, and Fairfield Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 8, 2020

Sold by

Kendall Kumpf

Bought by

Kumpf Kendall and Bowers Scarlett K

Current Estimated Value

Purchase Details

Closed on

Oct 7, 2020

Sold by

Fowler Frances C

Bought by

Kumpf Kendall

Purchase Details

Closed on

Apr 26, 2004

Sold by

Besl Carol A

Bought by

Fowler Frances C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$114,400

Interest Rate

5.5%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Mar 31, 1999

Sold by

Besl Carol A

Bought by

Besl Carol A and The Carol A Besl Family Trust

Purchase Details

Closed on

Feb 1, 1992

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kumpf Kendall | -- | Yonas & Rink Llc | |

| Kumpf Kendall | -- | American Homeland Title | |

| Fowler Frances C | $143,000 | -- | |

| Besl Carol A | -- | -- | |

| -- | $133,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Fowler Frances C | $114,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,710 | $73,580 | $9,800 | $63,780 |

| 2023 | $2,697 | $73,580 | $9,800 | $63,780 |

| 2022 | $2,349 | $49,070 | $9,800 | $39,270 |

| 2021 | $2,026 | $48,300 | $9,800 | $38,500 |

| 2020 | $1,725 | $48,300 | $9,800 | $38,500 |

| 2019 | $1,657 | $41,580 | $9,800 | $31,780 |

| 2018 | $1,627 | $41,580 | $9,800 | $31,780 |

| 2017 | $1,643 | $41,580 | $9,800 | $31,780 |

| 2016 | $2,121 | $49,100 | $9,800 | $39,300 |

| 2015 | $2,020 | $49,100 | $9,800 | $39,300 |

| 2014 | $2,660 | $49,100 | $9,800 | $39,300 |

| 2013 | $2,660 | $44,730 | $9,800 | $34,930 |

Source: Public Records

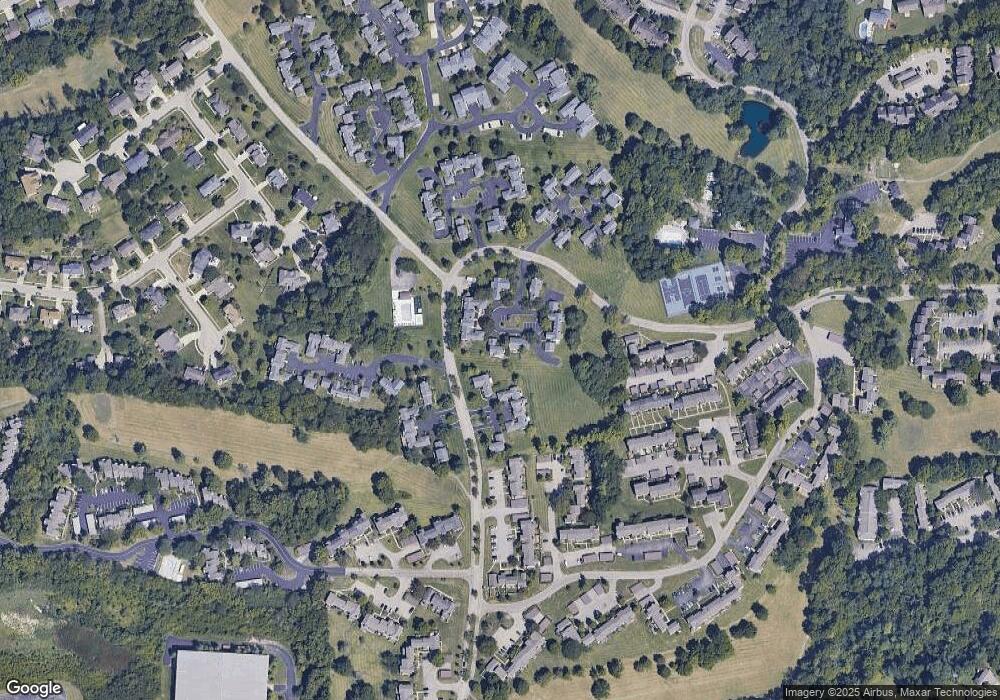

Map

Nearby Homes

- 4 Old Duxbury Ct

- 20 N Applewood Ct Unit 151

- 74 Applewood Dr

- 7 Darby Ct Unit 67

- 48 Applewood Dr Unit 48

- 40 Applewood Dr Unit 40

- 58 Twin Lakes Dr

- 62 Twin Lakes Dr

- 62 Ironwood Ct

- 4 Shoal Meadows Ct

- 15 Overlook Ct

- 4351 Whitmore Ln

- 3404 Woodside Dr

- 120 Twin Lakes Dr

- 159 Twin Lakes Dr

- 3032 Woodside Dr

- 5985 Flaig Dr

- 5890 Kay Dr

- 5875 N Turtle Creek Dr

- 3323 Devonian Dr

- 6 Cogswell's Grant

- 7 Cogswell's Grant

- 6 E Stonington Dr Unit 18

- 5 Cogswells Grant Unit 5

- 4 Cogswells Grant

- 3 Cogswells Grant Unit 3

- 3 Cogswell's Grant

- 5 E Stonington Dr

- 2 Cogswell's Grant

- 2 Cogswells Grant

- 4 E Stonington Dr

- 8 Cogswells Grant Unit 8

- 8 Cogswell's Grant

- 3 E Stonington Dr Unit 15

- 9 Cogswells Grant Unit 9

- 10 Cogswells Grant

- 10 Cogswell's Grant

- 1 Cogswells Grant Unit 1

- 1 Cogswell's Grant

- 11 Cogswells Grant