6 N Close Unit 6 Moorestown, NJ 08057

Estimated Value: $319,000 - $416,000

2

Beds

2

Baths

1,236

Sq Ft

$281/Sq Ft

Est. Value

About This Home

This home is located at 6 N Close Unit 6, Moorestown, NJ 08057 and is currently estimated at $347,623, approximately $281 per square foot. 6 N Close Unit 6 is a home located in Burlington County with nearby schools including Mary E. Roberts Elementary School, Moorestown Upper Elementary School, and William Allen Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 20, 2022

Sold by

Hartman Frances J

Bought by

Faxon Joy M and Foley Michelle L

Current Estimated Value

Purchase Details

Closed on

Aug 30, 2016

Sold by

Warner Richard M and Warner Katherine E

Bought by

Hartman Francis J and Hartman Barbara J

Purchase Details

Closed on

Sep 26, 2012

Sold by

Follin Donald F and Follin Susan H

Bought by

Warner Richard W and Warner Katherine E

Purchase Details

Closed on

Jun 25, 1997

Sold by

Simpkins Frederick H and Simpkins Mary S

Bought by

Cardwell John R and Cardwell Helen H

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Faxon Joy M | $325,000 | -- | |

| Hartman Francis J | $210,000 | -- | |

| Warner Richard W | $165,000 | Infinity Title Agency Inc | |

| Cardwell John R | $113,500 | Surety Title Corporation |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,556 | $160,600 | $90,000 | $70,600 |

| 2024 | $4,418 | $160,600 | $90,000 | $70,600 |

| 2023 | $4,418 | $160,600 | $90,000 | $70,600 |

| 2022 | $4,373 | $160,600 | $90,000 | $70,600 |

| 2021 | $4,315 | $160,600 | $90,000 | $70,600 |

| 2020 | $4,288 | $160,600 | $90,000 | $70,600 |

| 2019 | $4,213 | $160,600 | $90,000 | $70,600 |

| 2018 | $4,099 | $160,600 | $90,000 | $70,600 |

| 2017 | $4,127 | $160,600 | $90,000 | $70,600 |

| 2016 | $4,119 | $160,600 | $90,000 | $70,600 |

| 2015 | $4,070 | $160,600 | $90,000 | $70,600 |

| 2014 | $3,864 | $160,600 | $90,000 | $70,600 |

Source: Public Records

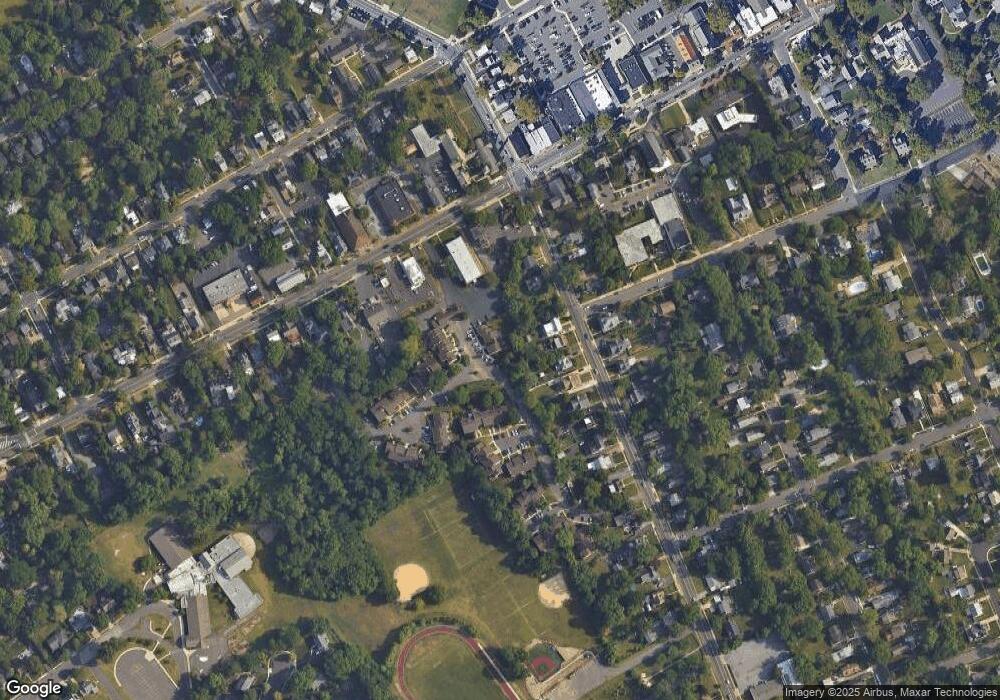

Map

Nearby Homes

- 10 N Close Unit 10N

- 8 N Close Unit 8

- 4 N Close

- 2 N Close Unit 2

- 11 Close S

- 11 N Close Unit 11

- 9 N Close

- 122 S Church St

- 7 N Close

- 120 S Church St

- 5 N Close Unit 5

- 206 S Church St

- 1 W Close Unit 1

- 110 S Church St

- 5 W Close

- 202 S Church St

- 1 E Close Unit 1

- 3 E Close Unit 3

- 5 E Close Unit 5

- 7 W Close Unit 7