6063 Griffin Ct Fairfield, OH 45014

Estimated Value: $395,065 - $456,000

3

Beds

2

Baths

2,102

Sq Ft

$201/Sq Ft

Est. Value

About This Home

This home is located at 6063 Griffin Ct, Fairfield, OH 45014 and is currently estimated at $423,016, approximately $201 per square foot. 6063 Griffin Ct is a home located in Butler County with nearby schools including Cherokee Elementary School, Heritage Early Childhood School, and Lakota Plains Junior School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 20, 2016

Sold by

Cristo Homes Inc

Bought by

Bell Gregory W and Bell Carrie M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$201,900

Outstanding Balance

$165,109

Interest Rate

3.94%

Mortgage Type

New Conventional

Estimated Equity

$257,907

Purchase Details

Closed on

Aug 19, 2016

Sold by

J A Development Llc

Bought by

Cristo Homes Inc

Purchase Details

Closed on

Dec 30, 2014

Sold by

Mill Estates Llc

Bought by

Ja Development Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$2,500

Interest Rate

3.95%

Mortgage Type

Undefined Multiple Amounts

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bell Gregory W | $252,455 | J & J Title | |

| Cristo Homes Inc | $35,000 | None Available | |

| Ja Development Llc | $100,000 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Bell Gregory W | $201,900 | |

| Previous Owner | Ja Development Llc | $2,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,550 | $116,700 | $10,080 | $106,620 |

| 2023 | $4,494 | $114,710 | $10,080 | $104,630 |

| 2022 | $3,895 | $76,480 | $10,080 | $66,400 |

| 2021 | $3,875 | $76,480 | $10,080 | $66,400 |

| 2020 | $3,972 | $76,480 | $10,080 | $66,400 |

| 2019 | $6,036 | $62,660 | $10,190 | $52,470 |

| 2018 | $3,647 | $62,660 | $10,190 | $52,470 |

| 2017 | $3,568 | $62,660 | $10,190 | $52,470 |

| 2016 | $536 | $6,620 | $6,620 | $0 |

| 2015 | $628 | $8,150 | $8,150 | $0 |

| 2014 | $534 | $8,150 | $8,150 | $0 |

| 2013 | $534 | $4,260 | $4,260 | $0 |

Source: Public Records

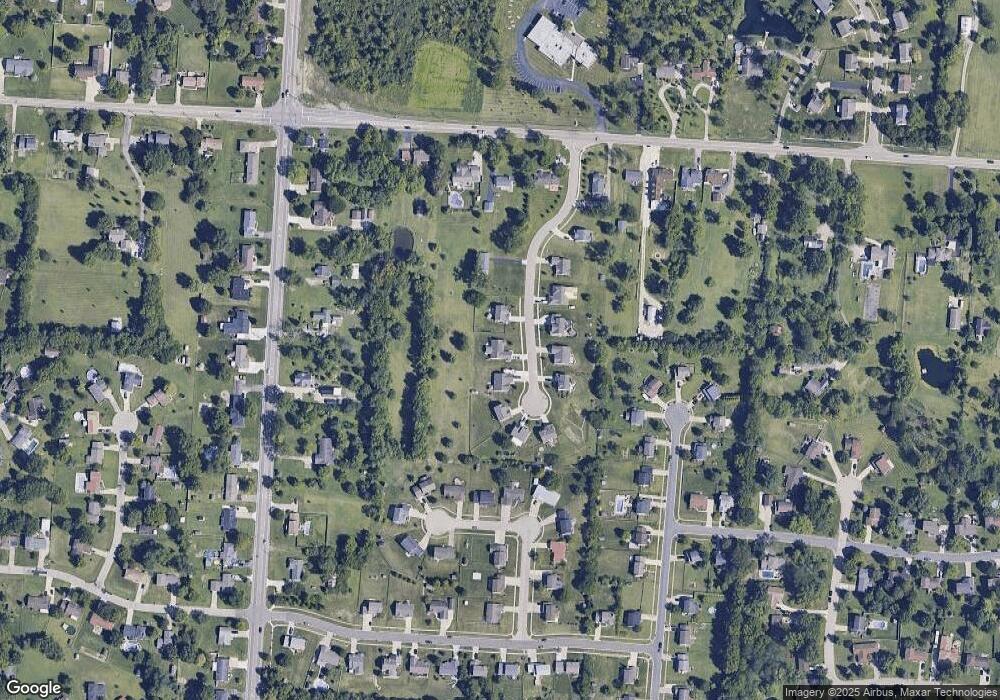

Map

Nearby Homes

- 6093 Griffin Ct

- 4334 Palomino Ln

- 4328 Palomino Ln

- 6077 Snow Hill Dr

- 5870 Shetland Ct

- 5901 Jenny Marie Ct

- 4077 Bramble Ct

- 4296 Moselle Dr

- 4004 Bayberry Dr

- 4085 Alsace Ln

- 5868 Greenlawn Rd

- 4600 Snowbird Dr

- 7626 Bridgewater Ln

- 6384 S Snowmass Dr

- 5791 Greenlawn Rd

- 5774 Longbow Dr

- 4628 Beech Knoll Ln

- 3915 Hamilton Middletown Rd

- 6232 Hollyberry Ln

- 6406 Whippoorwill Dr

- 6073 Griffin Ct

- 6053 Griffin Ct

- 6083 Griffin Ct

- 6064 Griffin Ct

- 6054 Griffin Ct

- 4275 Millikin Rd

- 7 Griffin Ct

- 14 Griffin Ct

- 10 Griffin Ct

- 5 Griffin Ct

- 6044 Griffin Ct

- 6093 Griffin Ct

- 6074 Griffin Ct

- 6074 Griffin Ct

- 6074 Griffin

- 6094 Griffin Ct

- 6094 Griffin Ct

- 6034 Griffin Ct

- 6092 Forest Knoll Ln

- 6102 Forest Knoll Ln