6 Westwinds Dr Unit 6 Conneaut, OH 44030

Estimated Value: $139,060 - $195,000

2

Beds

2

Baths

1,114

Sq Ft

$156/Sq Ft

Est. Value

About This Home

This home is located at 6 Westwinds Dr Unit 6, Conneaut, OH 44030 and is currently estimated at $174,265, approximately $156 per square foot. 6 Westwinds Dr Unit 6 is a home located in Ashtabula County with nearby schools including Lakeshore Primary Elementary School, Gateway Elementary School, and Conneaut Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 29, 2019

Sold by

Modern Lawn Care Llc

Bought by

Sylvester Steven

Current Estimated Value

Purchase Details

Closed on

Nov 9, 2010

Sold by

Sylvester Steven

Bought by

Modern Lawn Care Llc

Purchase Details

Closed on

Aug 24, 2009

Sold by

Justice Betty M

Bought by

Sylvester Steven

Purchase Details

Closed on

Jan 13, 2005

Sold by

Westwinds Condominiums Inc

Bought by

Justice Betty M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$30,000

Interest Rate

5.77%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sylvester Steven | -- | None Available | |

| Modern Lawn Care Llc | -- | Attorney | |

| Sylvester Steven | $86,000 | Franklin Blair Title Agency | |

| Justice Betty M | $120,000 | Chicago Title Agency |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Justice Betty M | $30,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,766 | $37,810 | $6,830 | $30,980 |

| 2023 | $1,756 | $37,810 | $6,830 | $30,980 |

| 2022 | $1,910 | $36,230 | $5,250 | $30,980 |

| 2021 | $1,943 | $36,230 | $5,250 | $30,980 |

| 2020 | $1,942 | $36,230 | $5,250 | $30,980 |

| 2019 | $2,042 | $37,420 | $5,600 | $31,820 |

| 2018 | $1,947 | $37,420 | $5,600 | $31,820 |

| 2017 | $1,943 | $37,420 | $5,600 | $31,820 |

| 2016 | $1,785 | $37,420 | $5,600 | $31,820 |

| 2015 | $1,803 | $37,420 | $5,600 | $31,820 |

| 2014 | $1,588 | $37,420 | $5,600 | $31,820 |

| 2013 | $1,452 | $35,210 | $5,250 | $29,960 |

Source: Public Records

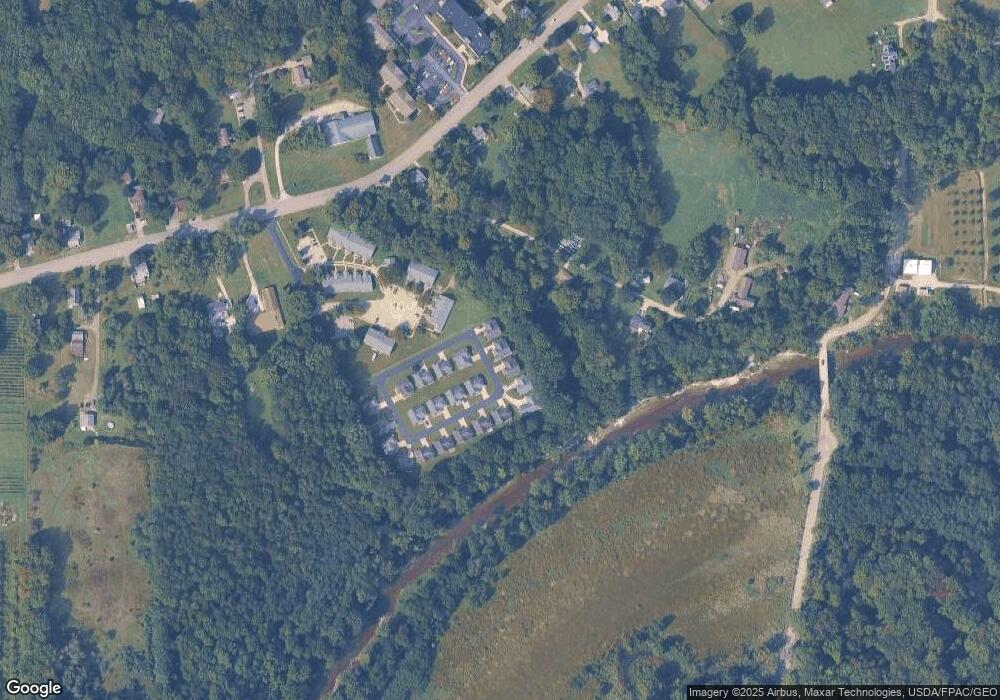

Map

Nearby Homes

- 40 Oakland Blvd

- 531 W Main Rd

- 220 Daniels Ave

- 0 Creek Rd Unit 5146859

- 202 W Main Rd Unit 49

- 202 W Main Rd Unit Lot 150

- 202 W Main Rd Unit 33

- 202 W Main Rd Unit 16

- 210 W Main Rd

- 4377 E Center St

- 106 Margor Dr

- 1300 Lake Rd

- 136 W Under Ridge Rd

- 57 Eaton Dr

- 2663 Lake Rd

- 855 Spring St Unit S9

- VL Center Rd

- 1145 Lake Rd

- 1150 Lake Rd

- 4017 Lake Rd Unit 17

- 5 Westwinds Dr Unit 5

- 7 Westwinds Dr Unit 7

- 8 Westwinds Dr Unit 8

- 4 Westwinds Dr

- 22 Westwinds Dr Unit 22

- 9 Westwinds Dr Unit 9

- 3 Westwinds Dr Unit 3

- 21 Westwinds Dr

- 10 Westwinds Dr Unit 10

- 11 Westwinds Dr Unit 11

- 2 Westwinds Dr Unit 2

- 20 Westwinds Dr

- 20 W Wind Dr

- 331 Dibble Rd

- 12 Westwinds Dr Unit 12

- 12 Westwinds Dr

- 1 Westwinds Dr Unit 1

- 19 Westwinds Dr Unit 19

- 13 Westwinds Dr

- 14 Westwinds Dr