61 Bedford C Unit 610 West Palm Beach, FL 33417

Century Village-West Palm Beach NeighborhoodEstimated Value: $78,000 - $108,000

1

Bed

1

Bath

684

Sq Ft

$135/Sq Ft

Est. Value

About This Home

This home is located at 61 Bedford C Unit 610, West Palm Beach, FL 33417 and is currently estimated at $92,105, approximately $134 per square foot. 61 Bedford C Unit 610 is a home located in Palm Beach County with nearby schools including Grassy Waters Elementary School, Bear Lakes Middle School, and Palm Beach Lakes Community High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 30, 2025

Sold by

Better Theresa R

Bought by

Theresa R Better Revocable Living Trust and Better

Current Estimated Value

Purchase Details

Closed on

Nov 23, 2016

Sold by

Chamochumbi Mria

Bought by

Bettee Theresa R

Purchase Details

Closed on

Oct 22, 2014

Sold by

Alonso Lazaro and Pola Maura

Bought by

Chamochumbi Jose and Chamochumbi Maria

Purchase Details

Closed on

Jun 20, 2003

Sold by

Davis Robert A and Davis Ann L

Bought by

Alonso Lazaro

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$26,125

Interest Rate

4.75%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

May 23, 1996

Sold by

Naomi Michael and Naomi Septoff

Bought by

Davis Louis A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$17,065

Interest Rate

8.02%

Mortgage Type

Credit Line Revolving

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Theresa R Better Revocable Living Trust | -- | None Listed On Document | |

| Theresa R Better Revocable Living Trust | -- | None Listed On Document | |

| Bettee Theresa R | $34,500 | Fidelity National Title Of F | |

| Chamochumbi Jose | $24,500 | None Available | |

| Alonso Lazaro | $27,500 | -- | |

| Davis Louis A | $18,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Alonso Lazaro | $26,125 | |

| Previous Owner | Davis Louis A | $17,065 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,297 | $51,096 | -- | -- |

| 2023 | $1,205 | $46,451 | $0 | $0 |

| 2022 | $1,072 | $42,228 | $0 | $0 |

| 2021 | $944 | $38,389 | $0 | $38,389 |

| 2020 | $924 | $38,389 | $0 | $38,389 |

| 2019 | $885 | $36,260 | $0 | $36,260 |

| 2018 | $790 | $32,260 | $0 | $32,260 |

| 2017 | $713 | $27,260 | $0 | $0 |

| 2016 | $660 | $23,386 | $0 | $0 |

| 2015 | $627 | $21,260 | $0 | $0 |

| 2014 | $233 | $15,489 | $0 | $0 |

Source: Public Records

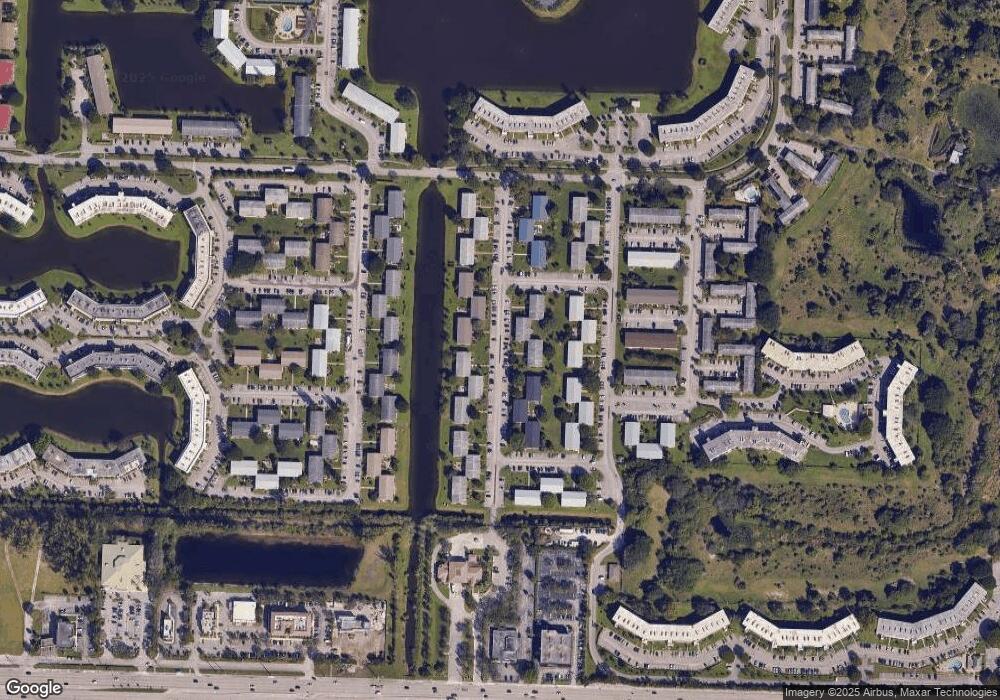

Map

Nearby Homes

- 320 Andover M Unit 3200

- 126 Bedford E

- 240 Bedford J

- 287 Andover L Unit 287

- 116 Bedford E

- 122 Bedford E

- 225 Bedford I Unit 2250

- 325 Andover M

- 326 Andover M

- 137 Bedford F

- 156 Bedford F

- 216 Andover I

- 132 Bedford F

- 271 Andover K Unit 271

- 222 Andover I

- 98 Bedford D Unit 980

- 168 Andover G Unit 168

- 181 Andover G

- 147 Bedford F

- 118 Kingswood F Unit 1180

- 59 Bedford C

- 60 Bedford C Unit 600

- 67 Bedford C Unit 670

- 56 Bedford C

- 56 Bedford C

- 54 Bedford C

- 110 Bedford E Unit 1100

- 113 Bedford E

- 253 Bedford J Unit 2530

- 251 Bedford J Unit J

- 251 Bedford J Unit 2510

- 252 Bedford J

- 112 Bedford E Unit 1120

- 78 Bedford C

- 77 Bedford C Unit 770

- 74 Bedford C

- 72 Bedford C Unit 720

- 73 Bedford C Unit 730

- 249 Bedford J