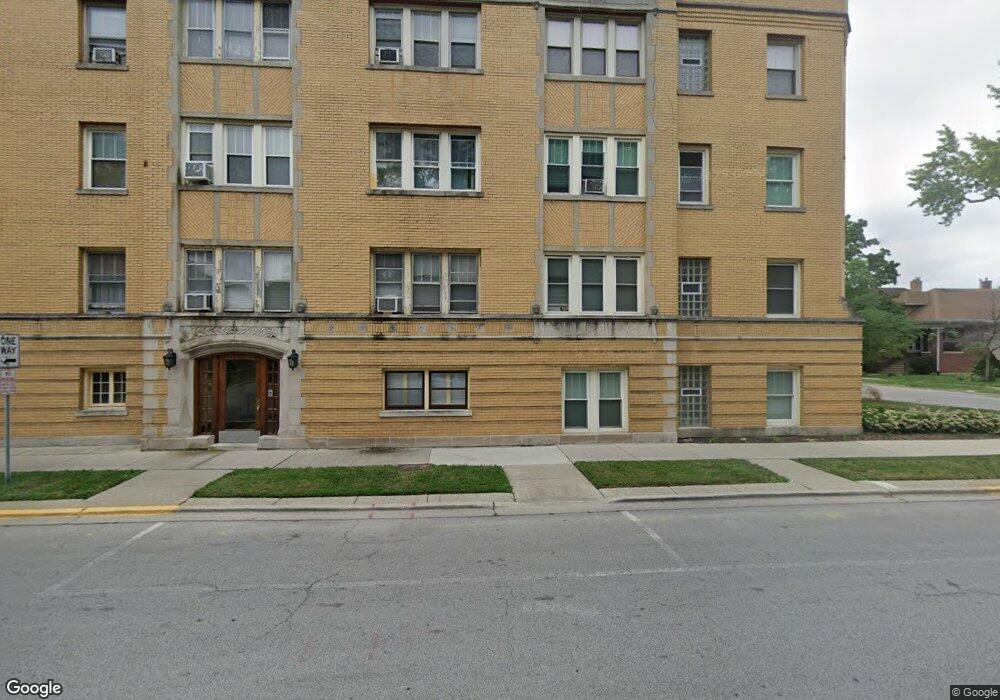

600 Elgin Ave Unit 1B Forest Park, IL 60130

Estimated Value: $152,000 - $173,000

2

Beds

1

Bath

925

Sq Ft

$173/Sq Ft

Est. Value

About This Home

This home is located at 600 Elgin Ave Unit 1B, Forest Park, IL 60130 and is currently estimated at $160,434, approximately $173 per square foot. 600 Elgin Ave Unit 1B is a home located in Cook County with nearby schools including Garfield Elementary School, Field Stevenson Elementary School, and Forest Park Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 26, 2021

Sold by

Largenterprises Llc

Bought by

Greene Janaya G

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$134,830

Outstanding Balance

$124,188

Interest Rate

3.37%

Mortgage Type

New Conventional

Estimated Equity

$36,246

Purchase Details

Closed on

Apr 18, 2017

Sold by

Brock David A and Brock Jenny M

Bought by

Largenterprises Llc

Purchase Details

Closed on

May 28, 2008

Sold by

Puscheck Coe Jean M

Bought by

Brock David A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$129,580

Interest Rate

6.04%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

May 23, 2001

Sold by

Baker Wayne K

Bought by

Puscheck Jean M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$99,910

Interest Rate

6.87%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Greene Janaya G | $139,000 | Prairie Title | |

| Largenterprises Llc | $73,000 | Prairie Title | |

| Brock David A | $136,500 | Prairie Title | |

| Puscheck Jean M | $97,000 | Chicago Title Insurance Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Greene Janaya G | $134,830 | |

| Previous Owner | Brock David A | $129,580 | |

| Previous Owner | Puscheck Jean M | $99,910 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,067 | $10,198 | $657 | $9,541 |

| 2023 | $738 | $10,198 | $657 | $9,541 |

| 2022 | $738 | $5,482 | $444 | $5,038 |

| 2021 | $1,866 | $5,480 | $443 | $5,037 |

| 2020 | $1,818 | $5,480 | $443 | $5,037 |

| 2019 | $2,088 | $5,931 | $410 | $5,521 |

| 2018 | $2,045 | $5,931 | $410 | $5,521 |

| 2017 | $2,000 | $5,931 | $410 | $5,521 |

| 2016 | $2,428 | $6,774 | $377 | $6,397 |

| 2015 | $2,389 | $6,774 | $377 | $6,397 |

| 2014 | $2,344 | $6,774 | $377 | $6,397 |

| 2013 | $2,200 | $6,802 | $377 | $6,425 |

Source: Public Records

Map

Nearby Homes

- 7212 Jackson Blvd Unit 3E

- 617 Harlem Ave

- 727 S Maple Ave Unit 106

- 7203 Adams St

- 500 Circle Ave

- 428 Elgin Ave

- 442 Hannah Ave

- 820 Elgin Ave

- 7243 Madison St Unit 409

- 830 Elgin Ave

- 836 Circle Ave

- 839 S Harlem Ave

- 1041 Susan Collins Ln Unit 402

- 1041 Susan Collins Ln Unit 203

- 500 Beloit Ave Unit A2

- 315 Marengo Ave Unit 2H

- 426 Wisconsin Ave Unit 3S

- 424 Wisconsin Ave Unit 3N

- 320 Circle Ave Unit 308

- 1022 Alexander Ln

- 600 Elgin Ave Unit P10

- 7210 Jackson Blvd Unit F2

- 600 Elgin Ave Unit 2A

- 7210 Jackson Blvd Unit P20

- 7210 Jackson Blvd Unit P8

- 600 Elgin Ave Unit B3

- 602 Elgin Ave Unit A1

- 600 Elgin Ave Unit GB

- 600 Elgin Ave Unit P16

- 602 Elgin Ave Unit P15

- 7210 Jackson Blvd Unit P14

- 600 Elgin Ave Unit P1

- 602 Elgin Ave Unit A3

- 600 Elgin Ave Unit B2

- 7210 Jackson Blvd Unit F1

- 600 Elgin Ave Unit B1

- 602 Elgin Ave Unit P3

- 600 Elgin Ave Unit P4

- 7210 Jackson Blvd Unit P21

- 602 Elgin Ave Unit P9