6005 Castlegate Dr W Unit B12 Castle Rock, CO 80108

Estimated Value: $303,000 - $326,000

2

Beds

1

Bath

972

Sq Ft

$321/Sq Ft

Est. Value

About This Home

This home is located at 6005 Castlegate Dr W Unit B12, Castle Rock, CO 80108 and is currently estimated at $311,588, approximately $320 per square foot. 6005 Castlegate Dr W Unit B12 is a home located in Douglas County with nearby schools including Sedalia Elementary School, Castle Rock Middle School, and Castle View High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 8, 2017

Sold by

Taber Lynn

Bought by

Albuquerque Sheree

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$218,250

Outstanding Balance

$182,352

Interest Rate

3.92%

Mortgage Type

New Conventional

Estimated Equity

$129,236

Purchase Details

Closed on

Sep 22, 2004

Sold by

Heckman Kristy L

Bought by

Taber Lynn

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$133,860

Interest Rate

5.81%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Albuquerque Sheree | $225,000 | Colorado Escrow & Title | |

| Taber Lynn | $138,000 | Chicago Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Albuquerque Sheree | $218,250 | |

| Previous Owner | Taber Lynn | $133,860 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,266 | $21,960 | -- | $21,960 |

| 2023 | $1,283 | $21,960 | $0 | $21,960 |

| 2022 | $1,114 | $16,720 | $0 | $16,720 |

| 2021 | $1,163 | $16,720 | $0 | $16,720 |

| 2020 | $1,085 | $15,930 | $1,070 | $14,860 |

| 2019 | $1,091 | $15,930 | $1,070 | $14,860 |

| 2018 | $932 | $13,270 | $1,080 | $12,190 |

| 2017 | $853 | $13,270 | $1,080 | $12,190 |

| 2016 | $599 | $9,070 | $1,190 | $7,880 |

| 2015 | $616 | $9,070 | $1,190 | $7,880 |

| 2014 | $524 | $7,080 | $1,190 | $5,890 |

Source: Public Records

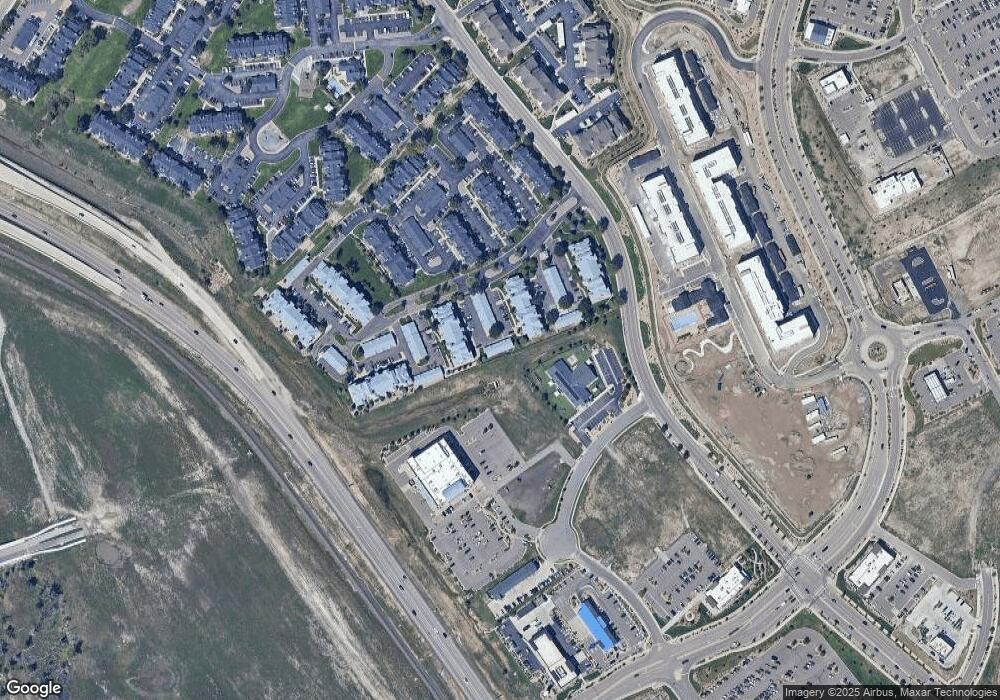

Map

Nearby Homes

- 6005 Castlegate Dr W Unit B27

- 6001 Castlegate Dr W Unit A21

- 6017 Castlegate Dr W Unit F25

- 5074 Covelo Dr

- 4374 N Canyon Ln

- 4218 Morning Star Dr

- 3761 Betty St

- 360 Morning Star Way

- 3538 Collins St

- 4364 Chateau Ridge Ln

- 4517 Silver Cliff Ct

- 5061 Vermillion Dr

- 504 Providence Dr

- 5051 Vermillion Ln

- 3398 Blue Grass Cir

- 315 Prospect Dr

- 312 Quito Place

- 4415 Hydrangea Way

- 4241 Coriander St

- 3673 Champagne Ave

- 6005 Castlegate Dr W Unit B37

- 6005 Castlegate Dr W Unit B15

- 6005 Castlegate Dr W Unit B36

- 6005 Castlegate Dr W Unit B36

- 6005 Castlegate Dr W Unit B17

- 6005 Castlegate Dr W Unit B37

- 6005 Castlegate Dr W Unit B36

- 6005 Castlegate Dr W Unit B26

- 6005 Castlegate Dr W Unit B16

- 6005 Castlegate Dr W Unit B13

- 6005 Castlegate Dr W Unit B18

- 6005 Castlegate Dr W Unit B28

- 6005 Castlegate Dr W Unit B15

- 6005 Castlegate Dr W Unit B25

- 6005 Castlegate Dr W Unit B22

- 6005 Castlegate Dr W Unit B32

- 6005 Castlegate Dr W Unit B33

- 6005 Castlegate Dr W Unit B23

- 6005 Castlegate Dr W Unit B11

- 6005 Castlegate Dr W Unit B21