611 Palm Dr Unit 39 Naples, FL 34114

Belle Meade NeighborhoodEstimated Value: $354,668 - $547,000

Studio

--

Bath

576

Sq Ft

$817/Sq Ft

Est. Value

About This Home

This home is located at 611 Palm Dr Unit 39, Naples, FL 34114 and is currently estimated at $470,417, approximately $816 per square foot. 611 Palm Dr Unit 39 is a home located in Collier County with nearby schools including Manatee Elementary School, Manatee Middle School, and Lely High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 18, 2020

Sold by

Sergeant David L and Sergeant Linda L

Bought by

Woods Patrick and Woods Andrea

Current Estimated Value

Purchase Details

Closed on

May 18, 2016

Sold by

Walker William C

Bought by

Sergeant David L and Sergeant Linda L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$150,500

Interest Rate

3.59%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 1, 2016

Bought by

Sergeant David L and Sergeant Linda L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$150,500

Interest Rate

3.59%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Woods Patrick | $290,000 | Attorney | |

| Woods Patrick | $290,000 | None Listed On Document | |

| Sergeant David L | $215,000 | Sunbelt Title Agency | |

| Sergeant David L | $100 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Sergeant David L | $150,500 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,618 | $207,683 | -- | -- |

| 2024 | $1,595 | $201,830 | -- | -- |

| 2023 | $1,595 | $195,951 | -- | -- |

| 2022 | $1,634 | $190,244 | $0 | $0 |

| 2021 | $2,642 | $233,240 | $0 | $233,240 |

| 2020 | $2,393 | $213,240 | $0 | $213,240 |

| 2019 | $2,282 | $201,720 | $0 | $201,720 |

| 2018 | $2,254 | $199,416 | $0 | $199,416 |

| 2017 | $2,234 | $195,960 | $0 | $195,960 |

| 2016 | $2,236 | $187,220 | $0 | $0 |

| 2015 | $1,981 | $170,200 | $0 | $0 |

| 2014 | $2,056 | $174,610 | $0 | $0 |

Source: Public Records

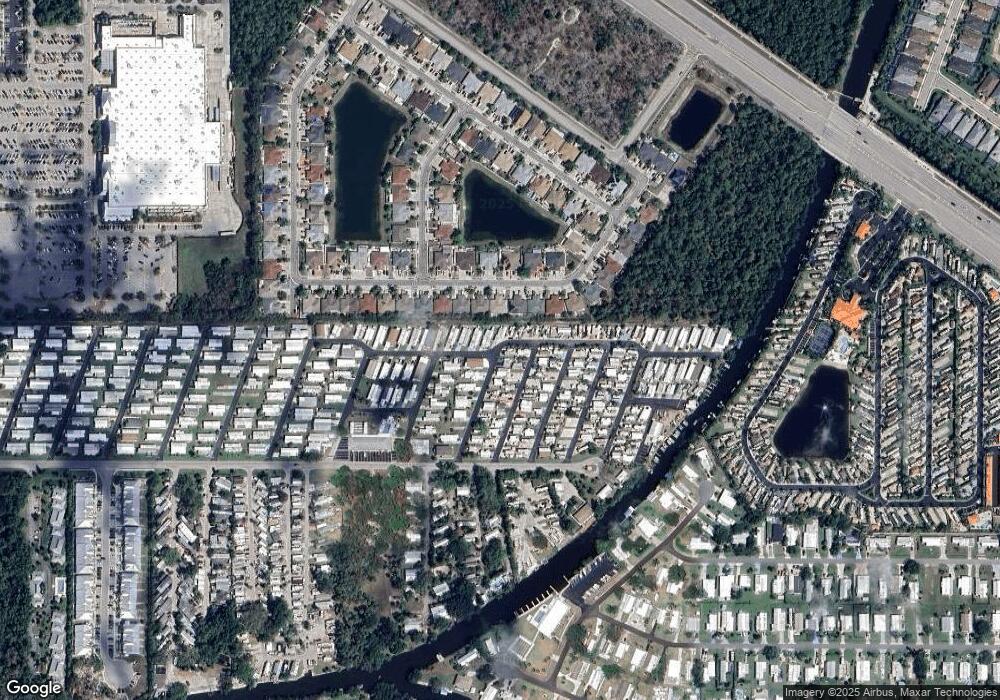

Map

Nearby Homes

- 539 Poinsettia Ln Unit 152

- 471 Palm Dr Unit 310

- 13403 Snook Cir

- 13411 Snook Cir

- 13419 Snook Cir

- 193 Carissa Ln Unit 89

- 13379 Snook Cir

- 13371 Snook Cir

- 23 Derhenson Dr

- 13367 Snook Cir

- 153 Carissa Ln Unit 85

- 13440 Snook Cir

- 13439 Snook Cir

- 20 Derhenson Dr

- 13455 Snook Cir

- 13323 Snook Cir

- 13319 Snook Cir

- 13453 Ladyfish Ln

- 16 Derhenson Dr

- 13307 Snook Cir

- 611 Palm Dr Unit F-30

- 611 Palm Dr Unit 32

- 611 Palm Dr Unit F33

- 611 Palm Dr Unit G-35

- 611 Palm Dr Unit 41

- 611 Palm Dr Unit 40

- 611 Palm Dr Unit 38

- 611 Palm Dr Unit 37

- 611 Palm Dr Unit 36

- 611 Palm Dr Unit 29

- 611 Palm Dr

- 611 Palm Dr Unit F-31

- 607 Palm Dr

- 623 Palm Dr

- 627 Palm Dr

- 587 Palm Dr

- 639 Palm Dr

- 655 Palm Dr

- 174 Oak Ln

Your Personal Tour Guide

Ask me questions while you tour the home.